Pension stories

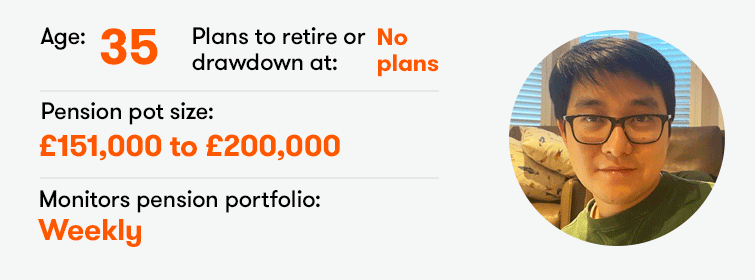

Cheng Zhen

Did you find it easy to start investing for a pension?

Yes, it was easy to start aged 25, but I wish I had known how important investing for a pension was.

What current pension contributions do you make, either monthly or otherwise?

I contribute 20% of my monthly salary.

Have you ever taken a break from pension saving?

No.

What do you invest in for your pension?

Funds, ETFs, and equities, both international and UK. I use ETFs for certain asset classes such as gold and oil.

What are your five largest holdings?

A gold ETF, HSBC UK Dividend ETF, Berkeley Group (LSE:BKG), Alibaba (NYSE:BABA), and Plus500 (LSE:PLUS) (as of November 2020).

Which international stocks do you invest in?

Quite a few, including Pfizer (NYSE:PFE), Alphabet (NASDAQ:GOOGL), Facebook (NASDAQ:FB) and NIO (NYSE:NIO) (as of November 2020). I do my own analysis and own about 20 different stocks.

What is your investment objective/target pension pot or annual retirement income?

My objective is to beat the average index passive return and certainly to beat bond/cash returns. My ultimate goal is to achieve a sizeable pot which provides about a £25,000 annual return from dividends.

As a SIPP holder, what advice would you give to anyone thinking of opening one?

A SIPP is great for individuals who are willing to spend a bit of extra time taking care of their own finances. The golden rule is to start early, be persistent and look at long-term investment over short-term speculation. This will allow the eighth wonder of the world (compound interest) to do its work.

A SIPP is great for individuals who are willing to spend a bit of time taking care of their own finances.

Do you have any pension savings tips?

Start early, contribute persistently even small amounts, avoid trading frequently and speculating, make an effort to understand the investment that you are buying and have a long-term view of your investments. Drip-feed investing to benefit from dollar-cost averaging.

How do you feel about your pension?

Pension saving was not a priority for me early on when my income was low. As my income has grown, my pension has become an important part of my savings because of its tax advantages. As defined benefit pensions [are rare], personal pensions are the most important saving option for retirement.

If you could ask one question about your pension strategy, what would it be?

When should I switch to lower-risk investment portfolios?

Pensions can be a party pooper topic, but not at ii. We want to know more about the retirement hopes and fears of the nation. Please help us paint the fullest picture yet by taking part in our annual Great British Retirement Survey

Our expert’s view

Victoria Scholar writes...

Cheng has an exemplary attitude to pension investing and clearly understands the importance of contributing as much as possible as early on in working life as possible. He has an above-average size pension pot for his age.

Cheng asks when to switch to lower-risk investments. Workplace pension schemes are often de-risked automatically when someone is in their 50s. But given his aim of continuing to work for as long as possible, he may not want to reduce risk until a bit later. It really depends on when he anticipates stopping work and drawing on his pension, though, so he should keep this under review – things can happen later in life that force you to bring forward your retirement date. There’s always that risk, with plans to retire later than your ‘healthy’ life expectancy, which has remained static at around 63.

That said, Cheng has made such good headway already that he should be in a relatively good place even if he ends up stopping work a bit earlier than planned.

Dzmitry Lipski suggests a fund which might interest an investor in their 30s

A more experienced investor could consider commodities as a diversifier and a hedge against rises in inflation. The WisdomTree Enhanced Commodity UCITS ETF(LSE:WCOB)provides broad and diversified commodity exposure, covering four broad commodity sectors: energy, agriculture, industrial metals and precious metals.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Take control of your pension

The ii SIPP is aimed at clients who have sufficient knowledge and experience of investing to make their own investment decisions and want to actively manage their investments. A SIPP is not suitable for every investor. Other types of pensions may be more appropriate. The value of investments made within a SIPP can fall as well as rise and you may end up with a fund at retirement that’s worth less than you invested. You can normally only access the money from age 55 (age 57 from 2028). Prior to making any decision about the suitability of a SIPP, or transferring any existing pension plan(s) into a SIPP we recommend that you seek the advice of a suitably qualified financial adviser. Please note the tax treatment of these products depends on the individual circumstances of each customer and may be subject to change in future.