Bellway: A five-star housebuilder

At a big discount to the sector and boasting a strong balance sheet, there's lots to like about Bellway.

27th March 2019 14:27

by Graeme Evans from interactive investor

At a big discount to the sector and boasting a strong balance sheet, there's lots to like about Bellway.

While housebuilder Bellway (LSE:BWY) probably won't set pulses racing in the same way as ultra high-yielding Taylor Wimpey (LSE:TW.) or Persimmon (LSE:PSN), the qualities highlighted in today's robust half-year results merit closer attention in the current climate.

The Newcastle-based firm lifted earnings per share by 8.3% to a record 207.5p, with a strong six months of trading seeing the completion of 5,007 homes, a rise of 5.6% on a year earlier. Despite market uncertainty, the average selling price was up 6.5% to £293,832.

Bellway boosted the interim dividend by 5% to 50.4p, although its yield of around 4.9% is still overshadowed by the sector average at closer to 7.5%. Taylor Wimpey, for example, has recently been trading with a projected 13% yield based on this year's promised return of £600 million to shareholders.

But Bellway's consistency and conservative balance sheet count for a lot in the current conditions, even if its shares appear undervalued. Peel Hunt notes that Bellway trades at a 20% discount to the sector, despite its return on equity of 18.4% being broadly in line.

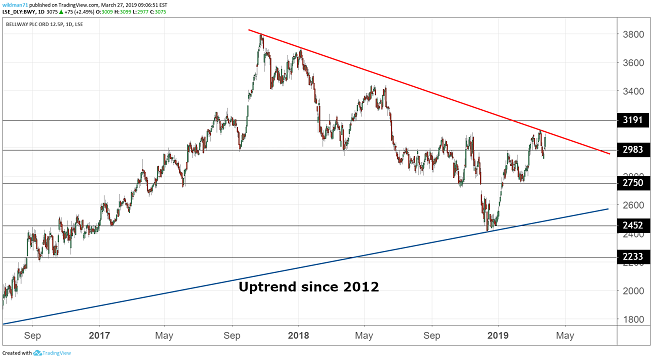

Source: TradingView (*) Past performance is not a guide to future performance

Shares rose 2% in the wake of today's results, with analysts at UBS thinking there's much further to go based on their 'buy' recommendation and price target of 3,600p. Other stocks benefited from today's update, particularly as Bellway provided vital reassurance on trading in the month since the last of the major housebuilders reported to the City.

In addition to the 12.4% revenues growth in the six months to January 31, the order book at mid-March was broadly flat at £1.48 billion with 5,724 new homes. Despite Brexit uncertainty, the cancellation rate only increased to 13% in the half-year, from 11% a year earlier.

Bellway's CEO Jason Honeyman described trading in the six weeks since February 1 as strong, with the 259 reservations achieved per week better than the 248 a week of a year earlier. High employment, good access to affordable mortgage finance and the continued availability of the government's Help to Buy scheme are factors in the positive performance.

The company has now boosted its output for ten consecutive years, meaning the number of homes it sells has risen by almost 150%. It believes its current structure of 22 operating divisions has the potential to deliver up to 13,000 homes a year, compared with the 10,307 achieved last year.

Despite this growth, and amid closer scrutiny on standards across the new build sector, Bellway has been named as a "five-star homebuilder" for a third year in a row following a customer satisfaction survey by the Home Builders' Federation.

It also boasts a robust balance sheet, with bank debt of only £26.6 million meaning that it should be agile enough to react to new land opportunities as they arise.

*Horizontal lines on charts represent levels of previous technical support and resistance. Trendlines are marked in red.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.