Are high yielder Royal Mail's results any good?

17th July 2018 10:59

by Richard Hunter from interactive investor

After a significant retracement from May's high, Royal Mail shares need a boost. Richard Hunter, head of markets at interactive investor, talks us through Q1 results.

The year has started at a pedestrian pace for Royal Mail, with the story little changed in an evolving delivery space.

The fact that letters and cards are slowly being consigned to history has long been known, but Royal Mail has, for the most part, been able to replace this lost business within a burgeoning parcels market.

In particular, its European business, GLS, continues to shine, with volumes up 10% and revenues up 11% in the period, underpinned by strong showings from the likes of Italy, Denmark and Spain.

Indeed, its generally increasing international exposure, including the US, is a strong backbone to the UK business which continues to dominate the sector. In addition, a dividend yield of 5% is another attraction in a generally income-starved environment.

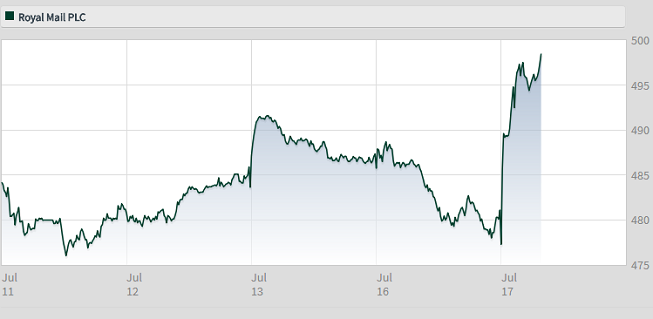

Source: interactive investor Past performance is not a guide to future performance

The proliferation in the parcels business has, inevitably, attracted competition – and serious competition at that. Deutsche Post remains a force to be reckoned with, whilst Amazon.com is also threatening to park its tanks on the lawn.

In response, Royal Mail is attempting to transition its business at pace to becoming a leaner operation, with a rather more slick delivery process, although this transformation is inevitably coming with financial strings attached.

Prospects for the business have been recognised by the market, where a rise in the share price of 20% over the last year, as compared to a 3% hike for the wider FTSE 100, has seen the company regain its place in the premier index.

At the same time, there has been some profit-taking pressure over the last three months, where the shares have dipped some 14% over the period.

This element of the price being up with events could continue to weigh in the shorter term, particularly with the shares being on an increasingly punchy valuation. As such, in the absence of some strikingly good news as Royal Mail's financial year unfolds, the market consensus of the shares as a 'sell' could well remain intact.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.