Here's what will tempt this professional investor back into equities

14th January 2019 12:07

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Dramatic swings and difficulty predicting what will happen next have turned Saltydog analyst Douglas Chadwick more cautious in recent months, but when will he invest his cash pile?

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation

A disappointing 2018

Last year was a tough one for UK Investors. It started OK, but the last three months were terrible. The FTSE 100 ended the year down by more than 12%. And it wasn’t just the UK that struggled, all the major global stockmarkets went down.

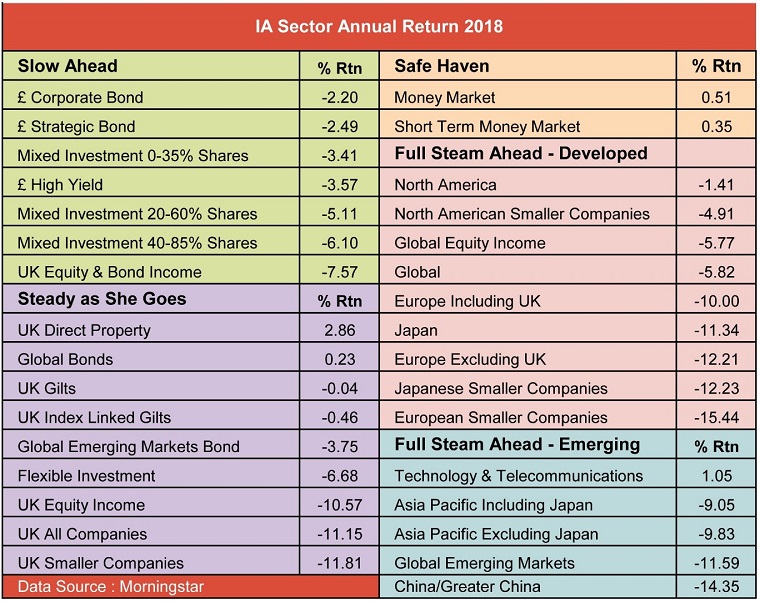

The Investment Association annual sector returns reflect this downturn.

The only sectors that went up were the Money Markets, UK Direct Property and Global Bonds.

North America was the best performing region, but still made a loss of over 1%. The UK and European equity sectors were down by between 10% and 15%. Japan fell by 11% and China & Greater China was down 14%. The bond and mixed investment sectors did better, but most of them still made losses.

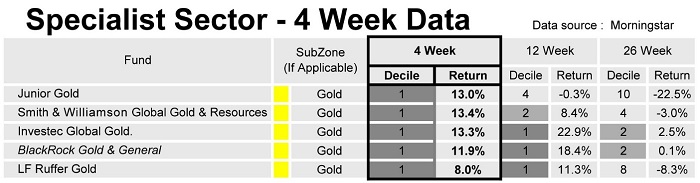

There are some funds in the 'Specialist' sector that have made reasonable gains over the last few months. Back in October I wrote about the gold funds that had started to show up in our analysis. Last week they were all at the top of our Specialist sector four-week data table again.

Our demonstration portfolios are still predominantly in cash, which has saved us from the worst of the falls in the last few months, and it's likely that they’ll stay like that for a while. We increased our cash holding during October and November and aren't in a mad rush to reinvest.

If something catches our eye we'll make a small investment and see how it gets on, but only add to it if it continues to make gains. We are holding the Investec Global Gold fund, and it’s performing well at the moment [up 20% since 10 October].

- Why did this successful investor just double their cash holding?

- Why now could be the time to buy gold

Although most stockmarkets are up so far this year, we've seen such dramatic swings that things could look very different in a few days. Our sector analysis shows most sectors making gains over the last couple of weeks, but they're still down over four weeks (and possibly 12 and 26 weeks).

All in all, it's pretty difficult to see what's going to happen next. We've seen a 'shutdown' in America, and Europe is waiting to see how the Brexit situation will unravel. Tensions remain between China and the US over the Trade War initiated by President Trump.

We'll need to see stronger signs of a recovery to tempt us back into the markets.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.