Four trusts tipped to profit from big opportunity in Japan

We consider the risk and reward of a long-term allocation to Japan and why buying now might be prudent.

24th May 2019 14:15

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

As Western economies show signs of their own 'Japanification', we explore the Japanese industries poised to take advantage of this change...

On a roll

If there is one way in which Japan leads the world it is in "Japanification". That is - it effectively invented it! The concept of “secular stagnation” is the contention that the developed world is entering a period of systemically lower growth and lower inflation in comparison to past decades.

One way of characterising "secular stagnation", is that it is the outcome of similar pressures which the Japanese economy suffered in the 1990s and 2000s.

The most important of these is demographic decline, while Japan also suffered a huge boom and bust which left "zombie" companies with high amounts of leverage and limited long-term viability, keeping GDP growth below its potential due to entrenched inefficiencies.

In our view, Japanese companies have developed strategies and technologies which have the potential to become crucial for those in countries following it down this path.

In this piece we consider the attractions and dangers of a long-term allocation to Japan and discuss why adding to exposure now, in a contrarian fashion, might be prudent. We also assess some of the more attractive trusts exposed to this opportunity.

Demographics

GDP growth can result from population growth (more people producing the same amount of stuff each) or productivity growth (the same people producing more stuff each).

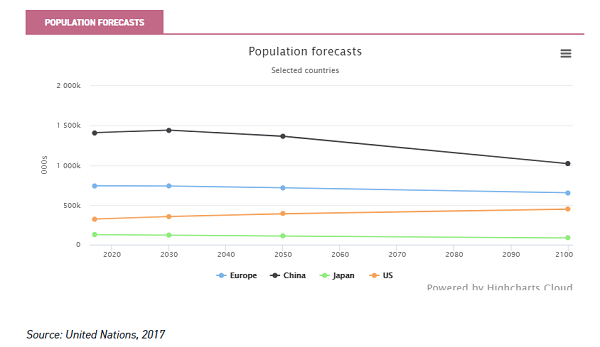

While the top line population of the world is set to grow over the next century, the forecasts of the United Nations Population Department suggest that the developed world as a whole, particularly Europe, will follow Japan down the path of declining population.

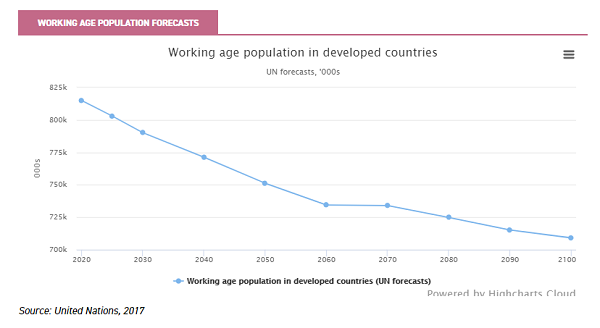

As a result, productivity gains will be essential if these economies are to continue to grow.

Crucially, China is demographically much more like Japan or Europe than Africa or ASEAN, where most population growth is set to come from.

Europe, Japan and China therefore are forecast to see their populations fall, while the US is predicted to see population growth, but only thanks to immigration as fertility rates are expected to be below replacement levels.

Most importantly from the perspective of economic growth, the working age population in these regions will also decline. The working age population in the developed world (those aged 15 – 64) is set to decline by 7.8% by 2050 according to the UN, and that is despite a forecast increase in the US.

It is interesting to note that China's demographics increasingly resemble Europe's, thanks to its erstwhile "one child policy". In China only 30% of the population is below 24, compared to a global average of 42%.

This is remarkably close to the 27% average for Europe, exactly the same as the figure for the UK, and well below the Asian average of 40%.

In the UK, 24% of the population is over 60, compared to a European average of 25%. The figure for China is 16%.

China's massive economy, already the second largest in the world having over-taken Japan, will be subject to the same deflationary pressure that Japan has been wrestling with for decades.

Japan and China's post-war demographic spurts are over, and the remainder of the developed world, excluding the US, is joining them in demographic decline.

This should have a deflationary impact on the global economy by lowering demand: there will be fewer people to buy goods or services that we produce.

Inflation in the developed world is likely to be lower than it would be with a stable or rising population. In nominal terms, GDP growth would by definition be lower, while in real terms the sapping of demand should also have a negative effect.

