Why Japan's lowly market has appeal

After years of underperformance, Japan's stock market presents investors with opportunities to exploit.

9th August 2019 15:18

by Ceri Jones from interactive investor

After years of underperformance, Japan's stock market presents investors with opportunities to exploit.

The Japanese stock market has underperformed for four years, and was slammed in last autum'’s tech sell-off, which knocked 18% off stocks in sterling terms. While the Topix index is still languishing 40% below its 1991 peak, other major developed markets such as the US have recovered to their all-time highs.

This means Japanese equities could now be cheap. "From a valuation perspective, Japanese stocks priced in much of the risk in late 2018, and they continue to look undervalued at around 12 times forward earnings," explains Nicholas Price, manager of Fidelity Japan Aggressive fund.

"With valuations testing historical lows in some parts of the market, there are opportunities to capitalise on disconnects between near-term sentiment and mid-term fundamentals."

While trade tensions between the US and China are an immediate concern as Japan does so much business with China, over the longer horizon, so-called Abenomics – the government's monetary easing, fiscal stimulus and structural reforms – are bearing fruit.

It is now five years since prime minister Shinzo Abe introduced reforms to corporate governance, such as tackling apathy among institutional investors who typically voted in line with management or did not exercise their votes at all.

Some progress has been made: 90% of companies now have two or more independent directors, up from half in 2010. However, allegiant shareholders, through their cross-shareholdings, still make up 10% of the market.

"Managers could take actions that weren't in the best interest of shareholders without the fear of repercussions or resistance," says Chern-Yeh Kwok, manager of Aberdeen Japan Equity.

Corporate balance sheets are healthy, with over 50% of non-financial companies net cash, and a greater focus on delivering higher returns on equity (RoE) and shareholder returns. Share buybacks topped 7.5 trillion yen in the period January to June 2019, which was more than the whole of last year, and dividends are up by 20% on last year. The launch of indices such as JPX Nikkei 400 and Nikkei High Dividend Stock 50 has also encouraged the redistribution of cash to shareholders.

In the near term, however, Japan is particularly vulnerable to trade tensions, especially in the manufacturing sector. This is a double whammy, as the strength of the world’s third-largest economy has historically been in the motor manufacturing and consumer electronics industries, which are now experiencing structural headwinds. Smartphones are disrupting camera and camcorder companies such as Canon and Nikon, while taxi apps, car-sharing and automated driving pose challenges for car manufacturing.

Pressure from both sides

Trade pressure, in tandem with a lack of internal catalysts for growth as the Japanese population declines, is squeezing the economy on both sides. Companies are increasingly putting capital expenditure plans on hold as business conditions remain unclear, but sentiment in the non-manufacturing sector is holding up. The government also plans to mitigate the effects of a long-awaited VAT hike from 8% to 10% that is scheduled for October.

Another risk is of the Japanese yen strengthening, if interest rates rise and demand for the currency as a traditional safe haven intensifies. However, the Bank of Japan appears to be in no rush to exit its massive stimulus programme, despite the costs of prolonged easing.

"Though monetary easing and fiscal stimulus have been received positively by the market, a growth strategy must be in place to achieve stable economic growth," argues Kwok. "Recently, the government has been making progress on increased labour productivity, with work-style reforms, fiscal consolidation with the planned VAT hike, and deregulation such as visa exemption for tourists and allowing non-Japanese workforces."

For active fund managers, Japan is a remarkably under-researched market. Most follow a bottom-up process, rather than focusing on sectors or themes, and the broad spectrum of performance of Japanese funds over the past five years – differing by a factor of 10 times – demonstrates this benchmark agnosticism.

"Of the approximately 2,000 companies in the Topix, well over 50% are covered by no more than one sell-side analyst," points out Nicholas Weindling, manager of the JPM Japan fund.

"The equivalent number for the US and Europe is only around 5%."

This can lead to pricing inefficiencies which can potentially be exploited by well-resourced investment teams.

"Many of these under-researched companies are going to be long-term beneficiaries of shifting structural sands,” adds Weindling. “One example of a structural shift is factory automation. As living standards rise in emerging countries, human labour costs become increasingly expensive for manufacturers operating in these countries. One solution is to increase factory automation. Robot usage in emerging countries, such as China and India, is still extremely low and there is significant room for growth."

Automation is an example of how an ageing population and tight employment conditions can help incentivise innovation.

Japan has a number of pure-play factory automation providers such as Keyence and Shima Seiki.

"The Japanese population in general has a more receptive attitude to automation. It is not a case of thinking: ‘it will take my job’, so much as ‘it will improve efficiency," says Karen See, manager of Baillie Gifford Japanese Income Fund.

"Japan still has a lot of advanced technical know-how and manufacturing capacity. We like companies in the automation space, as they offer potential for long-term growth. Fanuc is a leader in factory automation in car manufacturing plants, and is ramping up its capital expenditure."

The banking sector divides the fund managers, however. While Kwok believes most Japanese financial institutions are struggling under the Bank of Japan’s negative interest rate and accommodative monetary policy, See takes an overweight position because the team is looking for strong balance sheets and growth in earnings.

