FTSE for Friday: a big clue that the index will hit its pre-pandemic high

18th June 2021 07:46

by Alistair Strang from Trends and Targets

Analyst Alistair Strang is still positive about market direction, but there’s possible trouble if it falls below this level.

Usually, the market sidles toward the weekend, giving a bit of a clue as to market direction in the near term. For Friday, we can agree on one thing; we're utterly clueless as to market intentions!

On Thursday, the index dropped (a bit), successfully hitting our initial target, even breaking it for a few minutes. But as all the days action took place in the opening second of trade, it was all very artificial, leaving nothing in its wake except confusion. From our perspective, Thursday was an utter waste of time, especially as the market itself didn't feel like it knew what to do with itself.

The conclusion drawn from the exercise suggests the FTSE 100 actually now needs below 7,125 before any reversal dare be taken seriously. Such a movement feels like it could now trigger reversal to an initial 7,095 points with secondary, if broken, calculating at 7,057 points.

- Why reading charts can help you become a better investor

- Check out our award-winning stocks and shares ISA

However, we still maintain the hope the FTSE shall join other major indices by trading above its pre-pandemic high of 7,550. This results in the (perhaps naive) hope the index enjoys underlying force driving it upward. If this indeed is the case, above 7,175 points suggests the potential of near-term movement to an initial 7,201 points. If bettered, our secondary works out at 7,265 points.

It may also be worth remembering the lesson from Thursday. If all the action occurs in the first second of trade, why not go do something else as the day is liable to be another waste of time. There's always some grass needs cutting…

Source: Trends and Targets. Past performance is not a guide to future performance

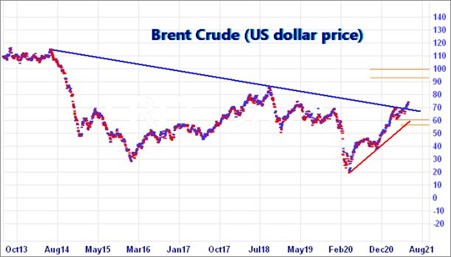

We're worried about Brent crude! Not because it may go up or down but because of our historical reputation with the stuff. Our track record of getting it right when it comes to Big Picture movements for crude oil is causing immediate concern. The price of Brent is now flapping around in a zone where it risks triggering a pretty major price cycle and, if it does so, it shall also trigger daily nerves at our end.

The first "issue" comes from the immediate price. The commodity is trading above the pre-pandemic level of $60. This provides the first trip into the realm of confidence.

The second "issue" is provided by the Blue line on the chart. This very obvious downtrend has now been exceeded, another reason for hope for the future.

The third "issue" is the previous high of $70, a price level which confirmed the Blue downtrend. As this has now been bettered, Brent crude is now living in the land of Higher Highs, conventionally the place where optimism resides.

And finally, there's our immediate target level just above the $75 mark. This was calculated using price movements from this year, hardly a big picture thing. Should Brent Crude now exceed $75.50, the price enters the realm of Big Picture calculations. As a result, we shall be forced to promote the concept of further price miracles in the direction of $93 initially with secondary, if exceeded, working out at $100.

If it all intends go wrong for Brent, the price needs to drip below $68, as this risks triggering an initial $60 with secondary, if broken, at $54. At present, the oil price is twitching around, just below our $75 level, displaying the hesitation we refer to as "stutters" prior to a future demonstration of direction.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.