Woodford stock ReNeuron joins Futura Medical on AIM casualty list

19th September 2018 14:47

by Graeme Evans from interactive investor

It's been a grim day for these two companies – down 16% and 37% respectively - but it's too early to write them off. Graeme Evans reviews today's events.

Updates from two well-respected small-cap healthcare stocks - Futura Medical and ReNeuron - put a big dent into their respective share prices Wednesday.

The decline at stem cell therapy firm ReNeuron offers more frustration for fund manager Neil Woodford, having spoken last year about the long-term opportunity that he believed is being overlooked by the market.

Unfortunately for Woodford Patient Capital Trust and other shareholders, the biotech has been told by a US-based speciality pharmaceutical company that it is pulling out of an exclusive agreement on ReNeuron's hRPC retinal stem cell technology.

While it is no longer interested in a licensing deal, the unnamed company stressed this had nothing to do with the technology or the data generated from due diligence.

• interactive investor AIM hub

• Neil Woodford 'very confident' he can deliver 10%-plus yearly returns

ReNeuron believes the potential for licensing remains strong and it is confident of securing a deal with another partner in the near term.

The stock still slumped 16% today and has now surrendered the 50% rise it achieved between May and July this year.

Analysts at Stifel noted one reason for the negative reaction was the loss of a second $2.5 million payment associated with the exclusive discussion period. This source of non-dilutive funding had previously eased market concerns about cash burn.

However, Stifel added:

"While today's news is disappointing, we still believe the market has yet to appreciate the significance of potential deals and the progress in the Pisces III (stroke disability) trial."

Stifel has a target price of 755p, compared with the current 65p.

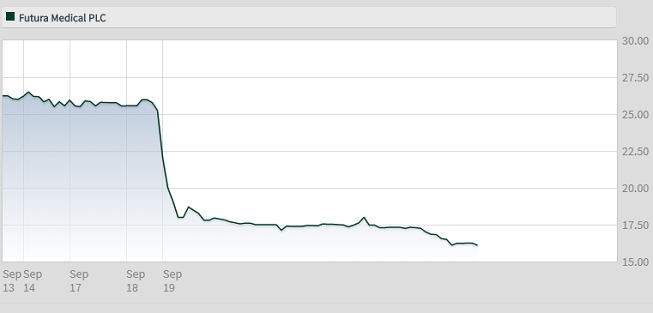

Source: interactive investor Past performance is not a guide to future performance

At Futura Medical, the 37% slide in share price to 16.1p follows an update on the development of MED2002, the company's programme for the topical treatment of erectile dysfunction.

Based on discussions with potential partners, the company is now planning to bring the programme through Phase III trials rather than seeking an immediate sale or licensing agreement.

Futura said the majority of potential commercial partners had wanted to see positive phase III data on MED2002, especially at the higher doses, ahead of more advanced licensing discussions. They have indicated that they are likely to pay more for the product after such data has been generated.

• Stockwatch: How to play this AIM tech share

• Most-bought AIM shares in August 2018

• Stockwatch: An AIM share to gobble up

The first Phase III trial is expected to commence in the next month, with top line data expected by the end of next year.

This means the company is now exploring a number of options for additional funding whilst it progresses the Phase III programme on MED2002. It said this should ensure it has sufficient resources to maximise shareholder value from the commercial opportunity.

The company, which is developing a portfolio of products for the pain relief and sexual health markets, said the MED2002 programme had the potential to deliver sales in excess of US$1 billion from prescription-only and over-the-counter markets.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.