interactive investor launches ii Managed Portfolios within SIPP offering

ii Managed Portfolios: helping more UK savers retire on their terms at great value.

17th November 2025 13:36

interactive investor (ii), the UK’s leading flat-fee investment platform, has launched ii Managed Portfolios within its personal pension (SIPP) offering - adding a whole new dimension of simplicity, convenience, and value to the pension saving landscape.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The ii Managed Portfolios offer great value for pension savers. With interactive investor’s flat-fee, they will not have charges eating away at their growing pension pot, unlike other providers who use a percentage-based platform charging model.

Key features:

- ii Managed Portfolios are available to both new and existing interactive investor customers from today (17 November 2025), where customers are matched to expertly curated portfolios that link to the level of risk they’re comfortable with and that suits their investment goals.

- Value: there is no separate management fee as the offering is available within interactive investor’s existing flat-fee subscription-based charging model*. The portfolios are expertly managed by Aberdeen and designed to keep fund charges low, making them outstanding value for investors.

- Best of both worlds: interactive investor customers can havean ii Managed Portfolio alongside their self-managed investments within their personal pension (SIPP), giving them the best of both worlds, and all available within the same flat-fee subscription.

Value breakdown

interactive investor research conducted earlier this year found that a staggering 83% of savers had no idea what they were paying in pension fees**.

interactive investor charges a simple and transparent flat fee for its Personal Pension (SIPP), there is no additional charge for Managed Portfolios. While there are still separate fund fees, as with any other investments, the expert team at Aberdeen keep charges low for investors. This ongoing management charge is taken directly from the value of the fund and can range from 0.13% to 0.36% (costs may change over time), depending on your portfolio.

You can view the fund factsheets here for more information on portfolio charges.

Cost comparison

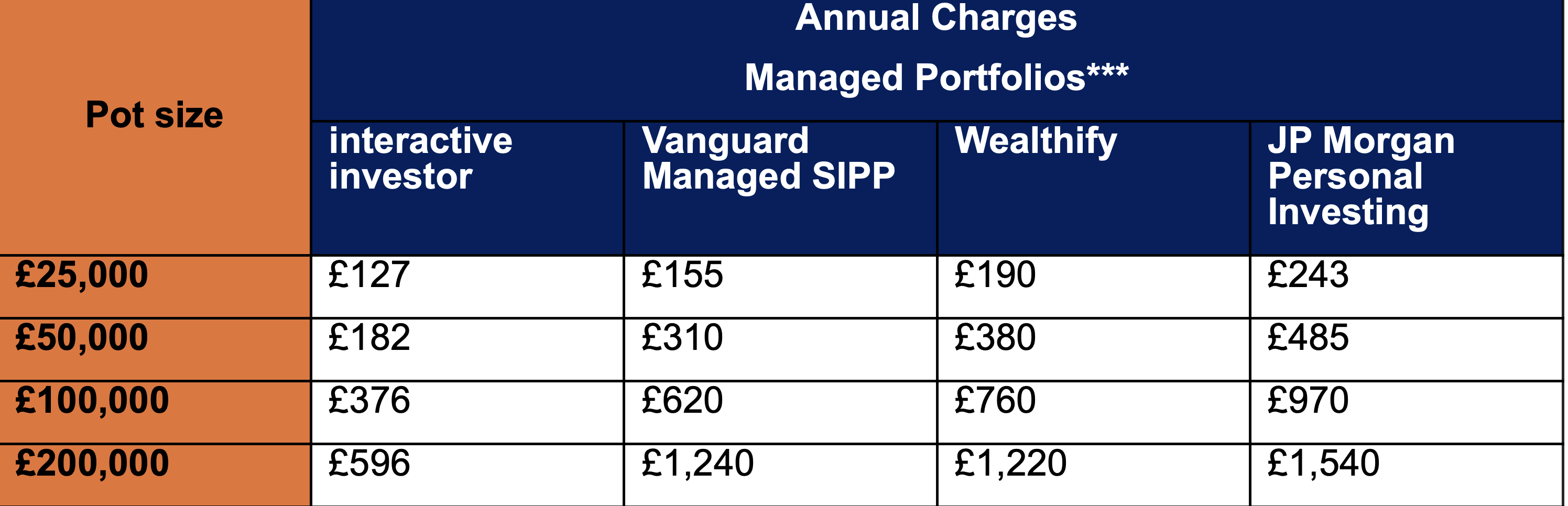

The ii Managed Portfolios offer outstanding value for pension investors. An all-in cost comparison with competitor Managed Portfolios illustrates the significant savings in annual charges. Furthermore, these yearly cost savings will compound over time providing quite the boost to investors’ pensions over the years to come.