Debt

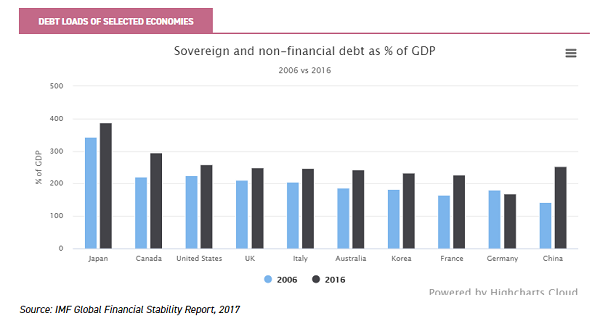

The debt load in the West is further evidence of its looming Japanification. It is hard to see high inflation or GDP growth in the coming decades because of high debt levels and this is a second key analogue between the situation of the developed world as a whole (and China) and Japan.

Debt levels have exploded since the financial crisis, with policy focusing on keeping banks and businesses afloat rather than unleashing “creative destruction”, with the concomitant losses of jobs and sharper shocks to GDP.

The debt burden is eased by the historically low rates that have been in place since the crisis. However, this still means that the proceeds of growth need to be used to pay the debt down, or, if it is rolled over, it means that higher interest rates are unlikely to be forthcoming, as they would make the burden unmanageable to debtors.

This is a brake on growth, as more of our productive capacity has to be used to pay down debt. Again, Japan was here first: its policy in the 1990s was aimed at ensuring the stability of its financial system at the cost of its balance sheet, and has contributed to low levels of growth ever since.

What Japan offers

The Japanese society and economy have evolved to cope with a series of economic circumstances which we in the West are starting to encounter.

Japanese business has created technologies and business models which allow it to generate growth despite demographic decline and the throttling effect of high debt levels in established businesses.

These technologies and the companies that own them should be able to generate strong shareholder returns irrespective of the trajectory of GDP growth in Japan or globally, due to firstly being suited to current and continuing conditions in Japan and secondly. being well-placed to benefit from the prospective Japanification of the West.

Either way, they offer secular growth prospects for investors which should bear fruit regardless of whether the Japanese market or economy stalls.

Factory automation is a key front. Automating production lines does away with the need for new, young workers, and Japan has been leading the way in this.

Robotics companies like Keyence and Fanuc are at the forefront of automating factories. Both companies have seen huge growth in sales in China in recent years, which we would view as likely to continue as China experiences Japan's demographic decline itself, and as Chinese labour becomes more expensive.

Japan is also home to more innovative, small-scale companies such as Shima Seiki, which has developed a robot seamstress used by Nike (NYSE:NKE) and the owner of Uniqlo amongst others.

Outsourcing is another industry to be supported by demographic decline. In an economy with fewer workers, using outsourcers to complete temporary or seasonal tasks can be an efficient way to utilise the capacity that is there.

In Japan, the company 'Outsourcing' has developed an innovative model of employing seasonal workers centrally and then charging companies to join its employment organisation and bid for workers when they need them.

This is an area where it is harder to see international expansion as there is nothing to stop other companies setting up and doing the same thing in their own countries, aside from different regulatory regimes, themselves a brake on expansion.

Nonetheless, with Japan's workforce predicted to continue to decline, this should be an industry which grows over the medium to long-term irrespective of the direction of its economy or stock market overall.

Healthcare is an area bound to see structural growth globally. In emerging economies, there will be growing demand for basic services previously not provided, while in developed economies such as Japan the aging of societies will mean greater demand as older people suffer more health problems.

This is not unique to Japan, but it has a number of drug-makers and medical companies with strong intellectual property.

Chugai Pharmaceutical generates 50% of its revenues from oncology treatments, for example, and cancer rates have been rising as populations age.

Asahi Intecc manufactures wires used in heart operations, which allow patients to avoid more invasive procedures.

Risks of investing in Japan and near-term outlook

The main risk with investing in Japan is that the country is highly sensitive to the global economy, and so in a down market can suffer higher losses than other countries.

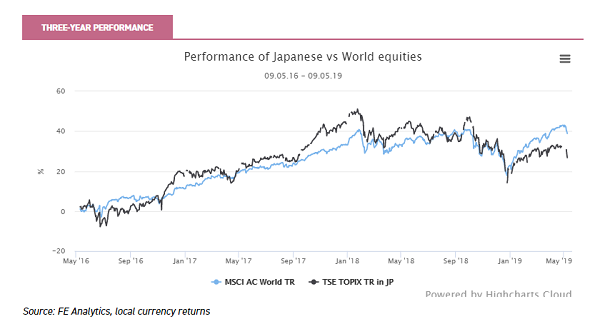

We can see in the performance graph presented below that the country outperformed global equities in the strong run for markets from 2015 to 2017, but has struggled since markets came off last spring, and has failed to keep up with the rally in 2019.

