Riding high with these UK funds

Funds in the UK All Companies sector are on the up, with the Saltydog analyst happy to stay on board.

15th April 2019 13:31

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Funds in the UK All Companies sector are on the up, with the Saltydog analyst happy to stay on board.

As part of our regular analysis we look at the amount of money moving in and out of a range of funds. In the UK Equity Income sector we track 73 funds with a combined value of nearly £100 billion.

When markets were struggling at the end of last year a massive amount of money was withdrawn from funds, and the UK All Companies sector was hit particularly hard. Between the beginning of September and the end of December, over £75 billion was taken out of all the funds that we monitor and £12 billion went from the UK All Companies sector, a reduction of 11.8%.

The other UK Equity sectors also suffered. The UK Smaller Companies sector went down by £1.9 billion (15.1%) and the UK Equity Income sector went down by £6.4 billion (13.9%). Since the beginning of the year this trend has reversed. The UK All Companies sector has seen an inflow of 4.0%, UK Smaller Companies is up 0.2% and UK Equity Income is ahead 2.2%.

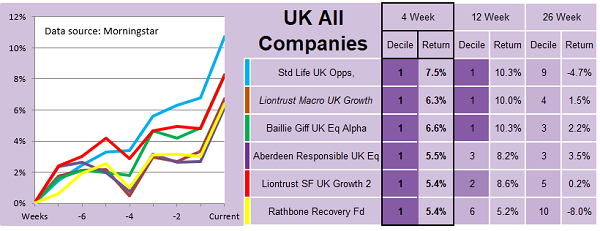

Despite the uncertainty over Brexit, we've also seen the FTSE 100 rise by more than 10% so far this year. Our latest sector analysis shows that the UK All Companies sector is at the top of our 'Steady as She Goes' group, and the leading funds have made impressive gains over the last four and twelve weeks.

We invested in the Baillie Gifford UK Equity Alpha fund at the beginning of February and it's still featuring in our tables. The other UK focused funds that we invested in earlier this year are Investec UK Special Situations, AXA Framlington UK Mid Cap, Newton UK Income and TM Cavendish AIM. They're all showing healthy gains.

There are still plenty of things for the UK to worry about, both politically and economically, but as long as this trend continues, we're happy to ride the wave.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.