Why Lloyds Bank shares are worth 36% more

17th July 2018 14:00

by Graeme Evans from interactive investor

With just a few weeks before the bank sector results season begins, Graeme Evans tells us what to expect and which players could do best.

After a depressingly familiar share price performance in Q2, investors in Lloyds Banking Group and the other major UK banks will no doubt be looking forward to the upcoming results season more in hope than expectation.

Brexit-related uncertainty has continued to damage the investment case, although that's not stopped analysts at UBS from continuing to see upside in the share prices of both Lloyds and Barclays.

The pair are UBS's chosen picks, while they are neutral on Standard Chartered and Royal Bank of Scotland and most cautious of all on HSBC. The UK results season is crammed into one week, with Lloyds among the first to report on August 1, followed by Barclays a day later and ending with HSBC on August 6.

Despite the recent Brexit headlines, UBS analyst Jason Napier expects Lloyds and Barclays to at least match consensus expectations for the second quarter of 2018.

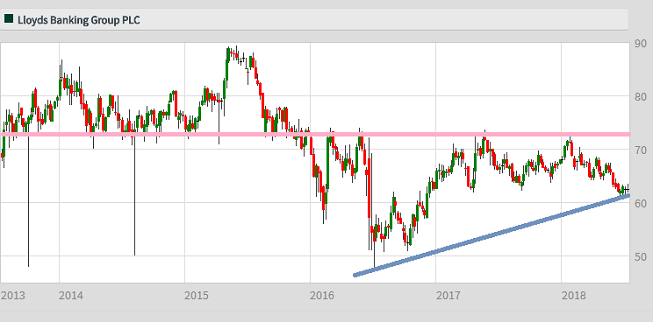

Source: interactive investor Past performance is not a guide to future performance

He thinks all-important net interest margins should prove at least stable in 2018 and going into the EU transition period, helped by falling wholesale funding costs and a slight increase in mortgage spreads.

Napier notes that Lloyds and Barclays are both undervalued in comparison with UK and European rivals, given that they trade on a projected 2019 earnings multiple of 8x. In contrast, HSBC is on 13.3x and the sector as a whole on 9.7x.

Napier said in relation to the pair: "We expect valuation and earnings per share stability to drive a recovery in rating, noisy backdrop notwithstanding."

His 87p target price on Lloyds should be music to the ears of investors, given that shares have languished below 65p since late May, despite strong performance metrics and the prospect for increased shareholder returns.

While margins have remained stable, next year's PPI claims deadline appears to have brought a revival in refund requests. UBS's estimates assume an additional £500 million in provisions for Lloyds in the second quarter, which should be sufficient to cover 13,000 claims per week up to August 2019.

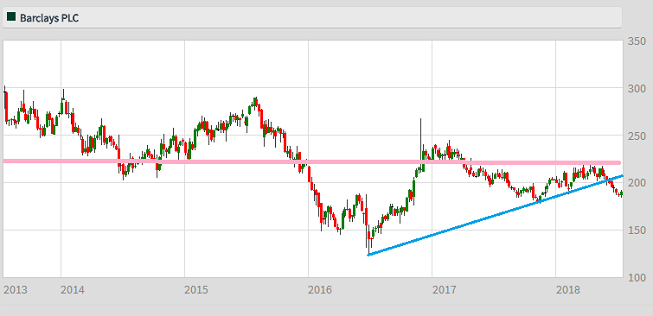

Barclays, meanwhile, has a target price of 240p, with UBS confident that buy-backs should improve key investor metrics over the next two to three years.

Even though a number of legacy issues have now been dealt with, UBS's Napier notes that the share price is down 12% since the bank's settlement in May with US authorities over the sale of mortgage-backed securities.

Source: interactive investor Past performance is not a guide to future performance

Napier said: "Either other events have overtaken the share, this litigation wasn't considered a real risk before, or there's a much more interesting valuation opportunity here."

Having told shareholders they would soon be able to plug into "the full earnings power" of Barclays, the bank's CEO Jes Staley has already promised that the 2018 dividend will be returned to where it was two years ago.

In contrast to Barclays and Lloyds, UBS sees the HSBC valuation as full at 13.3x.

Napier said the key question for investors is how can the bank improve its growth and operational leverage?

He added: "If the best shareholders can expect is 5% revenues growth in a decent GDP environment with rate increases boosting margins, it’s hard to envisage strong value creation through the cycle, taking into account periods of higher loan losses and tougher revenues."

UBS has a 735p target price for HSBC, while it is at 285p for Royal Bank of Scotland and 800p for Standard Chartered.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.