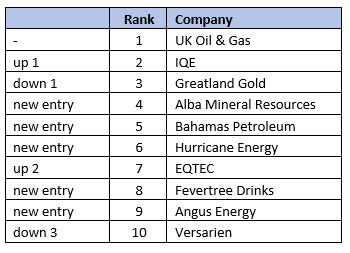

Most-bought AIM shares for July

10th August 2018 10:46

by Lee Wild from interactive investor

There were some old favourites in last month's popularity stakes, but our clients have identified plenty of new opportunities, according to Lee Wild, Head of Equities at interactive investor.

As is the nature of AIM, popularity of individual stocks can change very quickly as investors spot new opportunities. July was no different with half of the top 10 most-bought AIM stocks made up of new entries.

UK Oil & Gas is rarely far from investors' thoughts as the Gatwick gusher continues to develop an enormous potential oilfield beneath Gatwick airport and the surrounding area. IQE has been equally as popular for many months and edged up into second spot as investors decided a recent drift lower put them in bargain territory.

Oil plays Alba Mineral Resources, Bahamas Petroleum Co, Hurricane Energy and Angus Energy all attracted buying attention as a drop in crude prices from their recent peak fed through to small-cap players.

Fevertree Drinks was a small-cap once, but now ranks as the second-largest company on AIM, valued at £4.1 billion. Its shares, which listed less than four years ago at just 134p, neared £40 in July following another profits upgrade. Investors have been faced with a huge dilemma for much of the past few years, existing shareholders about when to sell and interested potential buyers wondering if they've missed the boat. There remains no obvious right answer as the shares continue to confound even seasoned stock watchers.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.