A blockbuster stock worth owning

This company’s long-term uptrend remains intact, and analyst Rodney Hobson believes his previous tip is worth sticking with. There could be a fresh buying opportunity too.

17th December 2025 09:10

by Rodney Hobson from interactive investor

Rising revenue coupled with falling profits is not the message one wants to hear from any company. Investors must decide if life is going to get better soon at drugs company AbbVie Inc (NYSE:ABBV), as the company itself promises. Investors are not convinced, as the shares have slipped back since the figures came out at the end of October.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

AbbVie, which specialises in two growing areas of medicine - immunology and oncology - reckons that earnings per share (EPS) for the full year will now be at least $10.61, which is higher than the top of the previous range of up to $10.58. Given that the new range is fairly tight, with a maximum of $10.65, and the year is almost over, the company is presumably pretty confident that it will deliver, especially as it raised its quarterly dividend by 5.5% to a fully covered $1.73.

However, investors were disconcerted by a sharp drop in profits in the three months to 30 September, with net earnings down from $1.56 billion (£1.4 billion) in the same quarter of 2024 to only $188 million this time. Diluted earnings per share also fell a whopping 89% to just 10 cents.

Such a big fall at so well established a company is almost always down to one-off costs, and this was no exception. AbbVie had acquired research and development that was already in progress and there were milestone payments for successful drugs acquired in previous years, both of which are again quite normal in drug companies.

Without these and other minor distortions, EPS would have been $1.86 in the quarter. While that is a more acceptable figure, it is still down 38% year-on-year and it meant that the underlying profit hardly covered the increased dividend, so there is still some making up to do.

The profit figure is particularly disappointing as revenue rose 9.1% over a year earlier to $15.8 billion. However, AbbVie is rightly concentrating on its big growth areas, with neuroscience sales climbing 20% to $2.84 billion and the immunology portfolio, the largest part of the group, boasting global sales up 12% to almost $8 billion.

- Watch our video: ARK Invest’s Cathie Wood on performance, Nvidia and China

- Pro investors pump cash into stocks and commodities at record rate

Specialised drugs such as Skyrizi used to reduce treat inflammation in psoriasis and Crohn’s disease and Rinvoq, also used to treat inflammation, are soaring, with sales up 47% and 35% respectively. In contrast, older drug Humira, which has been a blockbuster treatment for inflammation and autoimmune conditions, is dropping off a cliff edge now that generic rivals are taking its markets.

These are normal ups and downs in the life of a drug company, where new products must come through the pipeline and replace yesterday’s best sellers. Drugs must earn their keep while the patents offer protection. AbbVie is well aware that it must be continually innovating to retain momentum.

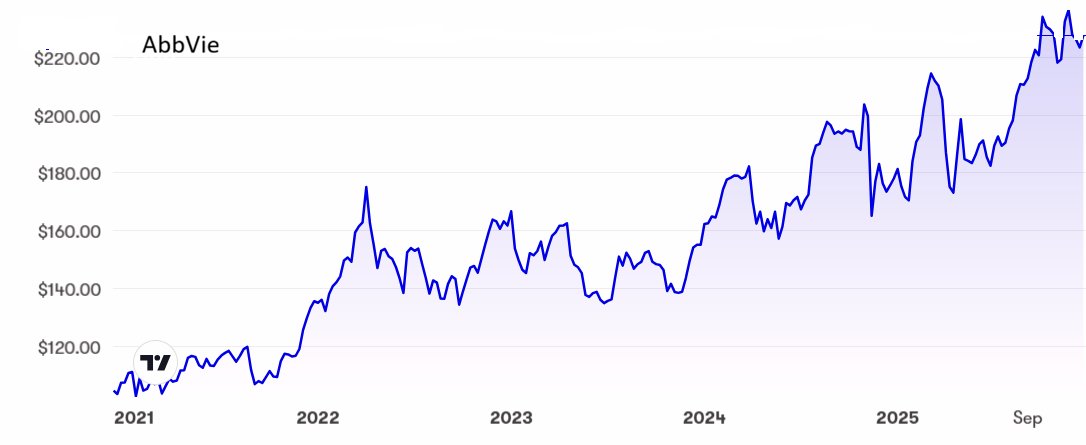

Source: interactive investor. Past performance is not a guide to future performance.

The shares have been a great long-term investment, more than doubling over the past five years from little over $100 to a peak of $238, but they have come off the boil and now stand at $223, where the price/earnings ratio, distorted by the one-offs, is massive at 172 but the yield is reasonable at 2.9%.

- ii view: why Oracle stock slumped after latest results

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Hobson’s choice: I have cautiouslyrecommended AbbVie several times in the past. They look fully valued for now, but existing shareholders have no cause to take profits at this stage as there is surely more to come in the longer term. Pharmaceuticals are admittedly an uncertain area as developing new treatments is expensive and the life of a new blockbuster drug is limited, but AbbVie has a good habit of spotting and buying up new treatments in its specialised fields. If the shares fall below $220, consider buying. They should hold above $210. The long-term upward trend remains intact.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.