The fund sector topping the performance charts

Our Saltydog analyst explains why over the past four weeks this fund sector has been on form.

24th August 2020 14:05

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Our Saltydog analyst explains why over the past four weeks this fund sector has been in form.

Each week, we review the relative performance of the 30-plus Investment Association sectors. We believe that the performance of the sectors reflects global economic trends. Having established which sectors are climbing, it is relatively easy to find the best-performing funds.

To help with our analysis, we put the sectors into our own Saltydog groups based on their historic volatility.

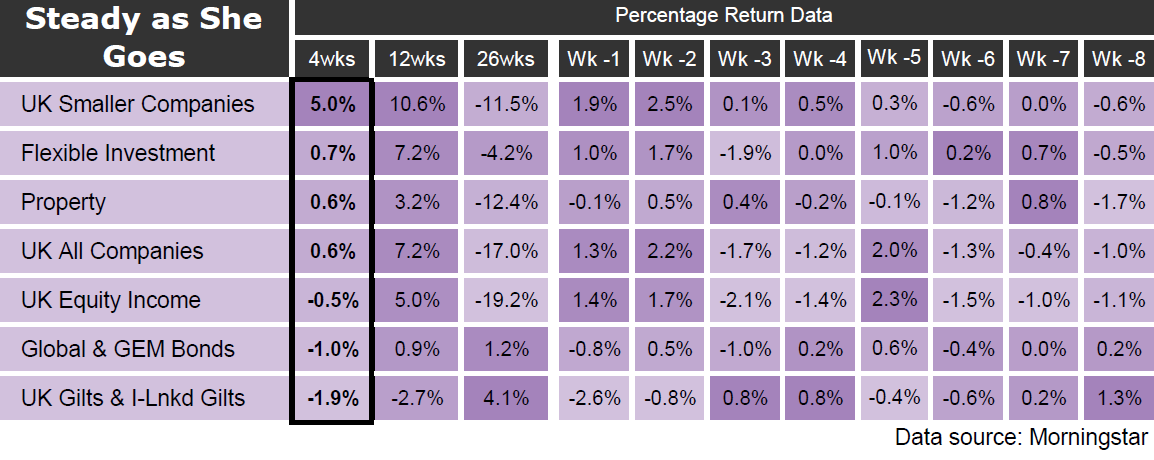

The groups, in order of increasing volatility, are: Safe Haven, Slow Ahead, Steady as She Goes, and Full Steam Ahead (which is split into Developed and Emerging Markets).

When stock prices are going up, we would expect the best returns to come from the more adventurous sectors in the Steady as She Goes and Full Steam Ahead groups.

In our reports last week, the sector with the best return over the previous four weeks was UK Smaller Companies in the Steady as She Goes group.

Past performance is not a guide to future performance.

It had gone up 5% in four weeks and more than 10% in 12 weeks.

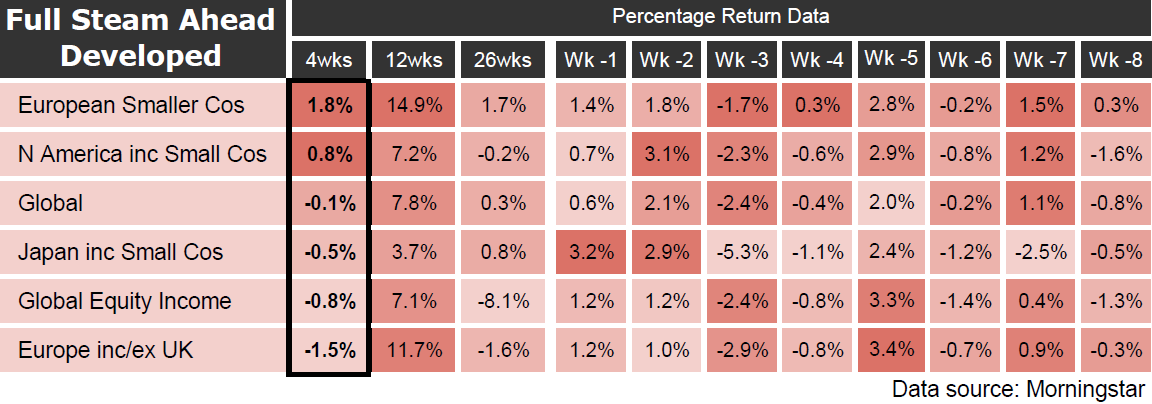

Quite often, we find that when the UK equity sectors are doing well, the American, European or Global sectors are doing even better. That is not the case at the moment, as can be seen from our analysis of the Full Steam Ahead Developed group.

