Why Inmarsat, Countrywide and Petrofac are falling

26th June 2018 14:41

by Graeme Evans from interactive investor

With Inmarsat shares heading back to earth and Countrywide continuing its rapid descent, this has been another tough session in the FTSE All-Share.

To add to the gloomy mood, Petrofac Ltd shares were in negative territory despite reporting momentum in new orders and further progress in its strategy.

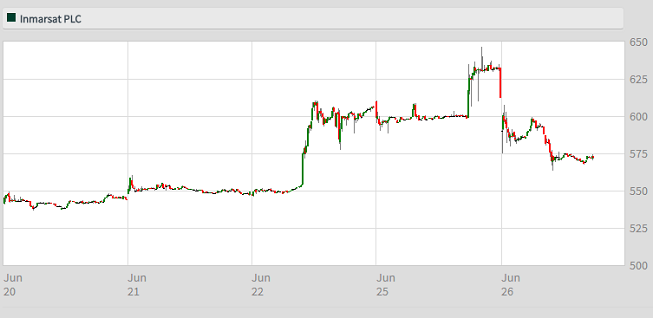

Easily the most eye-catching movement of the session came from satellite group Inmarsat after French rival Eutelsat ended its brief takeover interest.

The announcement was made a matter of hours after the Paris-based company told the London stockmarket on Monday that it was considering a bid, fuelling hopes among investors for a bidding war also involving EchoStar.

Inmarsat, which has a fleet of 13 satellites serving industries including shipping, aviation and the broadcast media, rejected a highly preliminary approach from US-based firm EchoStar earlier this month.

It now remains to be seen whether EchoStar returns with an improved offer for Inmarsat, which is valued at more than £2.6 billion.

Source: interactive investorPast performance is not a guide to future performance

Inmarsat's dividend yield has long made it a favourite among investors, although this has looked less attractive in recent months as shares have fallen from 800p a year ago due to markets that have been challenging and hard to predict.

At Britain’s biggest estate agency chain, Countrywide, shares seems to be heading in only one direction at the moment.

They fell to a record low of 55p last night after the company’s fourth profits warning in under a year, only to decline another 11% to 49p today.

Trading conditions are unforgiving, with properties taking much longer to shift and the company facing greater competition from online players.

Net debt is close to £200 million, which Countrywide said yesterday it wants to cut by at least 50% through an equity fundraising. These plans are at an early stage, but have the support of its largest shareholder in the shape of American private equity firm Oaktree Capital.

Source: interactive investor Past performance is not a guide to future performance

Further details are expected alongside interim results at the end of July, but in the meantime the prospect of a rights issue and little recovery in sight for trading has been enough to keep investors firmly on the sidelines.

Petrofac shares have been on a disappointing run in recent weeks, with the stock succumbing to a bout of profit taking after strong gains over the previous year. The provider of services to the oil and gas production and processing industry continues to trade in line with expectations, however, with new order intake of $1.8 billion reported today for the first six months of its financial year. A further $20 billion of bid opportunities are due for award in the second half of the year.

The FTSE 250 Index company is backed by a high yield in the region of 6%, which is covered at least twice by earnings and possibly more by cash flow.

Much will depend on the movement in oil prices after OPEC's decision at the weekend to increase oil production. Brent crude slipped 2% yesterday but was higher again today at more than 75 US dollars a barrel.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.