Share Sleuth doubles stake in this AIM tech stock

31st August 2018 10:19

by Richard Beddard from interactive investor

Companies analyst Richard Beddard looks to Solid State for a second time to fill a gap in his portfolio.

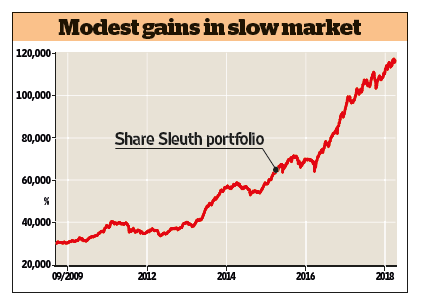

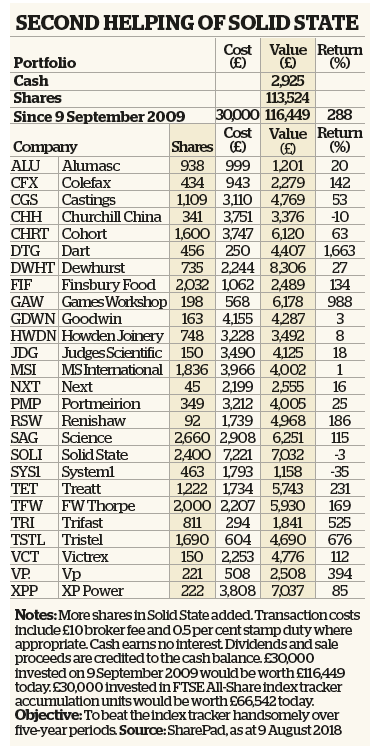

It was a hot day on 23 July when I more than doubled the Share Sleuth portfolio's holding in Solid State taking it from 1,070 shares, or 3% of the portfolio's total value, to 2,400 shares (6%). I know it was hot that day, because every day in July was hot, but I don't think my decision was influenced by the furnace inside my office. I followed the same measured process I have followed for every other trade in the portfolio for years now. I read the annual report, added the latest figures to a spreadsheet containing all the data I need on Solid State going back to 2006, and wrote down my reasons for believing the company will remain prosperous. I evaluated how it has made money, how it will make more money (its strategy) and whether its strategy addresses the risks it faces.

I won't repeat that analysis here, just the conclusion, because you can read a summary in this month's Share Watch column. Solid State is a relatively small company that is in fact two businesses. One, Steatite, manufactures technology used in harsh environments. The other, Solid State Supplies, distributes electronic components. I think Solid State is a good business and management is focusing on raising profit margins. Perhaps they will succeed in making Solid State a great business. I doubt other traders share this view, though, as the company's stock market valuation is very modest – too modest for a good business, let alone a potentially great one.

Quite contrary

Solid State is, therefore, a contrarian investment. I bucked the prevailing market view when I originally added the shares to the Share Sleuth portfolio in July 2016, just after it lost a very lucrative contract with the Ministry of Justice to supply electronic tags for off enders. The price then was 315p. I bucked the market view again last month, when I added more shares at 288p, just after the company admitted its ambitious plans to sell more military and meteorological antennae in the US had run into the US government's newfound preference for domestic suppliers.

Why throw good money after bad? Despite high-profile disappointments, Solid State continues to perform well. The company has grown quite rapidly over the years, partly by acquisition; and now, as a sizeable business, it is seeking bigger contracts with larger customers, which brings new risks. I expect that the company's experienced management is still learning, and that in time more of these bigger contracts will stick.

Seasoned investors might say sagely I have 'averaged down'. Before I bought the shares, the portfolio's Solid State holding showed a 10% loss. Immediately after I bought the shares, the enlarged holding showed a 5% loss, because I paid less for the newer shares. It won't take much of a change of heart by other traders to get my holding back into profit. It sounds clever, but I think this is one of many investing concepts that long-term investors can safely jettison.

Source: interactive investor Past performance is not a guide to future performance

I approach each decision to add, reduce or remove a share from the portfolio without considering what I paid for it. If the portfolio's notional investment hasn't made a decent return in 10 years' time, I will concede I have made a mistake. However, the post-mortem would reveal a more fundamental reason for my failed investment than the fact that the share price went down.

Adding more Solid State shares only required me to think of one factor beyond the prospects of the business and its valuation, and that was the size of the portfolio's holding. My policy is to trade in chunks of one thirtieth (3.33%) of the portfolio's total value. This is to stop me risking too much on one decision. To ensure I don't have too much at stake in a single business, I won't allow any shareholding to grow above 10% either.

The existing holding in Solid State was sufficiently small for me to add more shares and still leave enough headroom for the holding to grow significantly before my rules would compel me to reduce it.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.