Past performance is not a guide to future performance.

The China/Greater China and Global Emerging Market sectors are also down over the last four weeks.

It may seem strange that in the US the S&P 500 index has been going up and recently set a new all-time high, and yet the combined North America and North American Smaller Companies sectors are only showing a four-week gain of 0.8%.

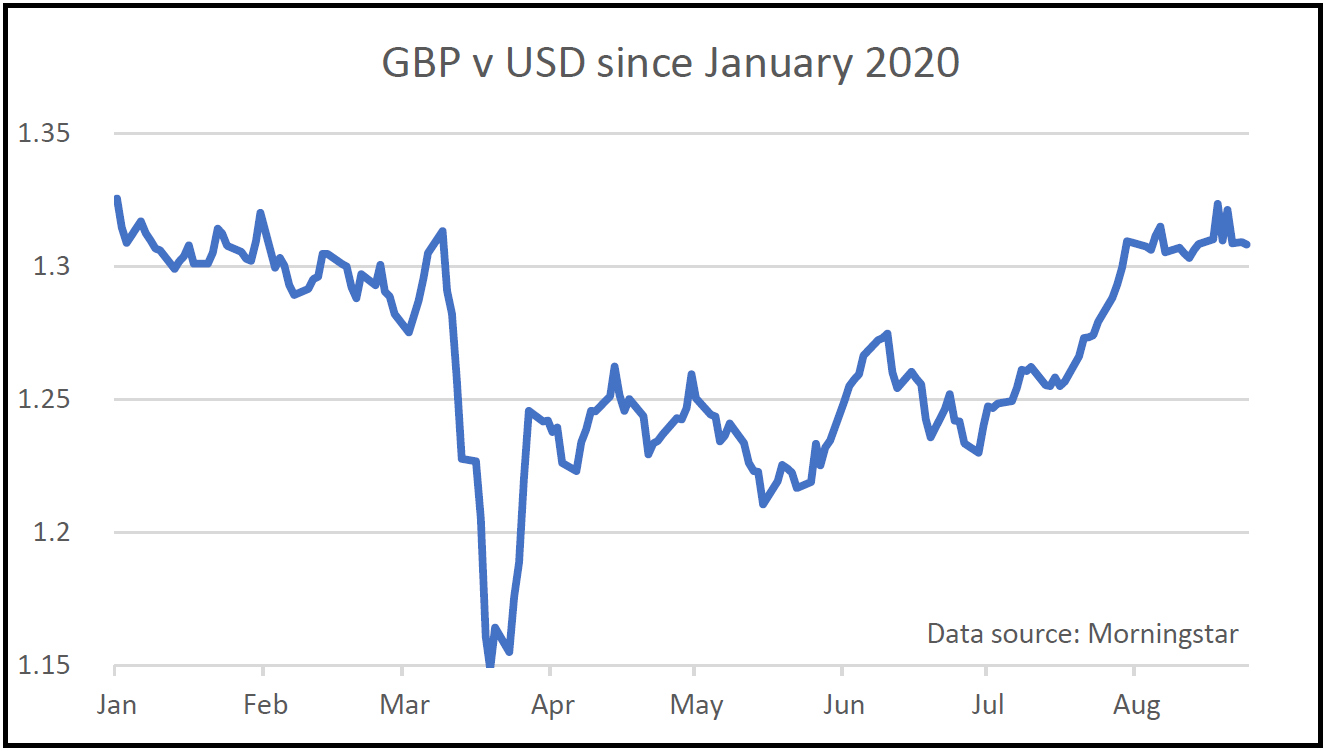

This is partly because the funds that make up the Investment Association sectors are all valued in sterling, and that the exchange rate between the pound and the US dollar has strengthened over the last few months.

Past performance is not a guide to future performance.

Since the beginning of July, a pound has risen in value from $1.25 to $1.31, an increase of 4.8%. This means that any assets or income valued in dollars would have gone down when converted into sterling.

Over this period, the pound has also strengthened significantly against the yen, the yuan, the rupee and the Brazilian real. However, it has not really moved relative to the euro.

The increase in the value of the pound would have put downward pressure on any funds investing abroad. The largest UK companies will also have suffered as a significant proportion of their income is generated overseas.

Many smaller UK companies are less reliant on overseas sales and may benefit from cheaper imported components. This could explain the relative outperformance of the UK Smaller Companies sector in recent weeks.

Last week, our demonstration portfolios invested in the Jupiter UK Smaller Companies fund, which at the time was showing a four-week return of 7.7%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.