The UK banks to buy in 2019

9th January 2019 17:10

by Lee Wild from interactive investor

Having been battered for much of 2018, local bank shares could be back in favour this year if a Brexit disaster is avoided. Lee Wild names the lenders tipped to do best over the next 12 months.

It's been a terrible 12 months for the UK domestic banks. Barclays (LSE:BARC), Lloyds Banking Group (LSE:LLOY) and Royal Bank of Scotland (LSE:RBS) have each seen their share price slump by at least 20% since the beginning of 2018, despite a decent start to the new calendar year.

Rising interest rates are typically good news for lenders who are quicker to charge higher costs to borrowers than they are to reflect rate rises in savings products. But domestic rates haven't risen at anything like the pace anticipated in late 2017, and investors have been more concerned that Brexit and much slower economic growth could trigger a sharp decline in demand for bank products.

Lloyds Bank, for example, recently fell below 50p for the first time since summer 2016, Barclays dropped below 150p and RBS shares swapped hands for just 200p in December, their lowest price since October 2016.

But a conversation around value and oversold domestic stocks is getting louder, and some of the unloved sectors like banking and housebuilding have enjoyed a resurgence in recent weeks.

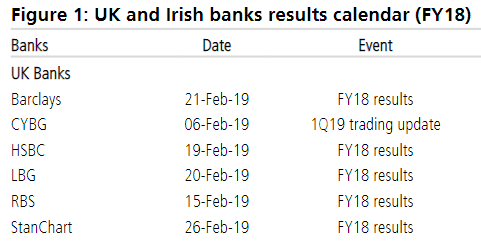

Now, ahead of the UK bank sector results reporting season in February, broker UBS has named the lenders it thinks are worth owning in 2019.

"With earnings estimates reasonably firm over this period the UK domestic banks in particular look to have de-rated substantially on political and macro concerns which we expect to ease," writes analyst Jason Napier.

"While it seems likely that Brexit clarity could take an extended period to emerge – with an Article 50 extension increasingly likely to allow legislative approvals to complete – a seeming lack of significant support for a no deal outcome appears to reduce the risk of a near term macro breakdown.

"The UBS house view is that global macro readings will stabilise, increasing confidence in GDP growth estimates, re-rating capital markets and giving the Fed and ECB room to tighten monetary policy."

The sell-off in UK domestic banks stocks has left the sector on a paltry forward price/earnings (PE) multiple of just 6.7-7 times capital-adjusted earnings per share versus an average among European peers of 8.3 times. If a Brexit transition deal is agreed, a bounce in GDP and a couple of Bank of England rate hikes could trigger a re-rating for UK banks, UBS says.

"We think the valuation discount is real and worth buying. Given increasing concerns around trade volumes we see the most upside for 'buy'-rated Barclays, Lloyds Banking Group and RBS," writes Napier.

Source: Company websites, UBS

Lloyds Banking Group – Buy, price target 80p

"We expect another set of uneventful numbers with the bank under good control, managing volumes against price in lending, tough conditions in Other Operating Income and solid credit quality," reckons Napier.

The full-year dividend is seen at 3.3p, up 7% year-on-year, plus a £1.5 billion share buyback, which gives a total capital return of 9% of market cap.

"LBG is, in our view, an undervalued, strongly capital generative bank, operating with a cost advantage in a competitive market and with decent medium-term growth opportunities in lending, savings, investments and general insurance," writes UBS.

The broker forecasts fourth-quarter adjusted pre-tax profit of £1.8 billion, including above-the-line remediation costs of £141 million and UK bank levy of £200 million.

Royal Bank of Scotland – Buy, price target 290p

"We see the RBS investment thesis as pretty straightforward and predominantly driven by an expected reduction in implied cost of equity as the domestic political backdrop becomes clearer and more significant capital returns approach, a topic we expect investors to revisit with results," says UBS.

The broker forecasts adjusted pre-tax profit of £927 million, up 81% year-on-year and down 43% on the previous quarter.

Barclays – Buy, price target 235p

Look for adjusted pre-tax profit of £724 million, tangible net asset value of 254p and a common equity tier 1 (CET1) ratio of 13%.

UBS is less confidence on the Far East-focused lenders HSBC (LSE:HSBA) and Standard Chartered (LSE:STAN), both of whom are rated 'neutral'.

"Trading in Asia looks to have been especially tricky," believes Napier. Watch for Standard's update on its three-year strategic plan and ongoing pursuit of a 10% return on equity. UBS is looking for fourth quarter adjusted profit of US$597 million. HSBC is expected to make $4.775 billion.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.