The week ahead: Ocado, Kingfisher

14th September 2018 13:38

by Lee Wild from interactive investor

There seems no end to the suffering across Britain's retail sector, and we'll get further insight when another raft of consumer-driven stocks report in the coming days, writes Lee Wild.

Monday 17 September

Trading Statements

Dairy Crest, Warpaint London, MP Evans Group, Tern, Gleeson (M J), Finsbury Food Group, Petra Diamonds, City of London Investment

AGM/EGM

Abzena

Tuesday 18 September

Ocado

Ocado makes no money, yet the business is worth over £6 billion and a member of London's exclusive blue-chip club of companies. Investors are betting this will change, and it will. But rather than get rich by selling and delivering groceries, Ocado's fortune lies in its automated fulfilment technology.

Setting up automated Customer Fulfilment Centres for giant European retail chains and America's second-largest grocer is clearly massive progress for Ocado. In future, though, it's widely accepted that rolling out its technology across different industries will be the real game-changer.

However, this technology does not come cheap, and spending vast sums on the business was a key reason for half-year losses reported in July. Third-quarter results will give us a good idea whether Ocado is on track to hit forecasts for 10-15% annual revenue growth at the retail division, plus a big increase in profit there during the second half. It would be surprising to hear of further tech deals at this stage.

Ocado shares will never be cheap. It will be years before they're making big money, but Amazon and other tech leaders have sustained ridiculous valuations for years and there's no reason to believe Ocado cannot do the same.

Source: interactive investor (*) Past performance is not a guide to future performance

Trading Statements

Ocado, Rosenblatt Group, JTC, Judges Scientific, Keywords Studios, Frontier Smart Technologies, Smart Metering Systems, Bango, Cloudcall Group, Spire Healthcare, Personal Group Holdings, Faroe Petroleum, PureCircle, AEW UK Long Lease Reit, Green Reit, GRC International, Eagle Eye Solutions

AGM/EGM

MediaZest, Real Estate Credit Investments, B&M European Value Retail, HML Holdings, Accsys Technologies

Wednesday 19 September

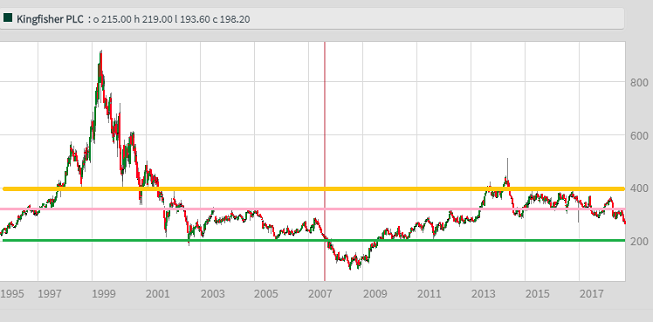

Kingfisher

Like the rest of the retail sector, Kingfisher is finding life tough. It's lost a quarter of its value in 2018 alone, and a second-quarter update only a month ago raised concerns about profit margins. Although interim margin will be down on a year ago, look for an improvement during the past three months. This will be crucial in deciding if management's promise to repair margins in the second half is deliverable. This must happen for there to be any sustainable recovery in the share price.

There are any number of excuses for poor performance – rising interest rates adding to mortgage bills and Brexit among them – yet there was some recovery in sales at B&Q and Screwfix in the second quarter versus the first. After a grim second quarter, watch closely for a promised improvement at Castorama France.

Source: interactive investor (*) Past performance is not a guide to future performance

Trading Statements

Babcock International, Randall & Quilter, Yu Group, RA International, Kingfisher, Cello Group, Elektron, Central Asia Metals, Greencoat Renewables, Accesso Technology, Alliance Pharma, Pan African Resources

AGM/EGM

Sosandar, Nuformix, F&C Managed Portfolio Trust, Eckoh

Thursday 20 September

Trading statements

IG Group, SciSys, City Pub Group, SOCO International, Hvivo, Modern Water, French Connection, Diurnal Group, Kier Group, Inland Homes

AGM/EGM

Arian Silver Corporation, Cambium Global Timberland, Worldwide Healthcare Trust, Twentyfour Income Fund, Begbies Traynor, IG Group, First Property Group, Petro Matad

Friday 21 September

Trading statements

Mainstay Medical International, SIG, Smiths Group

AGM/EGM

Mainstay Medical International, Sysgroup, Byotrol

*lines on charts show levels of previous technical support and resistance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.