Investors may have to accept this higher sensitivity to Global GDP as the price for generally investing in Japan, but we believe the structural factors considered above mean that over the course of the cycle there should be excellent excess returns available from playing certain themes.

Whilst we would not want to try to predict markets, buying now seems more sensible than buying at the start of 2018 after the long bull run.

Japan is also currently suffering from the knock-on effects of the US/China trade war, as it slows the Chinese economy and reduces demand for high-end parts from Japan, which are put together in China for onward export to the US.

We would expect a resolution to this spat eventually, given the importance of China and the US to each other economically, but it is a negative that has to be borne in mind in the short to medium term.

In the short term, a second risk is that there is a consumption tax hike due in October 2019, which could hit the economy through reducing expenditure. Japan's equivalent to VAT will jump from 8% to 10% for many goods.

However, the government has put in place counter measures to reduce the impact on consumption: tax relief on new build homes and on the purchase of cars with cleaner engines as well as a 2% reduction in tax for contactless purchases amongst others.

Really, for the long-term investor this shouldn't feature in the decision-making process. All the trusts we consider below are managed with the long-term in mind, and the managers do not select stocks which would be calamitously impacted by a 2% increase in tax but look for those with more solid prospects and more profitable enterprises.

Furthermore, as we have argued above, the long-term demographic and structural forces will continue to support the growth of certain industries and business models whatever the course of the economy.

A final risk to our thesis is that the developed world manages to generate high growth and inflation which means markets for Japanese goods and systems don't develop.

It is hard to see the basis for this: perhaps a loosening of immigration rules in Europe and tax cuts in the US leading to a surge of inflationary prospects.

In any case, the trends will continue to take effect within Japan, which we believe is enough for many companies serving these trends to continue to grow, making an investment in Japan for the long-term attractive despite the relatively poor prospects for the economy.

The funds

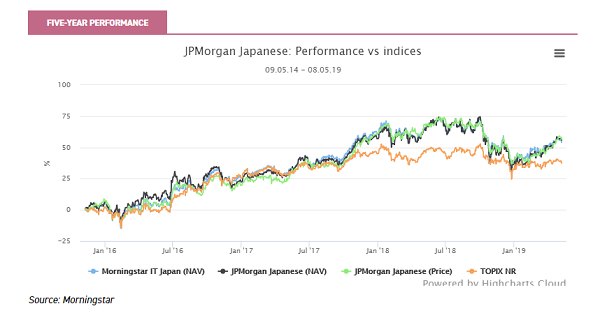

JPMorgan Japanese (LSE:JFJ) is managed by Nicholas Weindling, who has constructed a portfolio around a series of themes connected to social and technological changes ongoing in Japan.

In many cases, these themes are derived from the demographic and deflationary forces we have described above, most notably automation and robotics, an aging population, healthcare and improving corporate governance.

Nicholas looks for companies with high and sustainable ROEs, and is willing to pay a premium for growth.

The result is a trust with the most growth-oriented portfolio of any in the AIC Japan sector, according to Morningstar data.

This growth exposure helped the trust do extremely well in the 2016 and 2017 growth-led rally, but meant that it sold off in 2018 more than the market. In the 2019 rebound the trust has again beaten the Topix.

Despite its strong long-term performance, it is trading on a 9% discount. In our view the exposure to secular growth themes is attractive in the long run, and so this could be an interesting entry point (although the trust has traded wider in the past).

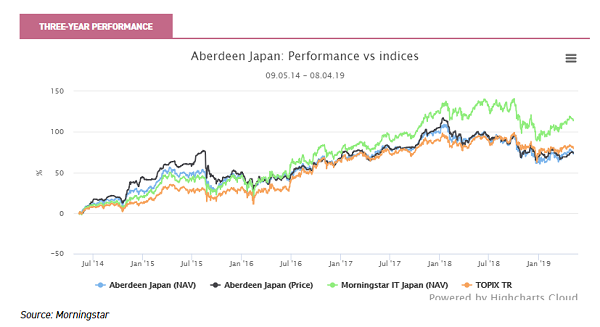

Aberdeen Japan (LSE:AJIT) also has significant positions in the industries discussed above: automation, smart factories and healthcare, for example.