***See notes to editors for further information on this comparison table.

An ii Managed Portfolio is only appropriate for those looking to invest for at least five years, are not currently drawing down on any existing pensions and are comfortable with experts making investment decisions on their behalf.

A pension that can really grow over time

This value gets even greater over time. Even thoughinvestors can’t control the market, they can control how much they pay to invest. It can be disheartening to integrate good pension saving habits, stick to an investment strategy for the long term, and see the fruits of compounding take effect over time, only for a growing pension pot to be eaten away in unnecessary fees. Over decades, the differences can add up to tens of thousands of pounds. Importantly, paying over the odds means less wealth for investors to enjoy down the line.

Craig Rickman, pensions expert at interactive investor, adds: “Our research on the UK pensions landscape consistently identifies concerning levels of confidence and knowledge gaps, making it harder for people to navigate the crucial task of saving for a comfortable retirement.

“We continue to develop our products, tools, content, and educational insights to help people take charge of their financial future. That’s why we’ve launched Managed Portfolios for those planning for retirement, which have been designed to benefit a range of pension savers. Those who lack confidence have the reassurance of experts handling their investments for them, while more experienced investors who crave convenience alongside their regular ii SIPP can get the best of both worlds. There’s more good news, too: as your retirement pot grows, your fees won’t. We’re very proud of the value we can provide pension savers through this new managed offering.”

Building pension confidence and retiring on their terms

For pension savers who want the control and value of an interactive investor personal pension (SIPP), but with a more hands-off approach when it comes to managing the underlying investments and level of risk, Managed Portfolio could be a great solution.

In addition, pension savers can choose to self-manage a portion of their ii personal pension (SIPP) alongside the convenience of a Managed Portfolio.

Either way, this level of choice, all under one flat fee, puts pension savers firmly in the driver’s seat of their financial future.

How can investors open an ii Managed Portfolio?

Before opening an ii Managed Portfolio, customers will answer a short questionnaire which will assess their suitability and risk tolerance. Based on their risk level and savings goals, people are matched to one of the managed portfolios on offer.

Once investors have confirmed they’re happy with their recommended portfolio, the account can be opened – after which it’s over to the experts at Aberdeen to manage.

While there is no minimum investment period, the ii Managed Portfolios are designed for long-term growth (at least 5 years).

