Buying this Japan fund to lead regional recovery

After underperforming global equities for 30 years, Japanese stocks have got a lot of catching up to do.

25th November 2019 13:20

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After underperforming global equities for 30 years, Japanese stocks have got a lot of catching up to do.

Saltydog analysis highlights Japanese funds

In recent months the Saltydog demonstration portfolios have been reducing their exposure to funds investing abroad. This has mainly been due to the strengthening of sterling. At the beginning of September, £1 was worth $1.21, now it’s gone up to nearly $1.29 - that’s an increase of 6.7%.

Any assets valued in US dollars would have decreased by this much when converted back into sterling. At the same time the pound strengthened by a similar amount against most other major currencies.

In the last four weeks, sterling has been more stable, and we’ve seen the performance of the funds investing overseas starting to pick up again.

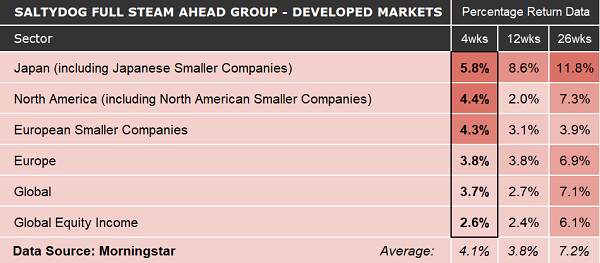

Each week we compare the returns of the leading funds from all of the Investment Association sectors. In last week’s analysis of the sectors in our ‘Full Steam Ahead - Developed Markets’ Group, all funds were showing gains over the last four weeks.

At the top of the table was the combined Japanese and Japanese Smaller Companies sector. It had the highest return over four, 12, and 26 weeks, and was the only sector where the 12-week return was higher than the four-week return.

The Japanese stock market is an interesting one. Most stock market indices have reached new all-time highs during the last 12 months, and some very recently. On the other hand, the Nikkei 225 peaked at the end of 1989, closing at 38,915.87, having grown six-fold during the decade.

Even though it has gone up by nearly 15% in the last three months, it’s still only at 23,292.81. It would have to go up by another 67% to reach the record that it set 30 years ago.

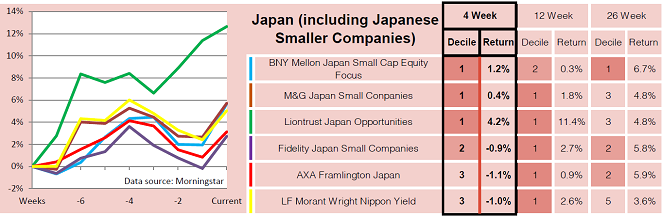

We invested in the Liontrust Japan Opportunity fund at the end of October. At the time it stood out, having gone up 4.2% in the previous four weeks and 11.4% in 12 weeks.

Here’s an extract from our weekly analysis at the time:

If confidence in the Japanese economy grows, and sterling doesn’t strengthen any further against the Japanese yen, then this sector could continue to do well. Japanese equities have underperformed relative to the rest of the world for 30 years and have got a lot of catching up to do.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.