The automation theme has caused some issues in recent months as the trust's exposure to the Chinese economy has led to short-term relative and absolute losses.

However, the managers remain focused on the long-term prospects rather than the short-term noise, and they highlight that valuations in the China-exposed areas of the market are now highly attractive. Keyence remains their largest position at 5%.

The trust has double the index weight in healthcare, at 16%, and these positions were strong contributors last year.

Chugai, mentioned above, is the second-largest position, while it also owns Asahi Intecc and Shionogi, which has FDA approval for a new flu vaccine as well as market-leading HIV drugs.

The trust is team-managed, and one of the key elements of the team's approach is corporate governance reform.

They are increasingly pushing on an open door given the country's reform programme, and within top 10 position Yamaha they are encouraging management in their unwinding of the motorbike and musical instruments businesses.

The trust is trading on a 13% discount, compared to a sector average of 4.6%.

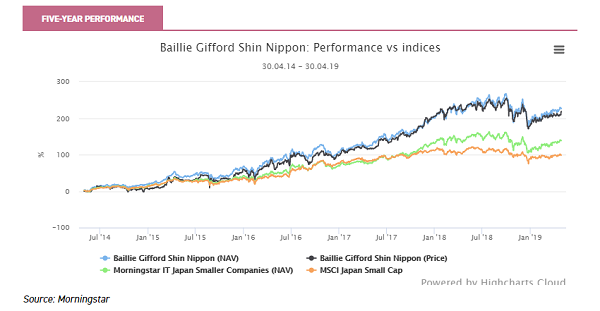

Baillie Gifford Shin Nippon (LSE:BGS) illustrates well how buying companies rather than economies can lead to excess returns.

The small-cap focused trust takes an ultra-long-term and ultra-active approach to picking stocks, looking for those which it believes can benefit from secular changes or defensible niches that allow them to generate a high return on equity year after year.

The team, led by Praveen Kumar, ignores the make-up of the index and focus on identifying the most attractive stocks irrespective of sector or industry.

The portfolio is heavily invested in companies developing or using new technologies, as well as other companies which are playing into secular changes in society and the economy.

The managers look at the portfolio in the light of certain themes, the most important of which are online disruption, niche manufacturers and outsourcing.

The result of this highly active approach has been exceptional outperformance and a premium rating.

Over five years the trust has made 226% in NAV total returns compared to the MSCI Japan Small Cap index's growth of 99%. The share price returns have been 218%.

Those shockingly high returns have been boosted by the devaluation of sterling versus the yen in recent years.

In yen terms, NAV total returns were 174% compared to 67% for the index, and the share price made 168%. You can read more detail on the trust in our recently published note.

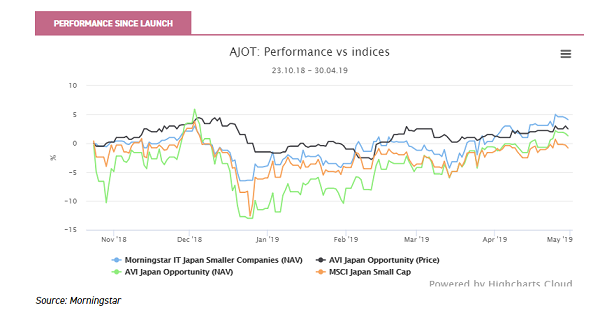

AVI Japan Opportunity is less focused on the technological and business model innovations within the Japanese economy and business, but more on the valuation opportunities thrown up by the radical policy changes implemented by the Japanese authorities to deal with the deflationary forces in their society.

The 'third arrow' of Abe's reform programme was structural reform intended to free up Japan's inefficient balance sheets and encourage more competitive performance from industry in order that the country would make greater returns on its assets to counteract a shrinking labour force.

Improving corporate governance is key to those reforms, and a stewardship code obliges signatory investors to interrogate company management about how they are implementing the government’s desired reforms.

AJOT was launched late last year to take advantage of the excessively cheap valuations in Japanese small caps and to identify those companies which were most likely to implement and benefit from corporate governance reforms.

The manager, Joe Bauernfreund, also runs British Empire (LSE:BTEM), and uses the same activist shareholder approach to encourage portfolio companies to return cash to shareholders or to streamline their balance sheets.

In its short life so far it has already seen significant corporate governance wins, which we detailed in our recent review of the trust.

The NAV is up 4.1% since launch compared to 1.3% for the peer group and a -0.8% loss for the index.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.