Why Rolls-Royce and Merlin Entertainments are on the move

2nd August 2018 11:11

by Lee Wild from interactive investor

There was plenty going on at both Rolls and Merlin during the first half, but what should investors expect in H2? Lee Wild, head of equity strategy at interactive investor, analyses the numbers.

Rolls-Royce

Rolls-Royce is undergoing one of the biggest overhauls in its long history, and at a time when numbers across the business are improving.

Civil Aerospace and Power Systems divisions were behind better than expected first half results, and both sales and profit at the defence business were similar to last year.

Crucially, costs are coming down in key areas, especially commercial aero where Rolls has had problems in the past, although a group-wide reduction will only come when restructuring benefits gather pace.

Currency fluctuations, restructuring costs and an ugly £554 million charge to cover the Trent 1000 engine issues caused a reported loss of over £1.2 billion for the six-month period.

There's not much Rolls can do about that now and it is addressing the problems sensibly. Strip out one-offs and an underlying profit before tax of £73 million versus a loss of £143 million a year ago tells you far more about the business right now.

Source: interactive investor Past performance is not a guide to future performance

Management is clearly happy enough to predict that both full-year underlying profit and cash flow will be in the upper half of its guidance range. Encouragingly, underlying operating profit is still expected to come in at £450 million give or take £100 million. So is free cash flow, and Rolls is still on track to hit £1 billion of free cash in two years’ time.

Warren East is right when he says Rolls is at a 'pivotal moment' in its history. It's been haemorrhaging cash for years and a massive overhaul is desperately needed to make this lumbering beast fit to compete in the 21st century. This update demonstrates clear progress, and while the divisional forecasts receive only minor tweaks here and there, East appears to be executing his simplification strategy to plan.

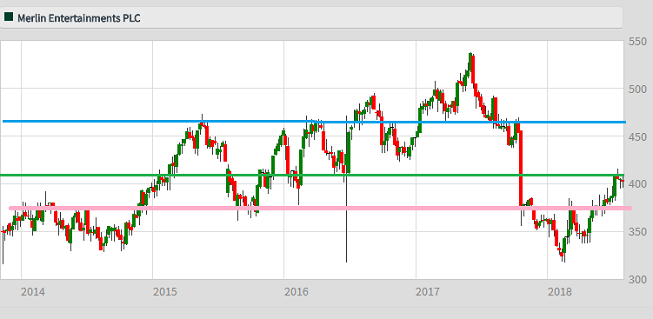

Merlin Entertainments

Merlin Entertainments' recovery from last October's profits warning is well underway, but nerves heading into these interim results have proved to be justified. Merlin runs some of the most popular attractions both here and abroad, and a great summer like this should continue to generate bumper profits for outside venues. But the Europe-wide heatwave is a double-edged sword.

Warm weather is keeping visitors away from indoor attractions, especially in London, and Merlin is feeling the heat. It's also taking time for revenues in the capital to make a full recovery from last year’s terror attacks, and Merlin is still not confident enough to call a recovery in the London market.

An increase in visitor numbers across the business improved revenue during the first half, but pre-tax profit fell by £7 million, or almost 14%, to £43 million. Much of that is due to a sharp decline in margin at manly indoor attractions like Madame Tussauds where there is a large fixed cost base, so lower sales drop straight through to the bottom line.

The first half is typically Merlin's weakest, so the next six months when it makes 70% of annual cash profit are crucial to the full-year outcome.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.