Why China powerhouse offers pocket of opportunity

Investors remain wary, but China A-shares should prove rewarding over the longer term.

2nd July 2019 11:35

by Ceri Jones from interactive investor

Investors remain wary, but China A-shares should prove rewarding over the longer term.

The S&P 500 index has risen by about 80% over the past decade, but stock markets in the rest of the developed world remain 25% below their levels before the financial crisis. Some 15% of that decline has occurred since the peak in January last year.

This bifurcation is odd, since the only real economic growth has been generated by emerging powerhouses such as China, whose GDP has grown by nearly 250% over the past decade.

The explosive growth of the FAANG stocks (Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL)), each one a US start-up, is partly responsible for the S&P 500 index's vitality, as they have stolen market share from established firms worldwide. The US Federal Reserve's monetary stance has also played a role.

It's interesting that China resorted to a similar stimulus when it embarked on a $589 billion spending spree that revived its economic growth after the crash and averted a widely feared 'hard landing'. Now, a decade later, it is again trying to counter slowing growth and the impact of its trade war with the US through a raft of accommodative measures.

China is throwing money at infrastructure projects in the technology, energy, transport and water conservation sectors, and it began approving local government bond issuances earlier than usual this year so that local authorities could issue debt ahead of the customary schedule. Meanwhile, tax cuts have delivered a 2% windfall to Chinese consumers to spend.

Chinese puzzle

Such measures naturally provoke inflation – the scourge of China since the era of the Tiananmen Square protests. Inflation has been exacerbated by higher crude oil and pork prices, the latter having gone up 20% following outbreaks of African swine fever. Meanwhile, a parasite called the fall armyworm is wreaking havoc on China's rice, sorghum, corn and wheat crops. The Ministry of Commerce is so concerned about rising food prices that it has promised to safeguard the supply of necessities such as fruits, vegetables, meat and eggs.

That said, the inflation problem does seem to be limited to food, rather than raw materials, and China does not face much wage inflation. What's more, the government may prove tougher and be more prepared to let its people suffer than Donald Trump and others think.

Having implemented 25% tariff s on rare earth exports to the US, China is now threatening to halt exports altogether in retaliation for the US's blacklisting of Huawei. China controls 97% of the production of rare earths, and a withdrawal of supplies to the US would wreak havoc with US business sectors such as car manufacturing, oil refining, defence and consumer electronics. The US is already feeling the squeeze from earlier tit-for-tat tariff hikes.

China used its dominance of rare earth production as leverage during its 2010 conflict with Japan over control of the Senkaku Islands. The episode damaged China's reputation as a stable producer, but ultimately earned it victory in a nasty spat.

Trump's latest threat is an extension of the US's traditional tactic of using its dominance of the global financial system to punish adversaries by blocking them from doing bank deals. This time the US has also used bully-boy tactics to target China's technology sector.

However, China is adept at wringing advantage from desperate situations, as evidenced by its recent dealings with Argentina, a country where factory closures are commonplace, wages are at rock-bottom, annual inflation is approaching 50% and the currency (the peso) has halved in value against the dollar.

At the G-20 summit in December, China's president, Xi Jinping, offered Argentina's president, Mauricio Macri, an opportunity to formalise the countries' trade links. Two massive hydroelectric dam projects in Patagonia, fiercely opposed by environmental groups, were touted as a route to unlocking Chinese finance. Macri, facing a dearth of financing options and an interest rate of 70% , was in no position to refuse Xi’s proposal.

China choice

Naturally enough, investors remain wary of China. However, China A-shares should prove rewarding over the longer term, because they are barely represented in the MSCI Emerging Markets index, a structural discrepancy that will undoubtedly change.

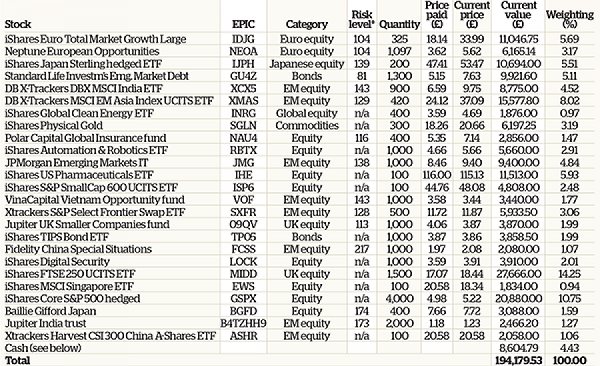

For those who prefer the cost-effectiveness of ETFs, the Xtrackers Harvest CSI 300 China A-Shares ETF includes the 300 largest and most liquid A-share stocks on the Shanghai and Shenzhen stock exchanges. The Chinese market is complex to navigate, however, and therefore a suitable vehicle for active management. First State has launched a China A-Shares fund that will invest in firms with high ESG standards and rising cash flows.

The portfolio will take a position in the former, funded by profits from iShares UK Property (LSE:IUKP), which now seems too indiscriminately spread as the retail sector disintegrates.

In the UK, a tortuous exit from the EU still hangs over the market, deterring investors from the attractively priced shares on offer. Global asset managers have now been underweight in the UK since the 2016 Brexit vote, according to a Bank of America Merrill Lynch fund manager survey.

The softening of sterling over the past three years reflects the deterioration in confidence. Weaker sterling has traditionally helped FTSE 100 firms export, but orders from overseas have plummeted recently, partly because of stockpiling there in the lead up to the UK's planned 29 March exit – abandoned at the last moment – and partly because businesses are finding it impossible to navigate the UK's chaotic political scene.

The Conservative Party leadership campaign and the prospect of Jeremy Corbyn as PM could further deter foreign investors.

This unholy mess has left UK stocks as a whole trading at a 30% discount to their global peers. Dividend yields are at about 4.5%, well above their 30-year average of 3.5%.

Many investors will feel more comfortable buying UK shares than China A-shares, but perhaps, for the first time in history, the political dynamics of the two nations are almost equally opaque and difficult to read.

China play could counter widespread market weakness

Notes: *Risk level is produced by FE Analytics and references the FTSE 100 as benchmark of 100. £10 standard interactive investor dealing charge and 0.5% stamp duty deducted from cash holdings on new purchases and sales. Cash at beginning of period = £1,540.16. Dividends in this period: 325 IDJG x €0.4872 = €158.34 = £140.96; 400 IWDP x $0.2207 = $88.28 = £69.29; 400 INRG x $0.0391 = $15.64 = £12.28; 1,000 TP05 x $0.639222 = $6.392 = £5.02; 1,000 FCSS x 3.85p = £38.50; 1,500 MIDD x 19.86p = £297.90; total dividends = £563.95. Cash before purchase = £2,104.11. Sale of 402 IWDP shares at £21.34 = £8,578.68. Purchase of 100 shares in ASHR = £2,058; £10 dealing charge x 2 = £20. Total cash after dealing = £8,604.79. Source: interactive investor, as at 7 June 2019

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.