The funds up 100% so far this year

Saltydog Investor examines top-performing funds, asking whether two dominant themes can endure in Q4 given that markets are near record highs and volatility is never far away.

6th October 2025 14:48

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

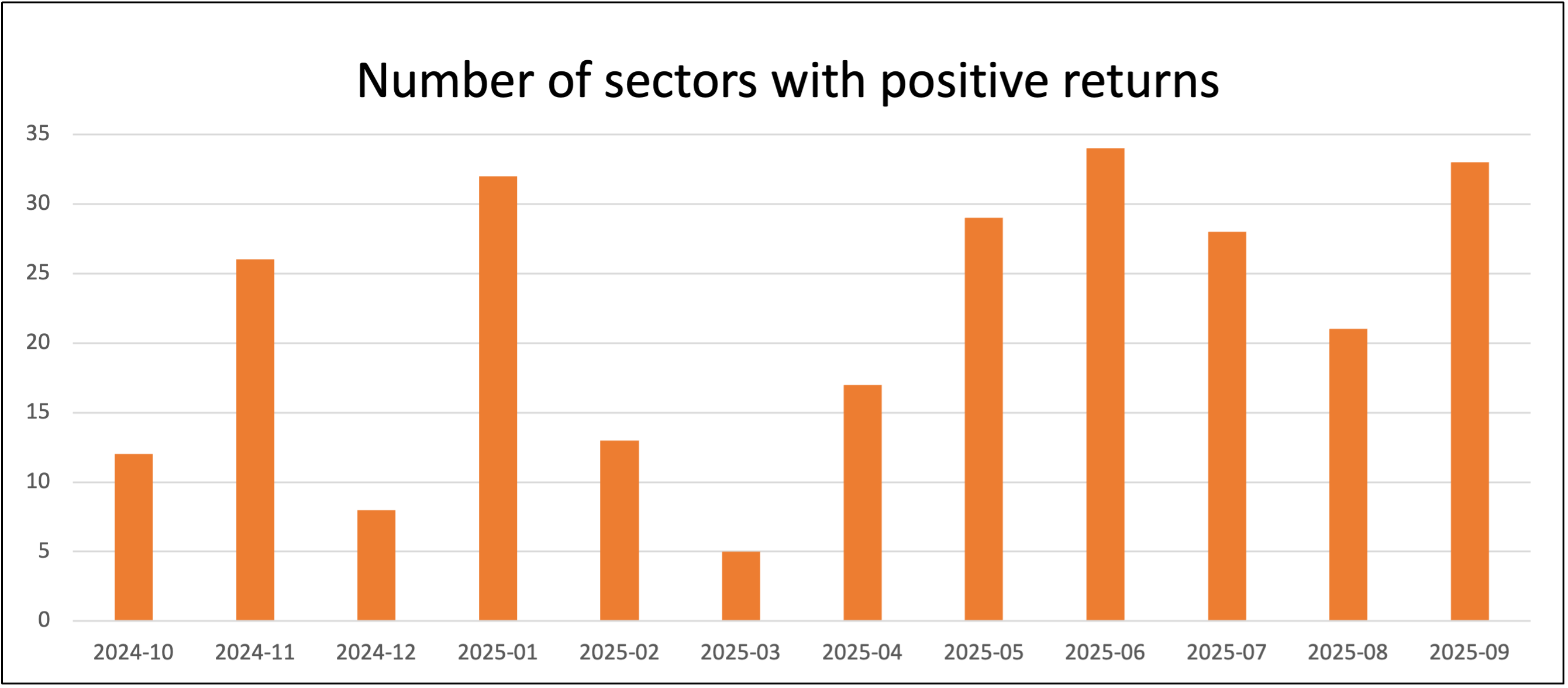

There are now more than 50 sectors that the Investment Association (IA) uses to categorise funds.

