Costain shares and the odds of a surprise lift in price

After doing a great job recovering from a wobble in August, independent analyst Alistair Strang assesses the likelihood of further upside.

2nd December 2025 07:49

by Alistair Strang from Trends and Targets

The news that Costain Group (LSE:COST) has received further contracts related to the UK’s nuclear program gives considerable hope, assuming the UK regulators are serious in their efforts to change the level of red tape inhibiting nuclear development in this country.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

Apparently, the UK has the worst, toughest, and most impossible set of regulations in the G20. Now, the realisation nuclear is the safest, cheapest, and most effective source of green energy, has shaken things within the green sector, giving hope there shall be a real change coming. This will not hurt Costain in the slightest due to their relationships within the sector.

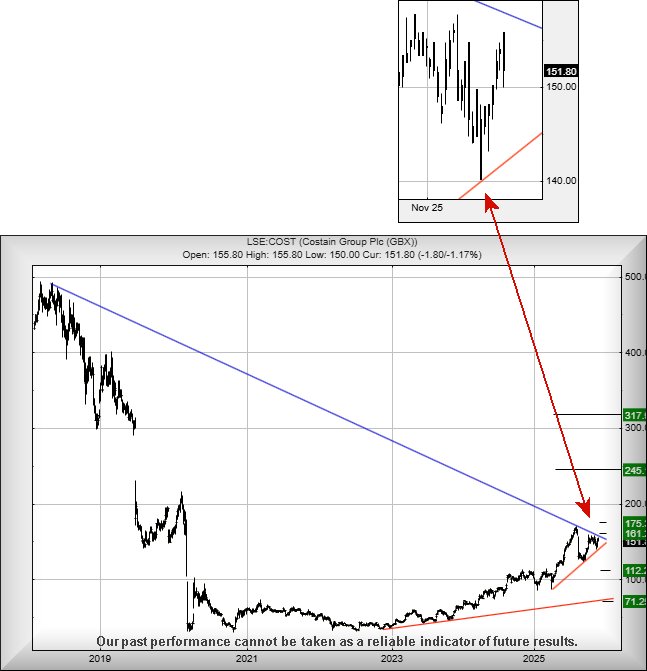

Currently, something quite curious – from our perspective – is happening with Costain's share price. It is reacting to a trend line which doesn’t exist. If it were bobbing along the current Blue downtrend, the share price would be at around 157p, but instead it’s a country mile away.

This situation has been ongoing since October and it’s a scenario we quite like. Historically, where a share price is reacting to a “trend from afar”, it’s proven to be a fairly reliable signal an irrational jump upward is coming. In the case of Costain, above 157p should trigger movement to an initial 161p with our secondary, if beaten, at 175p.

When we introduce a Big Picture scenario, movement such as this should prove very significant, launching the share into a zone where it shall be seen as being attracted to a long-term 317p, a price level not seen since the fake and contrived Covid-19 drops of 2020.

Should the market decide to move in a contrary direction, below 140p would be needed to introduce trouble, giving the potential of reversals down to an initial 112p with our secondary, if broken, an equally unlikely bottom at 71p!

For now, we suspect Costain are somewhere close to introducing a surprise lift in price.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.