The UK equity funds with Brexit in mind

As Brexit uncertainty continues, which UK equity funds offer the highest and lowest UK revenues exposure?

15th April 2019 12:53

by Tom Bailey from interactive investor

As Brexit uncertainty continues, which UK equity funds offer the highest and lowest UK revenues exposure?

The UK stock market has a heavy international bias, with many companies listed in the country having little or no exposure to the UK economy in terms of revenue are listed on the London Stock Exchange. Of all companies listed on the FTSE 100, for example, over 70% of revenue is derived from abroad.

This creates the counterintuitive dynamic whereby bad news for the UK economy can translate into good performance for the FTSE 100. The bad news is often greeted by a sell-off on the pound, which in turn adds a bump to the foreign-derived earnings when exchanged into sterling.

At the same time, the fortunes of these companies are more dependent on the global economy than the British, offering arguably a degree of protection against the UK's unpredictable politics.

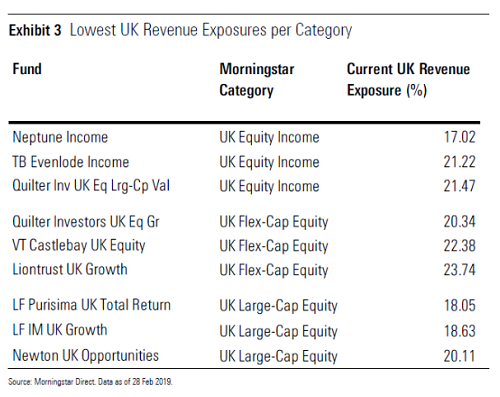

For those looking for this protection against the fallout from Brexit, new data from Morningstar shows which investment funds in the various UK equity sectors have the lowest exposure to UK revenues.

As the chart above shows, Neptune Income has just 17% exposure to UK revenues, the smallest amount for Morningstar's UK Equity Income fund category. Within its UK Flex-Cap Equity, Quilter UK Equity Growth has the smallest, with 20.3% and among UK Large-Cap the LF Purisima UK Total Growth fund has the lowest exposure, at 18%.

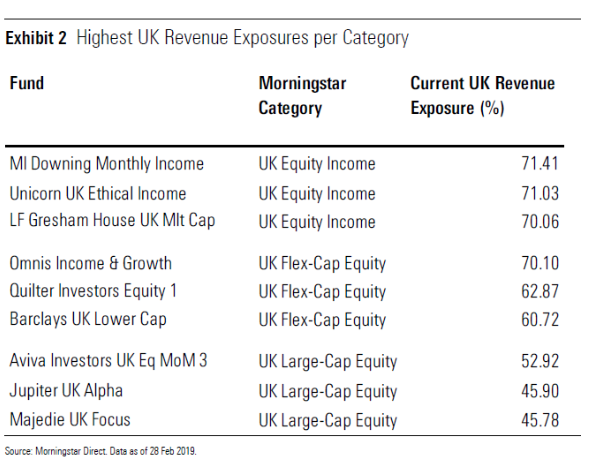

Other investors, however, may take the opposite view, instead opting for funds with higher UK exposure; a trend that various fund managers are currently playing in favouring the more domestically focused companies.

The UK funds with the highest UK revenue exposure include MI Downing Monthly Income (71.4%), Unicorn UK Ethical Income (71%) and Omnis Income & Growth (70.1%).

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.