Will China trade truce benefit these funds?

3rd December 2018 13:07

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

A truce in the trade dispute between China and United States is another positive sign for Asia Pacific stockmarkets. Saltydog analyst Douglas Chadwick considers the recent recovery, and takes a closer look at the funds on the move.

At the end of September I wrote about the dismal performance of the key Chinese stockmarket indices. Since the beginning of the year the Shanghai Composite had lost over 15%, the Chinext was down 20% and the Shenzhen Composite was down nearly 25%.

The Shanghai Composite had closed below 2,700 a few times and that was the lowest that it had been since 2014.

These indices had just started to move back up and we were wondering if they would continue on an upward surge. At the time I wrote "It's too early to tell if they're going to drop back again, as we've seen several times over the last six months, but we'll certainly be keeping an eye on them over the next few weeks."

Well, the recovery never really got going and on October 18 the Shanghai Composite closed below 2,500.

Over the last four weeks we've seen signs of another upturn and again we are wondering if this could be the beginning of a more substantial change in momentum.

A significant factor influencing China's performance over the last year has been the ongoing trade war with the US. Over the weekend Donald Trump and the Chinese leader, Xi Jinping, met and agreed that US tariffs on Chinese goods would not be increased for 90 days to allow for further talks. The plan had been for the US to raise tariffs on $200bn of Chinese goods from 10% to 25% on January 1.

Although the threat has not gone away, at least the relationship between these two economic superpowers seems to be improving. The Shanghai Composite has responded favourably, gaining 2.6% on Monday.

We're also seeing positive signs across the wider Asia Pacific region.

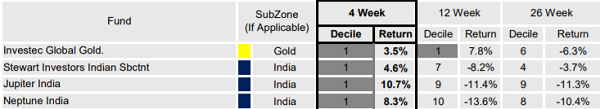

The Indian funds have started to perform well and last week I reported that our demonstration portfolios made a small investment into the Jupiter India — it is currently up just over 3%. The Indian funds still feature near the top of our 'Specialist' sector analysis.

Source: interactive investor Past performance is not a guide to future performance

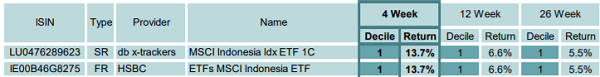

In our latest ETF reports, the best performing funds in the Full Steam Ahead Emerging Group were focused on Indonesia, with four week returns of nearly 14%.

Source: interactive investor Past performance is not a guide to future performance

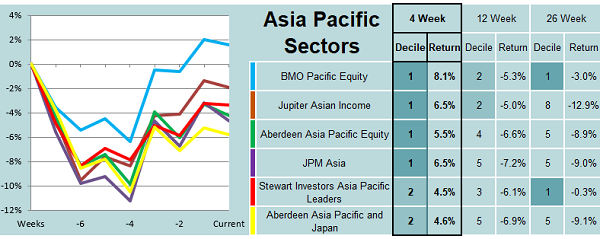

There are funds which have the flexibility to invest across the Asia Pacific region in general. This includes countries like Australia, Hong Kong, New Zealand, Japan, Singapore, China, India, Indonesia, Korea, Malaysia, Pakistan, the Philippines, Taiwan and Thailand.

These funds also feature in our analysis and have the advantage that they are naturally diversified.

Here are a few funds that have done particularly well over the last few weeks.

Source: interactive investor Past performance is not a guide to future performance

We have recently made a small investment in the BMO Pacific Equity fund, which has major holdings in India, Hong Kong, Australia, Indonesia, Malaysia and the Philippines.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.