A resurgence for UK smaller companies

24th September 2018 12:02

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst Douglas Chadwick has some advice for investors in the outperforming UK small-caps space, and names the fund he's just bought to exploit further upside.

For most of the last six months the top of the Saltydog performance tables has been dominated by funds from the Global, North American and Technology & Telecommunications sectors. The American economy has been improving, unemployment has been falling and, up until recently, the large technology companies have been doing particularly well. At the same time the US dollar was strengthening, giving a further bonus to UK investors.

In the last few weeks we've seen the pound strengthen, and this has had a detrimental effect on funds investing overseas, and also on funds investing in the largest UK companies, which generate a substantial proportion of their earnings in foreign currencies.

Our latest sector analysis now shows most sectors making losses over the last four weeks.

• A shot across the bow for funds with overseas earnings

• Best AIM companies of 2018 named here

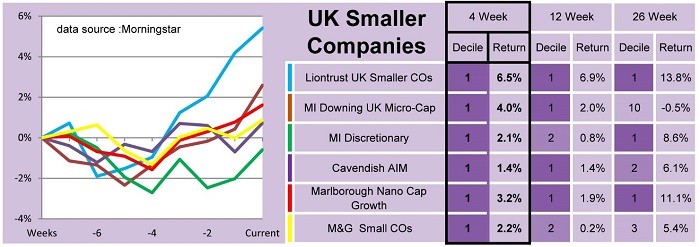

One exception is the UK Smaller Companies sector. It's the best performing sector (based on the top 50% of funds over the last four weeks) and it's up over 2%. These funds had a good run from the beginning of April through until the end of July. They dropped back in August, but have recovered in the last few weeks.

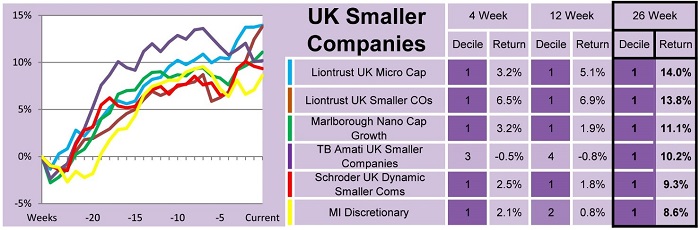

The graphs below show the leading funds over four and 26 weeks.

Past performance is not a guide to future performance

When selecting funds, it is important to take into consideration the costs. There was a time when most funds had initial charges, which you had to pay when you bought the fund. If you use one of the large fund supermarkets or discount brokers these are now fairly unusual.

Another thing to keep an eye out for is the bid/offer spread – the difference between the price of buying and selling a fund. Most Unit Trusts and OEICs are single priced, which means that the buy and sell price are the same, but that is not always the case.

Several of the funds in the UK Smaller Companies sector do have spreads, and they can be significant. The two Liontrust funds shown above have spreads of 3% and 4%, and the Marlborough Nano Cap Growth fund has a spread of nearly 10%. The fact that these funds regularly appear at the top of our tables may suggest that over the long-term it’s a price worth paying, but you’ve got to be planning to hold them for some time.

We have recently invested in one of the funds from this sector, but have gone for one without a spread - the Schroder UK Dynamic Smaller Companies fund. With the uncertainty over Brexit, we're not confident that we’ll be holding it long enough to justify an upfront cost.

However, if a deal is done, and we see the pound continuing to rise in value, then these funds could do well and certainly won't suffer in the same way as funds with overseas holdings.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.