Big share movers after Covid-19 updates on 18 March 2020

Another slew of trading updates have pushed shares sharply in both directions.

18th March 2020 14:28

by Graeme Evans from interactive investor

Another slew of trading updates have pushed shares sharply in both directions.

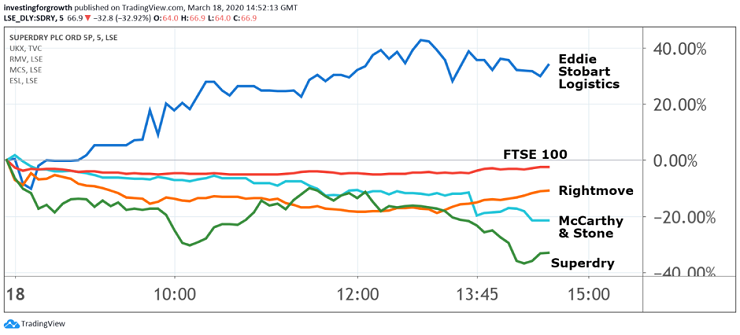

Double-digit percentage moves in both directions highlighted some extreme market volatility today, with Rightmove (LSE:RMV), National Express (LSE:NEX) and Travis Perkins (LSE:TPK) among those to decline sharply.

Retailer Superdry (LSE:SDRY), retirement homes specialist McCarthy & Stone (LSE:MCS) and currency provider Ramsdens Holdings (LSE:RFX) were also significantly lower after updates on the impact of coronavirus.

But while ongoing market fear sent the FTSE 100 index back down by 5% to near to the 5,000 threshold, there were at least some pockets of cheer for beleaguered investors.

Widely-held Vodafone (LSE:VOD) and BT (LSE:BT.A) both added 3%, while a clutch of FTSE All-Share stocks rose by 10% or more. Along with a number of retailers - aided by Chancellor Rishi Sunak's £350 billion of emergency aid — there were gains of 15% for Telecom Plus (LSE:TEP) and Petra Diamonds (LSE:PDL).

Bombed-out AIM 100-listed Eddie Stobart Logistics (LSE:ESL) also surged 28% and video gaming company Team17 (LSE:TM17) added 4% to ensure it is still comfortably higher than where it was at the start of 2020. ASOS (LSE:ASC) rose 5%, but, in a sign of the current market uncertainty, its big rival Boohoo (LSE:BOO) was down 26%.

Today's latest batch of regulatory news statements, or RNS, on the impact of coronavirus highlighted why we're seeing such levels of volatility. As Superdry pointed out in its update, giving formal guidance in relation to its likely 2020 financial performance is pointless.

As of today, 78 of the company's stores in Europe have been affected by government mandated closures. In the UK and the United States, where stores remain open, footfall has reduced on average by 25% week-on-week as shoppers follow advice to stay at home.

Online sales are unlikely to compensate for the weakness across the retail estate, meaning Superdry shares fell another 19% to 81p, compared with more than 500p seen in January. It is the latest blow for the chain as it attempts to rebuild the brand under new leadership.

CEO Julian Dunkerton said:

“We are taking mitigating action wherever we can but the situation is very fluid and uncertain, and we are working to put in place additional financing to secure our recovery.”

Source: TradingView Past performance is not a guide to future performance

Rightmove's Covid-19 update led to a 16% slide for shares after it said it was taking steps to ease the cash flow burden on its agency customer base with a payment deferral plan of £275 per month for up to six months. While traffic to its platforms has continued to be strong over the past two weeks, it said it was too early to give any guidance for the 2020 financial year.

McCarthy & Stone, meanwhile, admits it expects a “material impact” on trading due to its core customer base of over 70s being urged by the Government to enter a period of self-isolation. Shares fell 19% to a record low of 72.3p.

Ramsdens Holdings should benefit from increasing demand for pawnbroking and gold buying services as customers look to overcome potential short-term cash flow difficulties. However, this has been offset by the impact on its foreign exchange services of no international travel.

CEO Peter Kenyon said:

“At the start of February, we were looking forward with optimism to accelerating our growth plans. Just a few weeks later, we have no visibility on how long the current international travel disruption will last and how this will impact our foreign exchange income stream in the year ahead.”

Shares in the Middlesbrough-based company were trading at a record low of 80p today, having fallen 12%. They were 253p in January.

It's a similar story at Connect Group (LSE:CNCT), where travel weakness has offset resilient trading for its core operations of Smiths News and business-to-business distribution firm Tuffnells.

Connect has cut between £2 million and £2.5 million from its 2020 profits guidance, with the weakness at airline and travel supply business Dawson Media accounting for £1 million.

The rest is due to Uefa's decision to postpone the European football championships to 2021, which will impact the timing of football magazine and player sticker sales at Smiths News. Shares still rallied 7% from a record low to stand at 14.72p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.