Will The Hut Group shares recover?

19th October 2021 07:39

by Alistair Strang from Trends and Targets

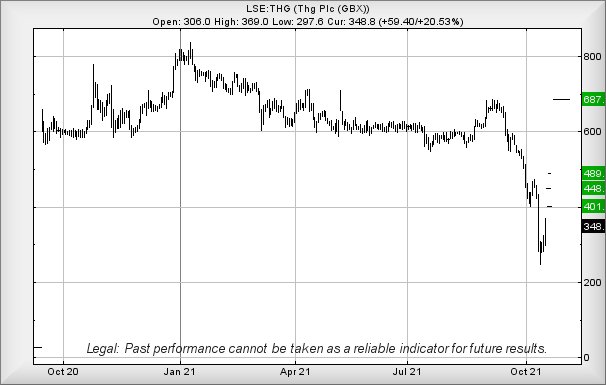

After THG shares plunged to a new low this month, independent analyst Alistair Strang examines the likelihood of a bounce back.

With considerable disappointment, we came to realise THG (LSE:THG), The Hut Group, have absolutely nothing to do with garden huts. As we’re currently building a new garden hut, it would have been nice to discover a real synergy with the subject of our report. A visit to their Wikipedia page quickly reveals THG to be a truly impressive organisation, based in Manchester but with sales predominantly outwith our shores.

Floated on the London Stock Exchange just a year ago, the company were excluded from membership of the FTSE 100 due to certain areas of corporate governance.

A recent effort to unveil their future strategy to investors saw the market celebrate by plunging their share price from 457p down to 248p over just a couple of sessions. It was not a pretty site but, from our perspective, the drop was incredibly precise from an arithmetic viewpoint, especially as we couldn’t produce any target level below 248p.

This, it appeared, was to be regarded as “ultimate bottom” at that time. In the period since, an announcement of a change to their CEO’s so-called “golden share”, is regarded as an attempt to regain the confidence of the City and allow the company to apply to join the FTSE100 next year.

If this is indeed the case, we need to examine criteria which should justify further price recovery.

Source: Trends and Targets. Past performance is not a guide to future performance

Presently trading around 348p, the price need only exceed 370p to promote further movement to an initial 401p. If bettered, we can calculate a secondary at 448p. While the secondary effectively matches the share price highs in the days prior to their fateful fall, any expectation of some hesitation will doubtless prove justified, but there’s an important detail worthy of consideration.

In the event the share actually closes a session an iota above 448p, a new cycle becomes possible with the potential of 489p in the future, perhaps even an astounding 687p. We shall need revisit price movements if it ever successfully closes above 448p, just to confirm these numbers.

After all, they’re almost too good.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.