A winning fund sector with a volatile past

Saltydog Investor details the mixed fortunes of October’s top cohort.

10th November 2025 13:22

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

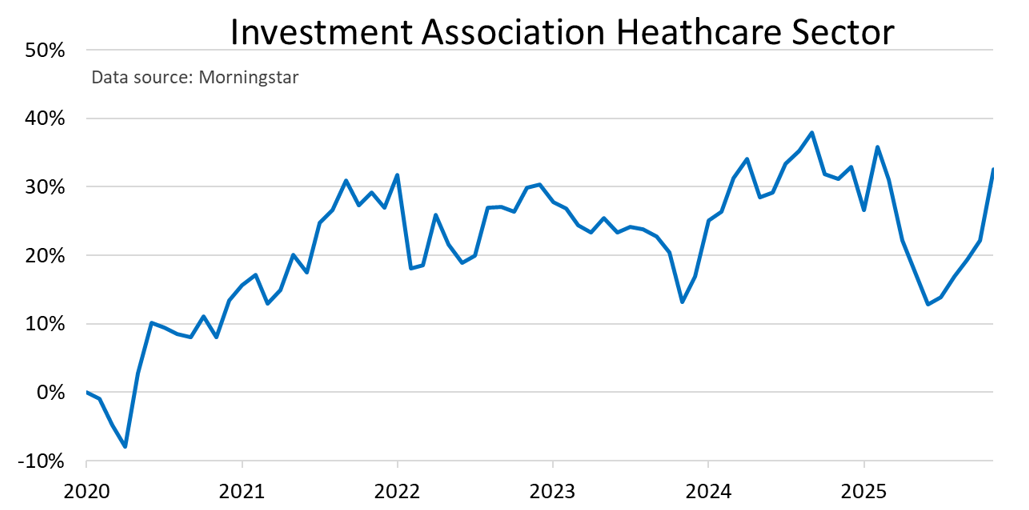

According to the latest analysis, Healthcare was the top-performing Investment Association (IA) sector last month. After significant declines in the first half of the year, the sector began rallying in July and has been rising ever since.

In October, it posted a one-month return of over 8%.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Over the past five years, the sector has delivered positive overall returns, but it has not been plain sailing.

There were strong gains beginning in the second quarter of 2020, when the sector suddenly became the global focus almost overnight. The Covid-19 pandemic generated intense attention from governments, health systems, and the public on vaccines, diagnostics, and therapeutics.

This unprecedented period saw scientific collaboration reach new heights and investment increase sharply. Clinical trial phases were condensed, and innovative designs allowed simultaneous rather than sequential testing.

As a result, Covid-19 vaccines were developed and produced in record time. Vaccine development typically takes 10 to 15 years.

- Around the world in ETFs: single-country funds to add spice

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Several vaccines received emergency use authorisation in under 10 months from the start of clinical trials. This rapid achievement captivated the public, government, and investors alike, highlighting biotech’s crucial pandemic role and boosting confidence in biotech innovation.

A shift in fortunes

As the pandemic’s peak passed, the investment landscape shifted.

Markets rotated away from ultra-defensive sectors, central banks raised interest rates, capital costs increased, and pharmaceutical research and development investment slowed.

The Healthcare sector’s performance stabilised, then drifted without clear direction through 2022 and 2023. While still strategically important, Healthcare lost some of the intense investor focus it had enjoyed during the crisis.

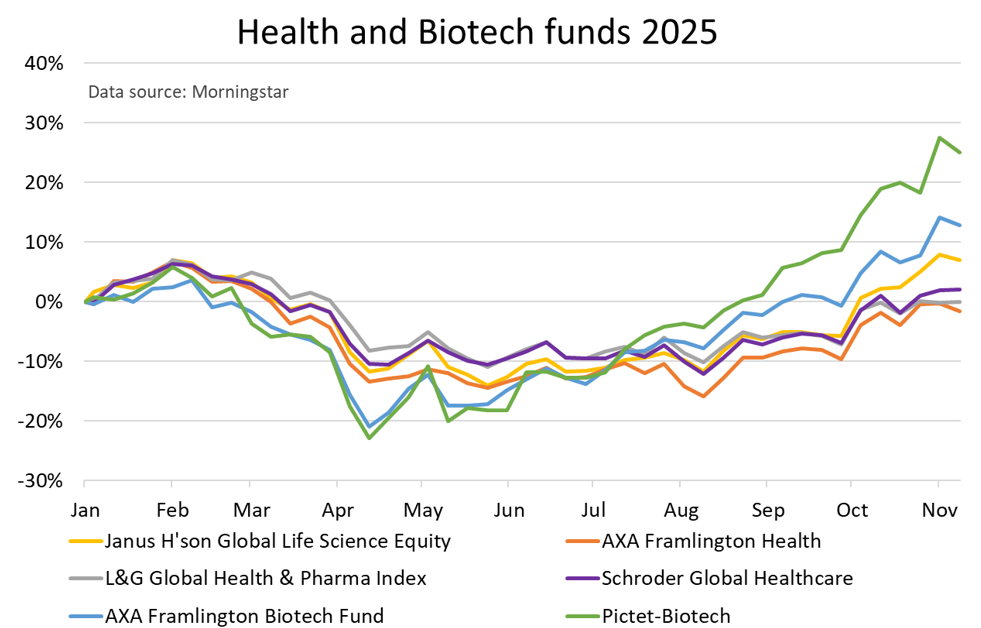

Biotechnology, part of the broader Healthcare sector, carries higher risk but potentially greater reward.

Early in the pandemic, biotech attracted extraordinary interest as it led vaccine design and the development of diagnostics and targeted therapies.

This innovation surge drove soaring valuations, high capital raises, and strong specialist fund performance. However, biotech was also hardest hit when conditions changed.

After a dip at the end of 2023, Healthcare rallied in 2024.

Companies were seen as undervalued relative to AI and technology stocks, and positioned to benefit from a new US administration.

Investors hoped supportive policies would ease regulatory pressures, including drug pricing reforms and clearer guidance on tariffs and healthcare budgets. In the UK, political parties made substantial pledges ahead of the 2024 general election to increase NHS funding and improve access to care.

However, sentiment weakened in the last quarter. Doubts grew that the Trump administration would be as supportive as anticipated.

There were proposals to renegotiate drug prices, cut Medicaid and research funding, and alter healthcare enrolment programmes. These factors raised fears of regulatory headwinds, disrupting revenue expectations and affecting stocks worldwide, given the US market’s global influence.

At the same time, Robert F Kennedy Junior re-entered the spotlight during the Trump campaign and became Secretary of Health and Human Services in early 2025. His decision to halt about $500 million in funding for 22 mRNA vaccine projects sent ripples through the biotech funding landscape.

The downturn continued into early 2025, but recent months have seen a rebound.

Lower interest rates eased financing costs, boosting investor sentiment for capital-intensive healthcare businesses, including biotech and medical devices. Once again, the biotech funds have outperformed the broader healthcare funds, although, like most funds, they dropped slightly at the end of last week.

A new factor shaping biotechnology's future is artificial intelligence.

AI is transforming drug discovery and development economics by allowing researchers to computationally model molecular interactions before costly lab work. This accelerates early-stage development and reduces failure costs, potentially making research pipelines more efficient and attractive to investors.

Investor capital is following this trend. Major pharmaceutical companies are investing in AI platforms, and startup formation in this space is rising, underscoring AI's long-term potential for transforming healthcare innovation. While success is not guaranteed, AI’s ability to improve research efficiency likely represents a structural shift.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.