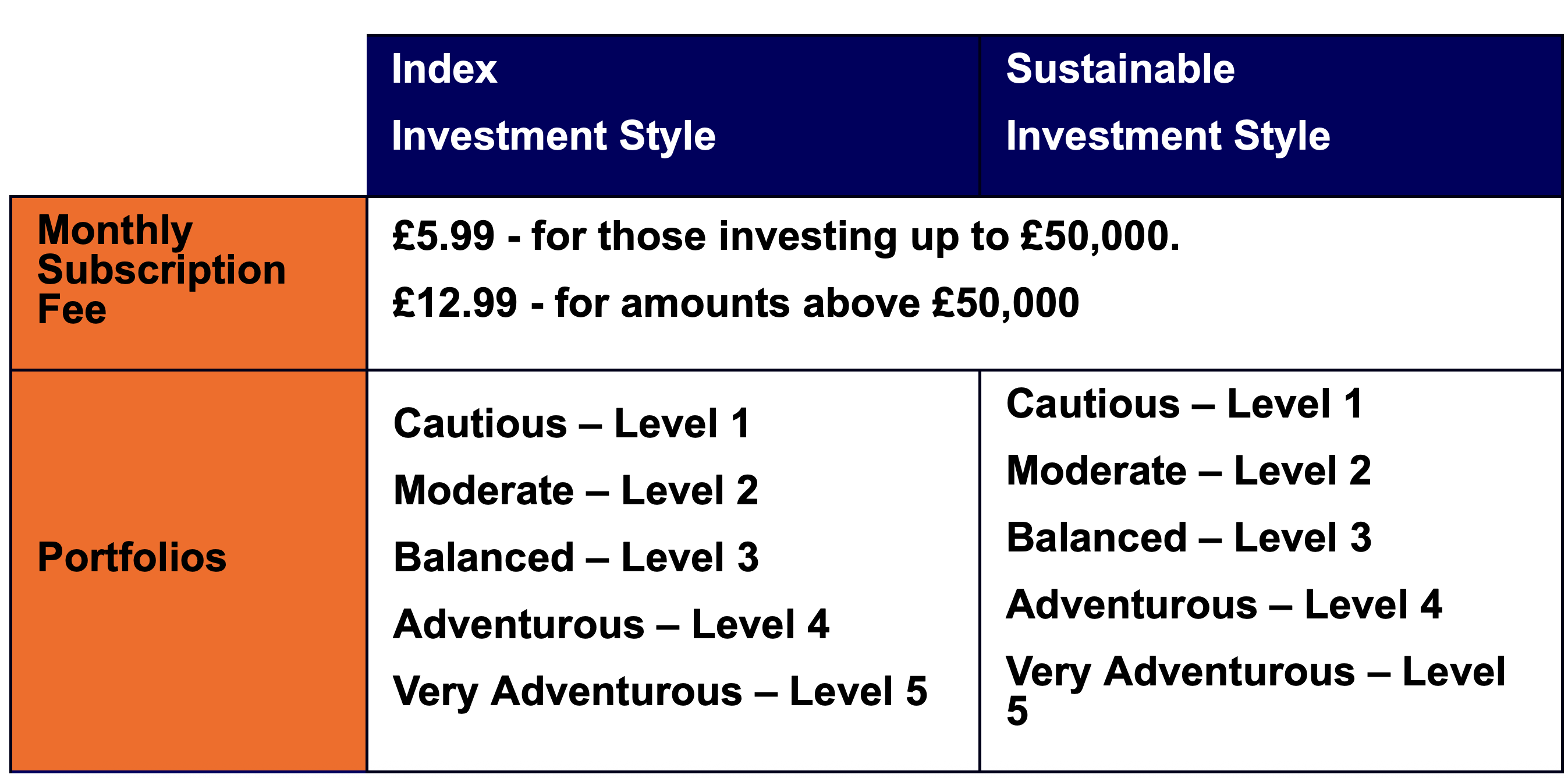

The portfolios have two distinct styles, and five levels of risk to choose from. There are therefore 10 portfolios in total, meaning investors can easily find a portfolio that matches their goals and preferences.

The two styles of investment portfolios are:

- Index investment style: This style aims to keep costs low by not making frequent changes to the investments held. The portfolio invests predominately in passively managed funds and provides exposure to a diversified range of investments.

- Sustainable investment style: This style aims to keep costs low by predominately investing in passively managed funds, in addition to seeking funds that integrate environmental, social, and governance (ESG) criteria into its investment selection. It will also invest in neutral assets such as cash and bonds.

- For more information on portfolio charges: fund factsheets

*Underlying funds also charge fees (OCF and Transaction Costs).

** 83% of UK savers in dark over pension fees

***How we calculated this comparison table:

Costs of investments in portfolios includes fund fees, market spread and variable transaction charges. ii illustration based on average portfolio investment cost of 0.22%. Vanguard illustration based on Vanguard’s Managed Personal Pension (SIPP) fund management fee of 0.17%. Wealthify illustration based on Original Plan average investment cost of 0.16%. JP Morgan illustration based on Fully Managed Personal Pension fund cost of 0.18% and market spread of 0.04%.

Account fees include any account fees, subscription fee or management charges. ii account fee is a monthly subscription. Other providers account fees are on an annual percentage of amount invested. Vanguard account fee is 0.15% (max £375 per year), and Management fee is 0.30%. Wealthify annual fee is 0.6% up to £100,000, 0.3% on portion beyond. JP Morgan Personal Investing is 0.75% up to £100,000, 0.35% on portion beyond.

Costs and charges correct as of November 2025. This is only an estimate. Actual costs may vary depending on performance of underlying investments.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

interactive investor (ii) is an Aberdeen company. Aberdeen advise ii on the fund selection for the ii Personal Pension (SIPP) Managed portfolios. The portfolios contain funds predominately managed by Aberdeen but may also include funds managed by other third-party managers. Please review the portfolio factsheets for more details on the underlying funds. Find out more about how ii and Aberdeen work together.