Where might bargain hunters look after today’s mini crash?

US markets made record highs recently, and Saltydog analyst names a fund blowing away the competition.

24th February 2020 13:23

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

US markets made record highs recently, and Saltydog analyst names a fund blowing away the competition.

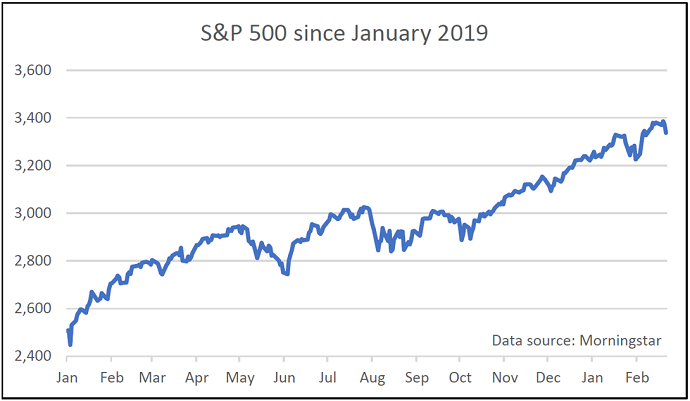

Last year the US economy grew for the eleventh consecutive year. The S&P 500 went up 29%, the Dow Jones Industrial Average made 22% and the Nasdaq beat them both, gaining 35%.

Later this year there will be a presidential election, so you can bet that Donald Trump will do everything that he can to keep markets moving up.

As of the end of play on Friday, the S&P 500 was showing a gain of 3.3% so far this year. The Dow Jones had risen by 1.6% and the Nasdaq was up 6.7%.

The S&P 500 and the Nasdaq both set new all-time highs last week, and the Dow Jones did the week before.

It’s not all been plain sailing, but overall there’s been a strong upward trend. And it is possible that Monday’s mini crash on fears about the spread of coronavirus may have presented a buying opportunity.

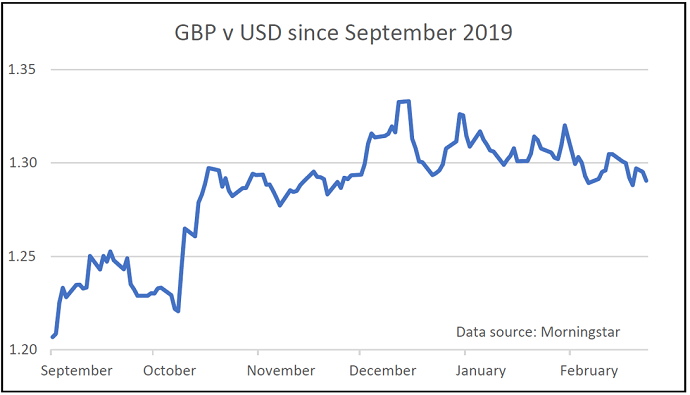

But just because you know another country’s stock market is doing well, doesn’t mean that it is easy to benefit as an investor. As long as the exchange rate remains relatively stable, you can take advantage by buying a fund which invests in companies from that country. However, if the pound strengthens against the local currency, then the gain will be eroded when converted back into sterling.

This is exactly what we saw in the final quarter of 2019 as the pound strengthened against the dollar. So far this year it hasn’t been a problem, and, at the moment, sterling is actually worth slightly less than it was at the beginning of January.

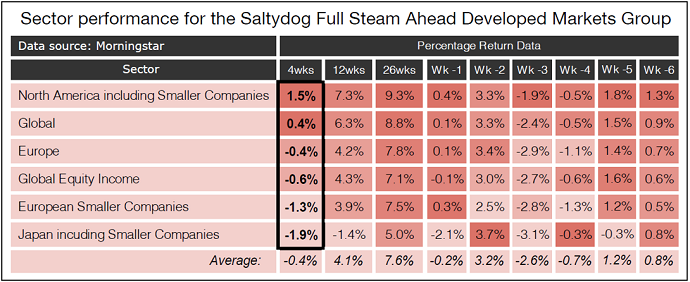

Each week we look at the relative performance of the Investment Association sectors, valued in sterling.

We group them into our own ‘Saltydog’ groups, based on their historic volatility. The groups are Safe Haven, Slow Ahead, Steady as She Goes, Full Steam Ahead Developed Markets, and Full Steam Ahead Emerging Markets.

The Full Steam Ahead Developed Markets group contains the sectors investing in developed markets outside of the UK.

The combined North America and North American Smaller Companies sector was at the top of the table last week with the greatest cumulative returns over four, 12 and 26 weeks.

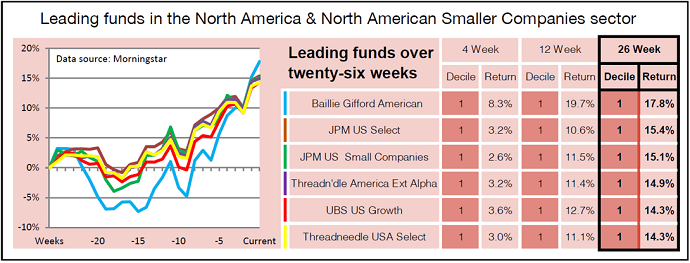

We also produce tables showing the leading funds in each of the sectors based on their performance over four weeks and also over 26 weeks.

In our last report, the Baillie Gifford American fund featured at the top of both tables.

As part of our analysis we sort all the funds within each group and give them a decile ranking, with the top 10% of funds in decile 1. Not only is the Baillie Gifford American fund in decile 1 based on its cumulative four, 12 and 26-week returns, but it has also been in decile one for the last six weeks based on each individual week.

Our demonstration portfolios currently hold this fund.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.