Which way for Barclays as rally stalls?

Many stocks outside the precious metals sector have eked out only small gains so far in 2026. Independent analyst Alistair Strang hunts for clues as to future direction for this retail bank.

2nd February 2026 07:51

by Alistair Strang from Trends and Targets

Three weeks ago, we presented an amazingly accurate article about Barclays (LSE:BARC). Unfortunately, it was only amazing to ourselves as absolutely none of the predictions triggered, Barclays' share price remaining delicately below our 493p trigger level as the value virtually flatlined for three weeks.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

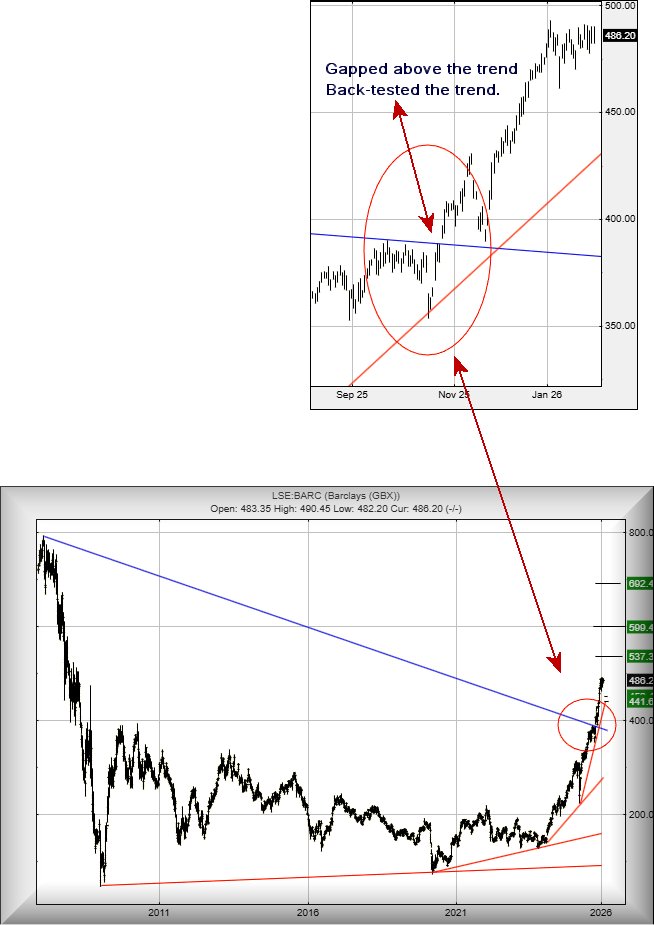

However, it’s worth – we think – paying attention to a pretty strong signal exhibited by Barclays, shown on the zoomed-in chart extract below. Last October, the market opted to gap Barclays' share price above a Blue downtrend. This line from 2007 clearly has inherited some gravitas, the market not only moving the share price above the trend but giving it a little kiss to back-test the trend a month later. Quite why this ritual was completed utterly defeats us, especially due to our solid belief that Barclays' share price now needs to close below 389p, the level of trend break, to deserve any real excuse for panic.

It is now the case where, from a Big Picture perspective, we can ask Barclays to trade above 505p to trigger happy days coming, currently calculating with the potential of gains to an initial 537p with our secondary, if beaten, at 599p and some potential hesitation.

But, overall, share price closure above 505p shall permit us to dream of a future 692p as exerting as much influence.

Should things intend to go a little bit wrong, below 468p suggests imminent reversals to an initial 452p with our secondary, if broken, at 441p and a potential bounce.

In the case of Barclays, we suspect our reversal scenario shall be favoured.

Source: Trends and Targets. Past performance is not a guide to future performance. Important: Trends and Targets charts only incorporate official share count consolidations, ignoring rights issues where investors have a choice as to whether to participate.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.