Wetherspoons rallies, but Burberry stumbles

11th July 2018 14:11

by Graeme Evans from interactive investor

These are both high-profile firms with an impressive record of stockmarket returns, but while pubs remain popular, Burberry's hit a rough patch, writes Graeme Evans.

Burberry Group and Wetherspoon (J D) are worlds apart in nearly every respect. But there's one marketplace where the pub chain currently enjoys premium status to rival the luxury goods brand.

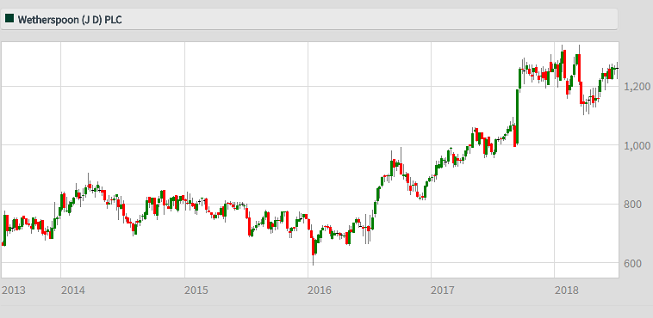

In the case of the Spoons share price, it's been on an upward path for the best part of two years. Today was no different, with a trading update triggering a rise of 6% to take shares back to the record levels seen earlier this year.

It's been a similar story at Burberry, where the FTSE 100 stock has doubled in value over the same period to reach an all-time high last month.

This was slightly undone by a trading update today showing a softening in tourist numbers in the UK and Europe. But overall it seems the market is growing more relaxed about chief executive Marco Gobbetti's grand plan to reinvent Burberry as a super luxury brand.

Source: interactive investor Past performance is not a guide to future performance

When we last wrote about Wetherspoon in January, under the heading "Cheap beer, pricey shares", we said the valuation had been looking frothy for a while.

A few months later and its price/earnings (PE) multiple has climbed further to stand in excess of 17x, compared with a 10-year average of 13.9.

That's despite there being no change in the company's overall guidance today, with the warm weather helping like-for-like sales up by an impressive 5.2% and total sales by 5.6% in the 10 weeks to July 8. The trend for the whole 49 weeks of the financial year shows growth of 5.2% and 4.2% respectively.

The share price progress comes despite the prospect of major cost increases, with next year's burden likely to be driven by business rates, the sugar tax, utilities and wages. Interest rate costs will also increase by around £7 million.

At Burberry, shares have performed well this year, having broken through a key area of technical support at 1,800p. The stock now trades at a 2018 price earnings multiple of 25x, although in the absence of a beat on like-for-like sales shares were 3% lower today.

UBS analyst Helen Brand said first quarter retail sales of £479 million were a slight miss, with like-for-like sales growth of 3% weaker than her 4% forecast.

There was no change to Burberry’s 2019 full-year earnings guidance for around £441 million, with the company helped by an easing in FX headwinds. Clever management of costs and spending cuts have also helped to sustain operating profits at a time of more challenging trading conditions.

A key landmark for investors will come in September when new Chief Creative Officer Riccardo Tisci presents his first collection for the Burberry brand. He joined the company in March after a decade at Givenchy.

Gobbetti called the debut collection in September "the next step in our journey."

He is working on plans to compete with the likes of Hermes and Dior by repositioning Burberry into this "most rewarding, enduring segment".

However, with the big benefits unlikely to show through until 2021 the rewards may seem too far off for many shareholders, particularly after the recent gains.

Gobbetti added: "While we know it will take time to achieve our ambitions, our progress to-date and the energy in and around the company give me confidence for the future."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.