What's in store for Poundland's owner?

9th September 2021 07:31

by Alistair Strang from Trends and Targets

It owns one of the UK's most recognisable budget brands. Here's what independent analyst Alistair Strang thinks of the shares.

We finally remembered to take a glance at the German market again, hoping to find a share worthy of some examination. There are numerous facilities on the internet, giving lists of the most active shares on markets. For Germany, Steinhoff topped the list, even meriting a “Strong Buy” rating, though we’re not familiar with the process used for such a definition.

The company, Steinhoff International (XETRA:SNH), is a South African/German/Dutch business with listings in SA and Germany. They deal mainly in furniture and household goods, operating worldwide, and a trawl of the corporate website was surprising, insofar as we’d never heard of the company despite their massive presence. Then again, here in the UK, we notice the company Poundland are one of their subsidiaries, literally the only company name we recognised from UK high streets. Perhaps our island is simply too small to deserve notice.

- Why reading charts can help you become a better investor

- Want to buy and sell international shares? It’s easy to do. Here’s how

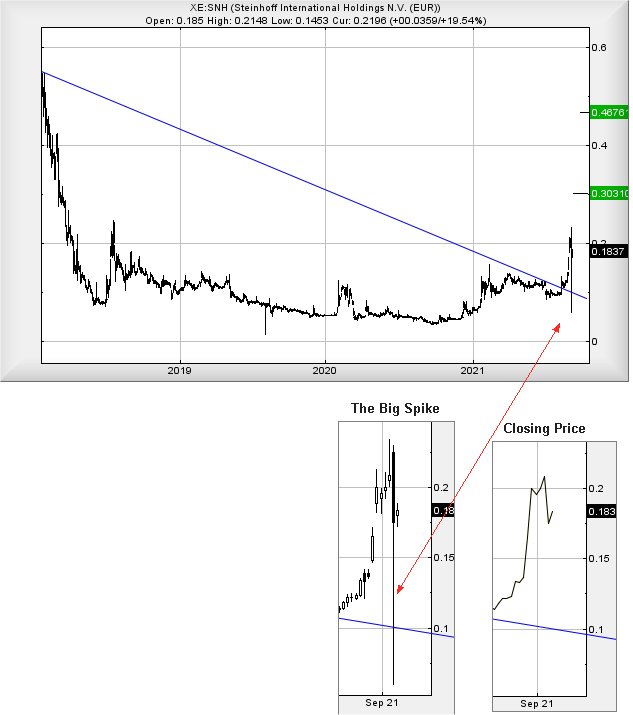

Something quite peculiar happened the other day with Steinhoff's share price. Just after 2pm on Monday, it was spiked down to €0.06, recovering within half an hour and is presently trading around €0.215.

Over the years, we’ve learned to pay attention to spikes as they can easily be used by the markets to generate movement of some strength. However, our favourite flavour of spikes generally take place at the market open, rather than half way through the trading day. With the aggressive nature of this particular drop and recovery, even if it was simply a “fat finger” moment, we suspect the market shall doubtless use the added bandwidth to provide some future gains.

As the chart below highlights, the drop on Monday, while taking the price momentarily below the blue downtrend, saw the share close in an area of safety. It’s easy to feel sorry for the folk who thought their ‘Stop Loss’ level was safe, tucked discreetly below a three-year-old trend.

As a result, movement next exceeding €0.24 looks very capable of producing recovery toward an initial €0.30. If bettered, our longer term calculation gives €0.46 as a reasonable ambition sometime in the future.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.