Recruitment is a hot sector at the moment following government moves to introduce a general work visa, which would not require sponsorship by a named employer. Additionally, after the VAT hike, electronic payments will be exempt for a brief period to coax Japanese consumers away from their traditional preference for cash, which could help stocks like GMO Payments Gateway and Mercari.

For investors looking for income, Baillie Gifford Japanese Income Growth grew out of the idea that improved governance is driving higher shareholder returns, so there is potential to invest in growth companies without sacrificing much on yield. The fund, which is concentrated into 62 stocks, should yield 2.6% versus 2.4% for the market.

Best non-indexed Japan funds over one year

| Total returns (%) over | |||

|---|---|---|---|

| 1 year | 3 years | 5 years | |

| Fidelity Japan | 9.5 | 8.1 | 11.3 |

| Baillie Gifford Developed Asia Pacific | 7.1 | 11.6 | 14.5 |

| Baillie Gifford Japanese Income | 5.7 | 13.1 | n/a |

| Janus Henderson Japan Opportunities | 5.3 | 12.3 | 14.1 |

| Jupiter Japan Income | 4.8 | 12.1 | 14.1 |

| Aberdeen Standard Japan Smaller Companies | 4.8 | 11.0 | 14.8 |

| Polar Capital Japan Value | 4.2 | 15.5 | 11.9 |

| Threadneedle Japan Fund | 4.2 | 10.3 | 11.9 |

| Goldman Sachs Japan Equity Portfolio | 4.1 | 9.4 | 12.0 |

| Baillie Gifford Japan | 4.0 | 14.4 | 15.6 |

| LF CanLife Japan Accumulation | 3.8 | 7.5 | 9.2 |

| LF Ruffer Japanese | 3.4 | 14.4 | 9.4 |

| Barings Japan Growth Trust | 2.9 | 11.3 | 12.7 |

| T Rowe Price Japanese Equity | 2.7 | n/a | n/a |

| Pictet Japanese Equity Opportunities | 2.0 | 11.8 | 12.4 |

| JPMorgan Japan Accumulation | 1.7 | 8.4 | 17.7 |

| LF Morant Wright | 1.2 | 10.5 | 12.2 |

| Lindsell Train Japanese Equities Sterling | 1.1 | 11.3 | 17.8 |

| Axa Framlington Japan | 1.1 | 6.9 | 13.8 |

| Capital Group Japan Equity | 0.8 | 10.5 | 11.8 |

| GAM Star Japan Leaders | 0.8 | 10.3 | 14.8 |

Source: Morningstar, as at 11 July 2019

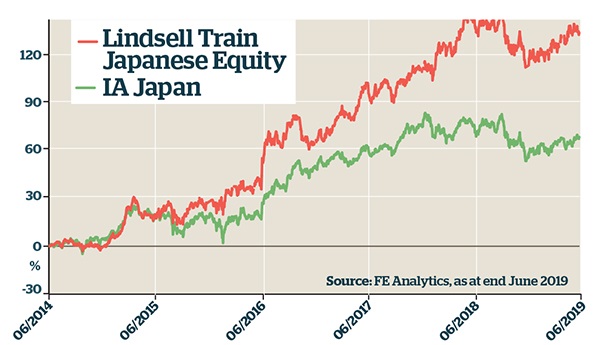

Fund in focus: Lindsell Train Japanese Equity Fund

The outperforming Lindsell Train Japanese Equity Fund is run by eponymous manager Michael Lindsell, who buys companies with established brands and long-term histories of profit generation.

The fund has suffered, if anything, rather more than its peers over the past year to the end of June, down 5.5% compared to the IA Japan sector average of -4.3%, but has gained 44% over the past three years and 122% over five years, compared with 34% and 69% respectively for IA Japan.

The portfolio consists of 22 positions, of which 45% are consumer franchises that have built up strong brand loyalty. "The average age of the companies is 90," says Lindsell. "They have survived heinous things like wars and recessions, and have a history of generating real returns."

An example is Cow Corp, which is focused on the personal care, household goods and healthy beverages, sectors that traditionally deliver steady growth in bad times. "Cow has increased its dividend steadily over the past 20 years, yet it is at the core of a deflationary economy, so if adjusted for inflation, real dividends should be sustainable," says Lindsell.

Other holdings include Milbon haircare products, which sells products exclusively to hair salons and is building out across Asia, and Sheiseido. The latter is enjoying double-digit growth in demand for its high-end cosmetics among Asian consumers, and is forging deals to sell directly to the Chinese, after the authorities there restricted the online reselling of goods bought in Japan.

The manager is concerned about the hike in consumption tax in Japan, especially as the last hike in 2014 plunged the country into recession. However, the fund holds Obic Business Consultants, which sells payroll software to small and medium companies, a sticky business where the change in the tax rate has been creating a spurt in demand.

"The economy does not look great, but any bump gives us chance to add to our positions," adds Lindsell.

Long-term strength from Lindsell Train

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.