At Saltydog Investor we track them all, but usually only report on 34. There are a couple of reasons for this. Where a sector has too few funds to provide meaningful data, we combine it with others. In some cases, the sectors themselves are so diverse that the average performance figure adds little value.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

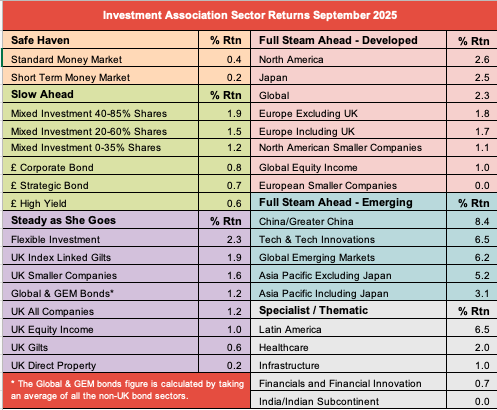

During the summer, the number of sectors posting one-month gains fell from 34 out of 34 in June, to 28 in July, and then 21 in August. However, last month overall performance improved, with 33 sectors making headway.

Past performance is not a guide to future performance.

The only sector that failed to remain above the waterline last month was India, which fell by just 0.04%. European Smaller Companies was next, with a modest gain of 0.05%.

At the top of the table, for the second month in a row, was China/Greater China, with a one-month return of 8.4%. Next came Latin America and Technology & Technology Innovation, both up 6.5%.

Data source: Morningstar. Past performance is not a guide to future performance.

One sector that’s not included in this list is “Specialist”. It serves as a catch-all for funds that don’t naturally fit into one of the other categories, covering a wide range of assets, objectives, and investment styles. The IA doesn’t publish returns for sectors “where performance comparisons may be inappropriate due to the diverse nature of funds in the sectors”.

