Where next for Barclays and Brent crude?

25th October 2021 07:25

by Alistair Strang from interactive investor

Here's what independent analyst Alistair Strang's charts tell him about possible future direction.

Fuel prices in the UK continue to explore new highs, a fact brought sharply home when filling a couple of cans of diesel for our little tractor. The price to fill the two diesel cans was nearly £15. When I last filled the cans earlier this year, I remember handing over £10 and a single £1. I probably bought fuel for the tractor at the lowest and highest prices of 2021.

- Energy crisis: investor Q&A and share tips

- Five things investors must know about Britain’s energy crisis

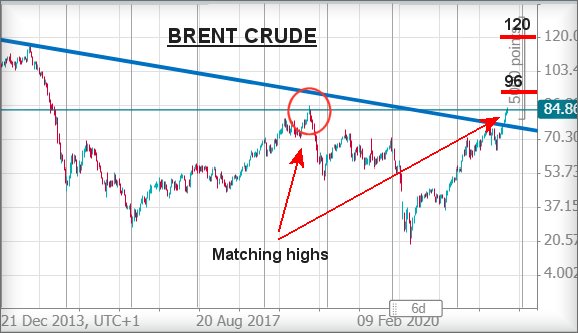

This suspicion is due to the price of Brent crude. We keep calculating the $86 level as a potential point of hesitation on the current rising cycle. Visually, this is also borne out by the high back in 2018, as there are few things the market likes more than to invent a reason for hesitation in price movements. As the chart below highlights, Brent crude now has every excuse to experience some hesitation, regardless of big picture growth characteristics. In the event the product discovers a reason to drip below $77, all bets are off for the longer term.

Source: Trends and Targets. Past performance is not a guide to future performance

As for Barclays (LSE:BARC), when we reviewed the share three weeks ago, we gave criteria for a climb to 198.7p. The share closed Friday at 198.86p, so this ambition can be successfully crossed off. The important detail, from a software perspective, is our initial target was exceeded, creating a set of circumstances where some optimism for the future is possible. Now above 202p looks important, calculating with an initial target level at 216p next. If exceeded, our longer-term secondary works out at 222p.

- Subscribe to the ii YouTube channel for interviews with popular investors

- Why reading charts can help you become a better investor

Despite it being true, the 'big picture' now demands that we admit a longer-term 240p should be regarded as the driving hope, our inclination is for caution, simply due to the retail banks' dreadful performance in the last seven years. Our real problem surfaces, if we concede that the share is entering a true recovery cycle, thanks to the big picture also giving a target above 240p as an astounding leap to 407p.

If Barclays opts to explore reasons to destroy hope, the share price needs to move below 161p. Ideally, the share should now only need infinite patience, world peace, universal health, and competent UK governments. Perhaps 'infinite patience' will be a realistic hope.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.