Alliance Pharma makes 13-year high

13th July 2015 16:45

by Harriet Mann from interactive investor

The first six months of financial year have gone very much to plan. The speciality drugs company has integrated its acquisitions well and sales are rising. Alliance shares hit a new 13-year high Monday, but strong cash generation and further acquisition activity will be needed to drive the next leg of this impressive rally.

Alliance either owns or licences the rights to over 60 products across 30 countries, although sales are mainly in the UK. In the first six months of the year, revenue was up 7% at £22.8 million, driven by 10% sales growth for Hydromol. Despite an additional rebate deduction under the UK government's Pharmaceutical Price Regulation Scheme, sales of the anti-eczema cream reached £3.3 million during the period.

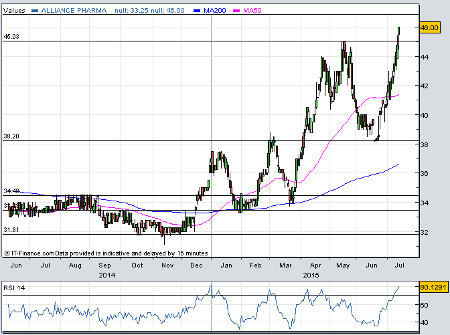

(click to enlarge)

Management still reckon sales from cancer treatment ImmuCyst will restart this year after problems at supplier Sanofi. However, volumes remain uncertain as production capacity is being ramped up by the French firm. Alliance's February acquisition of eye treatment MacuShield is also performing as expected, and in a bid to add to the 26 deals completed in the last 15 years, the group is keeping an eye open for any other buying opportunities. Strong cash generation, and further bolt-on acquisitions will drive Alliance's investment case, reckons Numis Securities analyst Sally Taylor.

There will also be a new man in town come September, as former finance director of Genzyme Therapeutics Andrew Franklin takes up the same role at Alliance.

Ahead of the company's first-half reveal in September, Taylor maintains her guidance for a 9% increase in 2015 sales to £47.3 million and pre-tax profit of £11.1 million, up 3%. Next year, Taylor pencils in £48.8 million and £11.7 million, respectively.

At 46p, Alliance trades on 13 times 2016 earnings estimates and close to Taylor's 48p price target. ImmuCyst sales must come through soon to maintain momentum, although the shares are overbought, according to the relative strength index (see chart), at least for the time being.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.