Metro Bank shares: Expectations improve, but by how much?

Our analyst's last review showed some foul expectations, but things could be about to change.

4th November 2019 09:20

by Alistair Strang from Trends and Targets

Our technical analyst's last review showed some foul expectations, but things could be about to change.

Metro Bank (LSE:MTRO)

Similar to UK politics, this is on the edge of becoming interesting. We last reviewed Metro Bank (LSE:MTRO) in September and we'd some pretty foul expectations for its future.

Something seems to have changed, and now we've calculated a trigger level which appears capable of provoking a "sure thing" trade!

- Are Metro Bank shares really worth just 103p?

- Chart of the week: Why I like Metro Bank shares even more now

There's no such thing as a "sure thing" and, to be blunt, the best we'd describe the potential is one of movement with an enhanced expectations.

Perhaps, a bit like saying some MP's will be elected on December 12th, just we're not sure whom nor where...

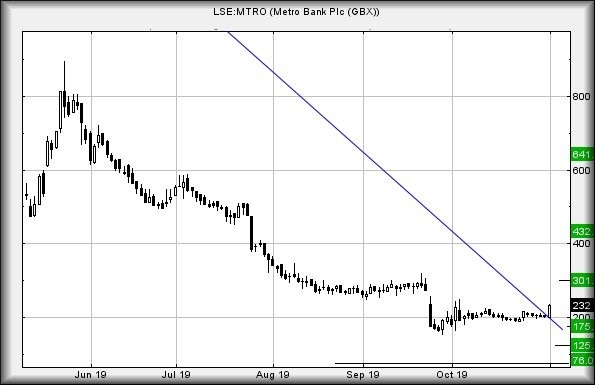

To cut to the chase, the situation appears to be fairly straightforward. If this lot now manage trades above 248p, we're calculating an initial 301p as an initial target ambition. Visually, this makes a lot of sense, matching the plateau of prices until September 23rd.

In fact, if 301p makes an appearance, the share can be expected to experience some hesitation thanks to folk trapped at the three quid level dumping their shares in exchange for cash, doubtless to be wasted on Xmas presents, frivolity, or any number of undeserving causes which appear at this time of year. (Guess who made the mistake of going Xmas shopping at the weekend!)

Longer term, closure above 301p is liable to prove interesting, calculating with a surge to a vague looking 432p.

In fact, we're supposed to believe 641p is exerting an influence, a price level we're less than confident about. In this instance, the only movement which appears to have some confidence is from 248 up to 301p.

If it's all going to go wrong, the price needs to fall below 198p at present to give serious alarm as this appears capable of bringing 175p initially. If broken, secondary computes at 125p and hopefully a bottom capable of providing a rebound.

For now, it appears worth keeping an eye on for our trigger level making an appearance.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.