Fevertree shares: This analyst thinks they could go much lower

As this once popular AIM share loses its fizz, here's the price this expert thinks it could fall to.

21st January 2020 08:52

by Alistair Strang from Trends and Targets

As this once popular AIM share loses its fizz, here's the price this expert thinks it could fall to.

Fevertree (LSE:FEVR)

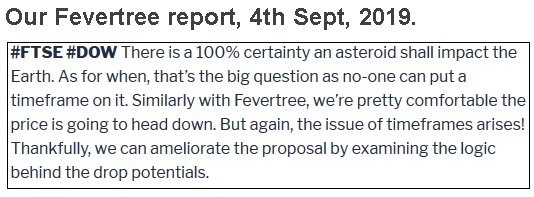

Our report on Fevertree Drinks (LSE:FEVR) last September did not prove terribly popular with a few readers. Of course, who likes being told "your investment looks dodgy", when the investor has taken the time to research the company to hell and back. But, rather more often than people like, 'the computer says' tends be correct.

Whatever the content of its trading update on 20th January, as for as 'the computer' goes, the writing had been on the bottle for four months.

The share price opened the day down, just above our initial drop target of 1,632p.

Amazingly, following an initial drop below target, after 30 minutes of trading the price recovered and briefly revisited our drop target, almost a gentle kiss to confirm our numbers were correct. Then it dropped like a stone!

The situation now is unbelievably messy as weakness below 1,411p suggests ongoing travel down to 1,215p, with secondary, if (or rather when) broken, calculating at 983p and hopefully a proper rebound.

To be honest, we'd prefer if the price bounced before the 983 level as it should imply some residual strength. Of course, there's an important "however".

Should the share find sufficient reason to break 983p, it looks like our ultimate bottom of 159p risks coming to fruition.

This, neatly, would undo all the work of the last five years.

To get out of trouble, the share price needs to exceed the blue trend line on the chart, presently at 2,092p. We're not optimistic.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.