Accsys Technologies overcomes early plunge

16th June 2015 13:49

by Lee Wild from interactive investor

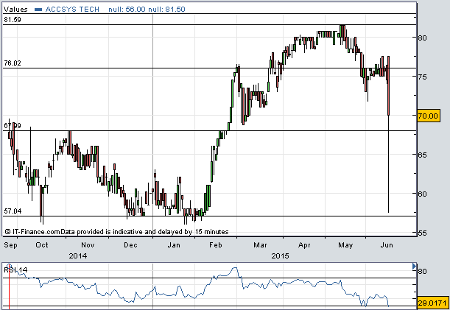

AIM-listed lost more than a fifth of its value in the first hour of trade on Tuesday following publication of its latest full-year results. But clearly concerns about another year of chunky losses were misplaced. After flushing out sellers early on, including one large trade, the price has recovered partially and analysts remain upbeat.

There's clearly interest in the company. Run by Paul Clegg, former banker and brother of ex-Liberal Democrat leader Nick, Accsys has developed a process of modifying softwood - mainly fast-growing southern hemisphere pine - called acetylation. Tests show it can stop wood from moving or rotting outside for 50 years. In reality, it's likely to be much longer.

It's perfect for windows, doors and decking, but it's a relatively new technology, and is more expensive to install than equivalents built with traditional woods and PVC. Of course, it works out cheaper in the long-run, but convincing housebuilders and consumers to spend the extra is never easy.

That said, revenue surged by 38% in the year ended March to €46 million, of which €40.7 million was from Accoya wood sales. A 32% rise in Accoya volumes to 33,483m3, a 5% price hike in the third quarter and cost cutting, also improved gross margins by 400 basis points to 27%. It ended the period with net cash of €10.8 million.

However, despite halving its EBITDA loss to €2.4 million and losing just €0.4 million in the second half of the year, pre-tax losses remain substantial at €7.7 million. Strip out £2.9 million of damages and costs linked to a claim against Accsys by Diamond Wood, and the company still lost almost €5 million compared with €7.5 million in 2014.

(click to enlarge)

An agreement signed in 2007 gave Diamond Wood an exclusive licence to manufacture and sell Accoya in China. Accsys tried to get out of the deal in 2013 then Diamond tried to sue for over €140 million of damages. The courts have now ruled that the pair must work together. In a recent development, Diamond is planning to reverse into cash shell Cleantech Building Materials and list on AIM. Money raised will fund construction of a plant in China, although all this will take years.

Interest in Accsys - which also owns rights to "super MDF" Tricoya - took off in February when Majedie Asset Management bought 500,000 shares with the price at around 56p. Shortly after, Accsys reported a strong set of nine-month results and record production in January.

But Numis Securities believes the shares have yet to fulfil their potential. "As the market for Accoya and Tricoya develops the group's model will evolve from licensing towards a royalty and manufacturing based business, which we believe could crystallise substantial value for shareholders," says analyst Christen Hjorth. "We therefore reiterate our Buy recommendation and target price of 117p/share."

If Numis has got its numbers right, Accsys will make a cash profit of €3.1 million in the year to March 2016. Expect a first pre-tax profit - €3.4 million - in 2018.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.