Lloyds Banking Group: here's what's troubling this analyst

Lloyds shares remain 'in the gutter' and something here has got our chartist worried.

21st May 2020 08:41

by Alistair Strang from Trends and Targets

Lloyds shares remain 'in the gutter' and something here has got our chartist worried.

Lloyds Banking Group (LSE:LLOY)

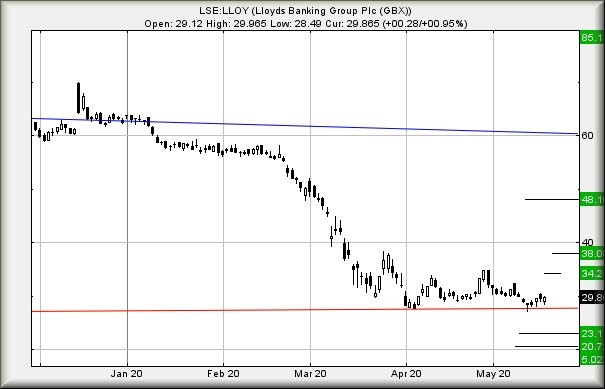

Many shares are showing early signs of 'coming off the bottom'. Needless to say, the Retail Bank Sector is not yet part of this grouping and Lloyds Banking Group (LSE:LLOY) remains resolutely trapped in the gutter. When last reviewed, we suggested Lloyds needed only to exceed 35p to give hope, something the price carefully avoided.

Rather worse, in keeping clear of our 35p 'early warning' trigger level, Lloyds managed to briefly stumble below 27.7p.

This movement risks real danger as weakness next below 27p risks further reversal toward 23p as a hopeful rebound level. And, if broken, it almost must bounce by 20.7p, thanks to the only calculation below such a level indicating the price faces a final bottom down at just 5p.

- UK banks: what City experts think of Lloyds, Barclays, RBS and HSBC

- Lloyds and other UK bank shares slump after halting dividend payments

We wonder if Lloyds' share price shall face a price consolidation next in an attempt to make this FTSE 100 component look more respectable.

Eight years ago, The Royal Bank of Scotland (LSE:RBS) suffered a 10:1 reverse split, thanks to the share price spending the previous 12 months trading in the 20p range.

As it is now trading around 100p (10p in real money) the effort did not really work, other than to propel the share price away from 'penny share' territory.

We are obviously just thinking aloud as there is absolutely nothing to indicate a price split is planned, nothing aside from the painful detail Lloyds share price is not showing early signs for recovery yet.

The share still needs movement above 35p to give hope for the future.

If there is to be early warning of a movement to this early warning trigger (yup, we are reduced to absurd levels of logic), next above 30.6p is supposed to deliver 31.5p. If bettered, our secondary calculation presents a confident looking 34.25p.

While the visuals still suggest a glass ceiling awaits at the 35p level, we suspect closure above 34.25p shall deliver sufficient strength to allow a longer-term ambition of 38p and beyond.

For now, Lloyds is quite troubling and we are quite concerned regarding last weeks breach of 27.7p.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of interactive investor.

All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.