Glencore shares: Good news and bad news

The price has moved in a fairly predictable fashion, but what will make our chartist enthusiastic?

23rd September 2019 10:01

by Alistair Strang from Trends and Targets

The price has moved in a fairly predictable fashion, but what will make our chartist enthusiastic?

Glencore PLC (LSE:GLEN)

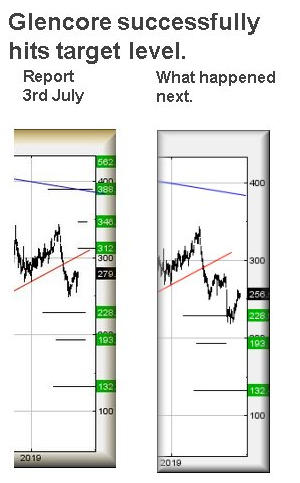

Our July report explained the chances of Glencore (LSE:GLEN) hitting 228p. It did, but something funny happened.

The price did not actually break 228p on the first surge downward.

By normal rules, this is a good thing, suggesting we should not be terribly worried at the share pivoting above and below the 228p level in the weeks since.

We've been keeping a slightly mad eye on some of the major shares, looking for early warning signals the market is about to be trashed by the effect of Brexit.

While the retail banks all appear to be wandering around ringing sad bells to keep the unwary clear, there are pretty mixed signals amongst many other shares.

Some of the major miners (Fresnillo (LSE:FRES) for instance) adopted a stance of utter defeat some time ago, others like Glencore are sending slightly different signals.

Equally, amongst oil shares, the situation is far from clear and overall we're forced to conclude no-one has a clue what effect Brexit shall bring.

Source: Trends and Targets Past performance is not a guide to future performance

In-house, we suspect a dip before the actual Brexit day (whenever that is) followed by strong market recovery with the first piece of positive news.

Our basis for this is fairly straightforward - sometimes things need a good shakeup.

As for Glencore, since hitting our 228p, the price has moved in a fairly predictable fashion with the result it need now only trade above 263p to become useful.

Exceeding a trigger such as this should enter a cycle to an initial 270p with secondary, if bettered, a longer term 304p.

Visually, we'd be quite enthusiastic to witness 304p against this as further confident growth looks extremely possible.

That's the end of the good news. We're basing a lot of optimism on 228p not breaking on the first downward surge. (It actually hit 227.95p but we'd inclined to believe this a callibration error)

Now below 218p and travel downhill to an initial 204p looks possible. If broken, secondary calculates at a bottom - hopefully - of 132p.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.