Why we've exited UK shares and bought this sector

The UK market has lost momentum, but Saltydog analyst Douglas Chadwick has found something else to buy.

22nd July 2019 13:29

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The UK market has lost momentum, but Saltydog analyst Douglas Chadwick has found something else to buy.

Saltydog Portfolios move into the 'Flexible Investment' sector

Over the last month or so, we have been reducing our exposure to the UK All Companies, UK Smaller Companies and UK Equity Income funds. Their performance has deteriorated as uncertainty has increased ahead of the Conservative leadership election, and in particular how it will affect our relationship with Europe.

We invested in several funds from these sectors earlier in the year, when it still looked like some agreement could be made with the EU and fund prices were rising after a disappointing end to 2018. At the time it wasn't unusual to see these sectors in the top three positions in our 'Steady as She Goes' sector analysis.

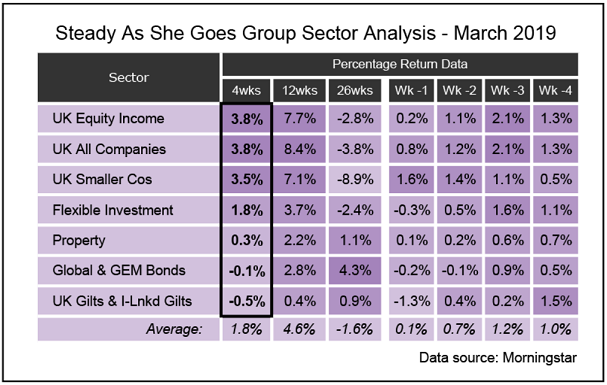

Here's how the 'Steady as She Goes' Group table was looking at the beginning of March.

The three UK Equity sectors were still showing losses over 26 weeks, as a result of the downturn in global markets in the final quarter of 2018, but were nicely up over four and 12 weeks and gaining momentum.

We had already been invested in UK funds for a month and were busy adding to our holdings.

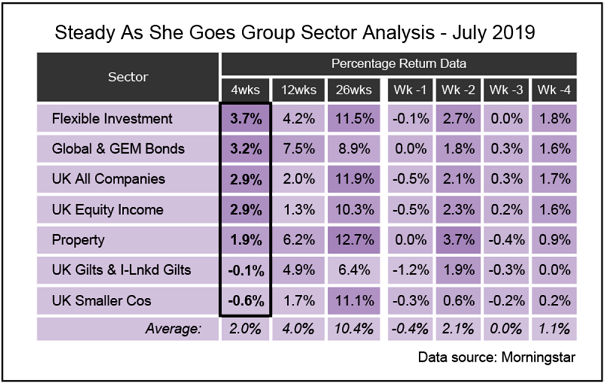

This is how the table looked last week:

The UK Equity sectors no longer dominate the table. The 26-week returns now look reasonable, but the 12 and four-week returns are less impressive. The UK Smaller Companies sector has dropped to the bottom of the table.

The UK All Companies sector is doing OK in third place, but the momentum has shifted to the Flexible Investment sector which looks better over four and 12 weeks and is catching up over 26.

The performance of the funds in this sector can vary quite significantly because the Investment Association sector rules give the fund managers more leeway than in many other sectors.

The IA sector definition states …

The funds in this sector are expected to have a range of different investments. However, the fund manager has significant flexibility over what to invest in. There is no minimum or maximum requirement for investment in company shares (equities) and there is scope for funds to have a high proportion of shares.

The manager is accorded a significant degree of discretion over asset allocation and is allowed to invest up to 100% in equities at their discretion.

- No minimum equity requirement

- No minimum fixed income or cash requirement

- No minimum currency requirement

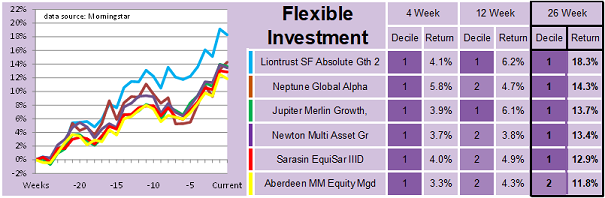

We invested in the Liontrust Sustainable Future Absolute Growth fund a couple of weeks ago, and last week it was still at the top of the 26-week data table. If it continues to perform well, then we will consider adding to our holding.

We will also be keeping a very close eye on the UK sectors.

The principle behind momentum investing is that the chances are that tomorrow is going to be very much like today, and therefore what's doing well today will probably do well tomorrow and vice versa.

However, we know that in the UK tomorrow will be slightly different from today. We will have a new leader of the Conservative party, who will soon be our new Prime Minister.

It will be interesting to see how the markets react.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.