Why Trump's tariffs won't fix global trade issues

22nd August 2018 12:21

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The trade tariff war is a little like putting dirty fuel into your car and then wondering why it won't run, says Douglas Chadwick.

I can fully understand why Donald Trump might be attempting to level up the playing field and reduce the imbalance of trade between America, China, the EU and other nations around the world.

I also can see his reasoning and desire to have these very same nations take their fair share of the funding of the United Nations, NATO, the World Health Organisation, and many other global organisations.

He sees on the one hand that these nations are frequently critical and denigrate the actions taken by Americans, yet their other hand is held out seeking financial assistance. To Trump and many other Americans this must be irksome, so it has become a target for them to correct.

Having said the above, I do find it puzzling as to why you would endeavour to put tariffs onto what at the end of the day are simply worldwide commodities. For example, oil, gas, soybeans, and rice are capable of being purchased from multiple sources.

If the Chinese stop buying American soybeans and buy them instead from Brazil, then the American farmers will simply have to sell their beans elsewhere, such as to the EU. The same applies to the sanctions placed on purchasing Iranian oil. Even if America and the EU were to stop buying oil sourced in Iran, I cannot see the Chinese taking any notice of the restriction, and the EU will simply buy more American oil.

It is a similar circular story with gas and rice. To me all that seems to be happening is that supply chains are going to be altered and put under stress, but the imbalance which Trump is trying to alleviate with his trade tariffs will remain.

Now if the tariffs were applied to Mercedes, Scottish whisky, fine wines and goods and materials that cannot easily be replicated from elsewhere, then I could understand the reasoning. As it is at the moment, it would seem to be causing complications to the supply chain, but will not necessarily produce the re-alignment of trade that Trump is trying to achieve.

However, the last few months have seen the dollar strengthen against the yuan, euro and most other currencies. This by default is making the above dollar-denominated commodities more expensive.

If this currency movement has anything to do with the application of tariffs, then Trump is hurting the entire world, and this includes the American people who are putting more expensive dollar-priced fuel into their vehicles.

It is beyond my capability to reason out what all this means for the future. I am reminded of my brother and myself sitting in a seaside pool fighting over what water belonged to each of us. A lot of splashing but no sensible result!

Nevertheless there is potential to learn from the stockmarket and currency movements that occurred during this period. Since the beginning of February the Chinese yuan has devalued against the US dollar by over 8%, whilst the Chinese Shanghai Composite index has fallen by around 20%.

On 5 July it dropped to 2,734 and was down at levels we hadn't seen since 2016. It then rebounded, going back up to 2,900, but has now dropped back a bit. It ended the week at 2,795.

Is this as low as it's going to go?

Those of you that have followed my thoughts in the past will know that I have an affinity for Vietnam and the diligent Vietnamese people. Vietnam is the place where China and Japan have offshored some of their manufacturing.

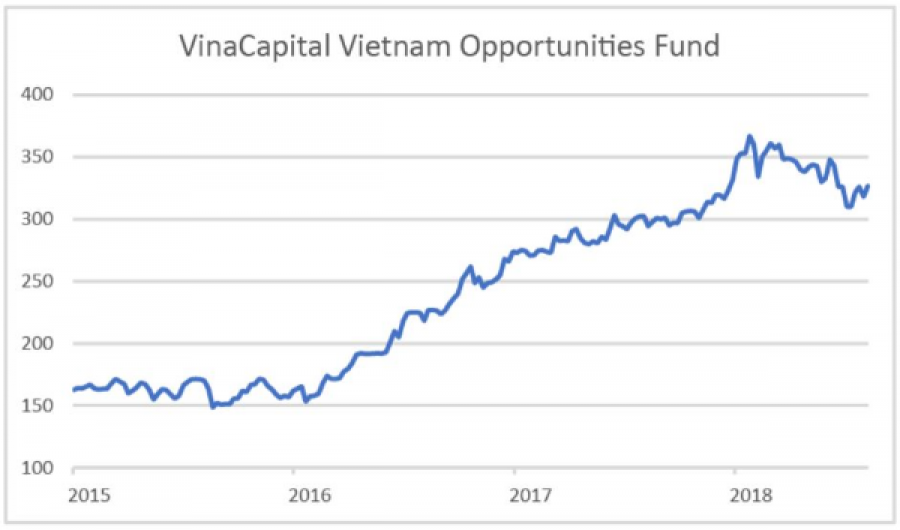

To satisfy my fondness, since late 2014 I have been invested in the VinaCapital Vietnam Opp Fund Ord. During this time I have seen its price move from below 150p to a recent high of 370p. In the last three months it's fallen to 310p, but it has started going up again.

Past performance is not a guide to future performance

It's quite obvious that since the beginning of the year Vietnam has caught a cold when China sneezes. In the past when the VOF price was under stress, I have twice sold half, only to buy it back later. I did this six weeks ago and I am now looking to buy back in again.

I'm waiting to see if the 6% recovery in the Shanghai Composite that we saw recently is going to be repeated - and if it then continues upwards, reflecting a calming down of the trade discussions and a return to some sort of normality.

Douglas Chadwick is founder and chairman of Saltydog Investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.