Why Red Emperor is up 126% today!

Our industry expert gets under the bonnet of Red Emperor Resources, the most popular stock in town.

6th March 2019 12:24

by Rajan Dhall from interactive investor

Our industry expert gets under the bonnet of Red Emperor Resources, the most popular stock in town.

The general trajectory for Brent crude is still up as the market continues to digest the OPEC+ output cuts and all attempts to balance the market.

There have also been supply issues in Venezuela, but the biggest development has come from the unpredictable US president who took to twitter to display his displeasure at the current oil price.

Trump tweeted:

"Oil prices getting too high. OPEC, please relax and take it easy. World cannot take a price hike — fragile!"

Over the last week we have also had comment from OPEC delegates. The Saudi Energy Minister Khalid al-Falih said "We are taking it easy," at an OPEC symposium in Riyadh. This week media reports suggest the oil cartel will wait until June, rather than April, before reviewing policy, although much depends on the scale of US sanctions on OPEC members Iran and Venezuela.

Oil inventories in the US are getting pretty volatile, and last week there was a draw in both weekly API's and the Department of Energy (DoE), but just last night the API inventory figures showed a larger than expected build of 7.29 million barrels for the week ending March 1. That exceeds analyst expectations of a build in crude oil inventories of 388,000 barrels. Elsewhere, US production is averaging 12.1 million barrels per day, making America the largest oil producer in the world.

Looking at the technicals on the daily Brent chart, you can see in the last few days there has been some indecision. The price is currently in a tight range between $64.40 and $67.70 per barrel.

A break out in either direction would likely be significant, and the DoE data Wednesday could be the catalyst.

Currently, the price has just made a new lower high, and a lower low break of the $64.34 level would confirm a technical short term trend change, as a lower high and lower low would be made.

Source: TradingView Past performance is not a guide to future performance

Red Emperor Resources

For those of you that have not heard of Red Emperor Resources (LSE:RMP), the company is listed on the AIM market and valued at just £14 million. It is focused on identifying and exploring for oil and gas on the Alaska North Slope and in South East Asia.

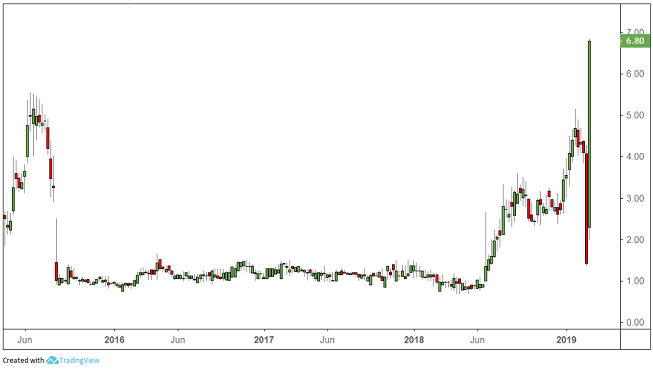

Source: TradingView Past performance is not a guide to future performance

As you can see from this weekly chart above, the company's share price is full of ups and downs. But after a strong run since last summer, up from below 1p to above 5p in January, they plunged last week to just 1.4p. Today they've just hit 7.45p, their highest since August 2012!

The recent whipsaw was due to progress made on a key area of the company's strategy.

The share price tumbled following the company's drilling results at the Winx Prospect, located on the Western Blocks, North Slope of Alaska. Results from the Nanushuk formation in the Winx-1 exploration well were at the "lower end of the range required for commerciality". However, further petrophysical analysis was said to be necessary to confirm this opinion.

So what changed today?

There was finally good news for shareholders as we heard that drilling reached 6,800ft on 3 March, and that all pre-drill targets were successfully intersected. Multiple potential pay zones have also been identified, including in the main Nanushuk target zone.

So next up for the AIM company is verification of the prospectivity of the zones of interest in Nanushuk. It is expected to take around 10 days to complete and then, depending on results, the company says ''a decision will then be made on whether to proceed with production testing of the most prospective zone within the Nanushuk Formation''.

The 10 days is slightly longer than the industry standard, but experts aren't reading too much into that.

The Winx prospect is a conventional oil prospect with a gross mean unrisked prospective resource of 400 million barrels, of which 126 million is net to Red Emperor. It's also just four miles from the Horseshoe 1/1A discovery well drilled by the Armstrong/Repsol joint venture in 2017.

Horseshoe is part of the billion-barrel plus Nanushuk oil play-fairway, one of the largest conventional oil fields discovered in the US in more than 30 years.

We now wait for the next update in around two weeks' time.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.