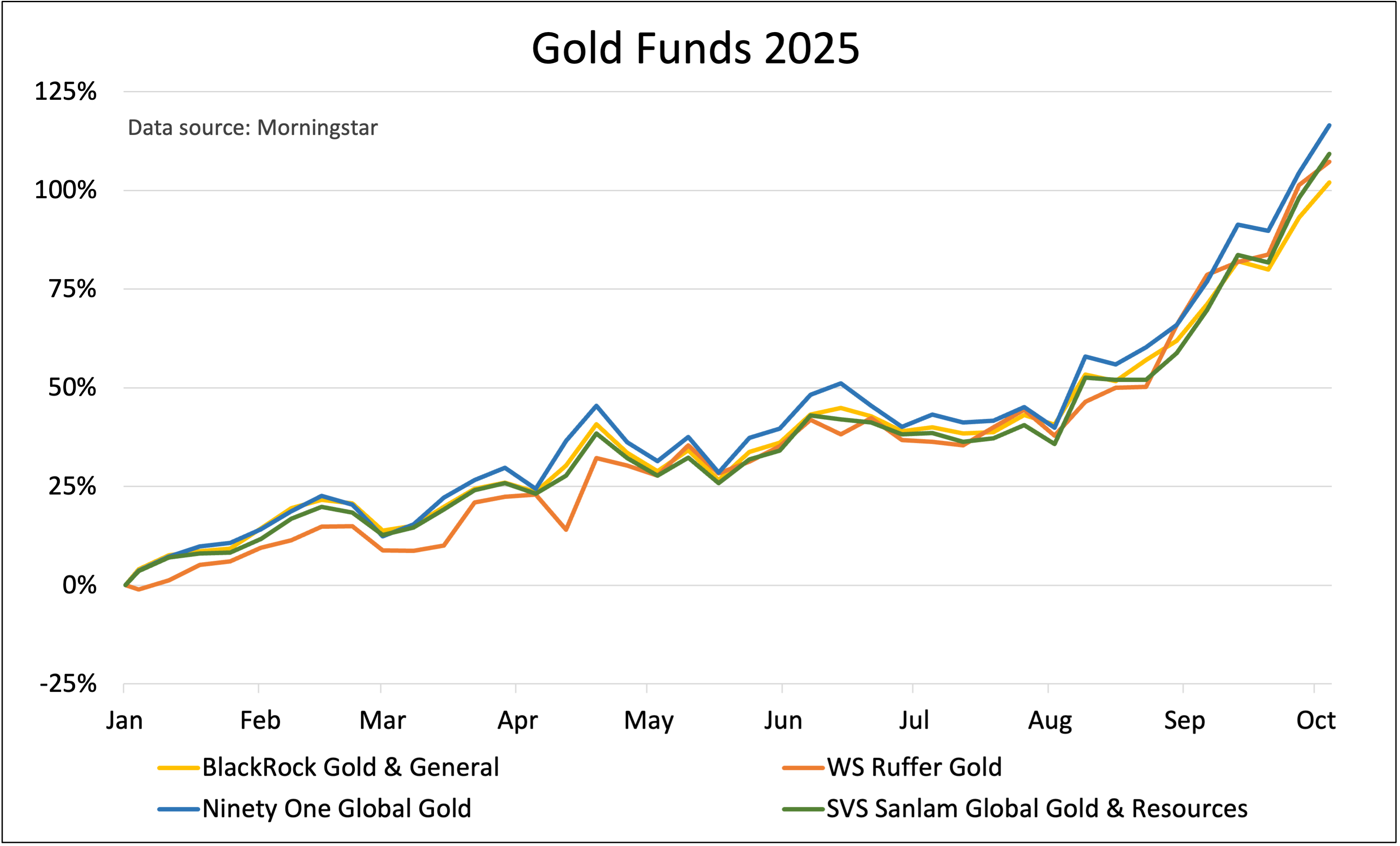

Within the Specialist sector, there are a small number of funds that invest in companies involved in the mining of gold and other precious metals. They currently dominate our list of best-performing funds in September.

Saltydog’s top 10 funds in September 2025

| Fund | Investment Association sector | Monthly return |

| SVS Sanlam Global Gold & Resources | Specialist | 28.6 |

| Ninety One Global Gold | Specialist | 27.0 |

| BlackRock Gold and General | Specialist | 22.8 |

| WS Ruffer Gold | Specialist | 22.3 |

| WS Amati Strategic Metals | Commodities & Natural Resources | 22.2 |

| Veritas China | China/Greater China | 13.8 |

| Polar Capital Global Technology | Technology & Technology Innovation | 12.6 |

| HSBC GIF Chinese Equity | China/Greater China | 11.5 |

| Polar Capital Smart Energy | Specialist | 11.0 |

| Ninety One GSF All China Equity | China/Greater China | 10.9 |

Data source: Morningstar. Past performance is not a guide to future performance.

The top four funds are the same as last month, but in a slightly different order. The SVS Sanlam Global Gold & Resources fund, which was in third place in August, has now climbed to the top with a one-month return of more than 28%.

The WS Amati Strategic Metals fund has appeared in fifth place. It is also heavily weighted towards gold and precious metals, but includes meaningful exposure to industrial and speciality metals such as copper, nickel, lithium, manganese, and rare earths.

- Copper price rally boosts these UK mining shares

- The case for diversifying beyond gold

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Gold funds have benefited from a sharp rise in gold prices, which have gained over 40% in 2025 and recently broken through $3,900 per ounce. The rally has been driven by sustained central bank demand, particularly from emerging markets, and a weaker US dollar, which has made gold more attractive for international buyers.

Investors have also sought safety amid heightened geopolitical tensions, trade uncertainty under the Donald Trump administration, and growing expectations of interest rate cuts by the Federal Reserve. Combined with lingering inflation concerns, these factors have reinforced gold’s role as a reliable, though volatile, hedge in uncertain markets.

Past performance is not a guide to future performance.

As we move into the final quarter of the year, gold and China remain the dominant themes, with Technology & Technology Innovation close behind.

However, with markets near record highs and volatility never far away, investors may find that diversification across a range of sectors remains the most reliable strategy.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.