Share Sleuth: here’s why I am selling a firm that’s almost perfect

13th September 2021 08:30

by Richard Beddard from interactive investor

Following the latest trade, the portfolio now has more than sufficient funds to add a new share or more of an existing constituent.

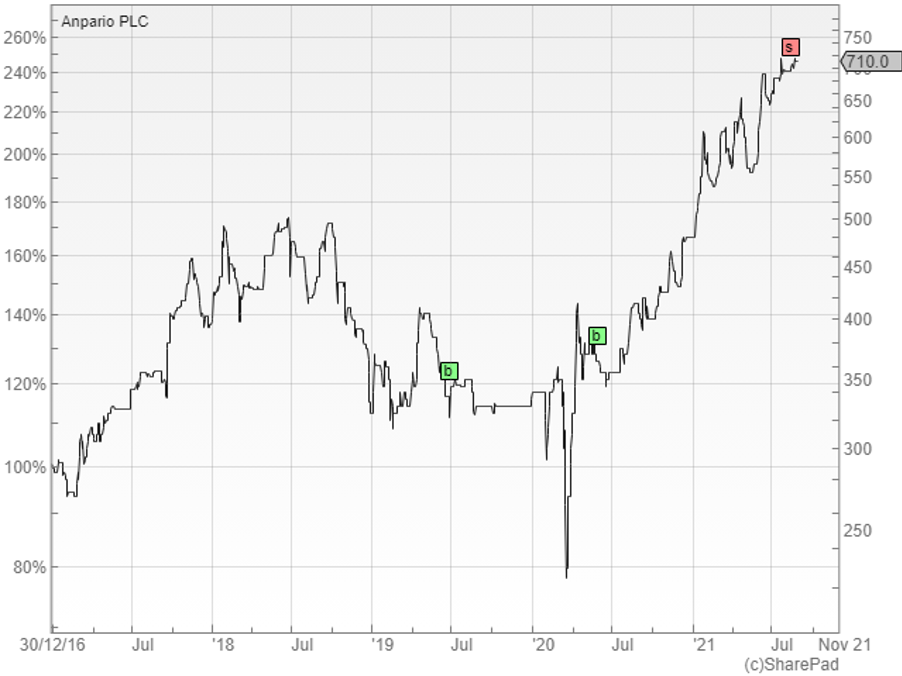

This month, I reduced the portfolio’s holding in natural animal seed additive manufacturer Anpario (LSE:ANP).

Selling an almost perfect stock

As recently as June, I described the business as “almost perfect”.

It provides an alternative means of keeping farm animals healthy now that the use of antibiotics as growth promoters has been outlawed in most places. Unlike antibiotics in the food chain, which leads to human antibiotic resistance, Anpario’s products, such as Omega 3 supplements, can be beneficial to human health as well as animals.

Financially, it is a healthy-looking business, too. Anpario has grown profit at a compound annual growth rate of 10% over the last six years, almost entirely under its own steam (i.e. without recourse to big acquisitions), and it has accumulated a large cash surplus.

Anpario does not have it all its own way, of course. It has competitors. And farms can do much to improve animal health apart from putting supplements in the feed. They can vaccinate animals and improve farm hygiene, for example.

In the very long run, there is also the question of whether the decades-long trend of increased global meat consumption can be sustained.

- 15 stocks that could change the world

- Share Sleuth: taking action on two high-scoring shares

- Fund Finder: big shares versus small shares

On the one hand, as populations in less developed countries are lifted out of poverty they eat more meat.

On the other hand, health advocates and climate change scientists say we can have too much of a good thing and we need to cut meat consumption.

- Hot sector: should investors put down roots in plant-based foods?

- Ethical investing FAQs: we answer your questions about the ii ethical investment list

Healthy animals, though, produce less methane, which is a greenhouse gas, so it is not clear to me that in being part of the meat industry Anpario is necessarily part of the climate change problem.

I considered all these factors when I gave Anpario a score of 6 out of 9. Its high share price was the main reason I docked it points, but I also knocked off a point because of meat’s cloudy future.

A score of 6 is more than sufficient for me to hold a share for the long term, but the advancing share price had breached the limit I set for a holding of score 6, which is, as it happens, is slightly under 6% of the portfolio’s total value, so I decided to trim it back down to size.

One other thing was playing on my mind when I made this decision. Anpario is not the only share in the portfolio to have appreciated considerably in recent times (see the chart and table at the end of this article).

For the first time I can remember, none of the shares in my Decision Engine scored 8 or 9, the highest scores available in my system. With good businesses looking pricey, I do not think it is a bad idea to have some cash in the portfolio, at least until such time as I can find a share that is compelling enough in terms of price and quality to add.

Past performance is not a guide to future performance.

Putting aside the pandemic panic of March 2020, Anpario’s share price has pretty much only gone up in the relatively short time I have held it in the Share Sleuth portfolio.

On 12 August, I reduced the portfolio’s holding by 750 shares to 1,124. The actual price quoted by a broker was a tiny fraction over 700p, which, after deducting £10 in lieu of broker fees, increased the portfolio’s cash balance by £5,242.

At the time of writing, Friday 3 September, the value of Share Sleuth’s holding in Anpario is 3% of the portfolio’s total value and the value of cash is 4%.

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

- Read more of our content on UK shares here

I will sit on the money until I can find a stock that scores highly enough to add to the portfolio, or an existing member that is under-represented in it.

A prime candidate is engineering company Goodwin (LSE:GDWN), which is the only share scoring 8 currently (there are still none scoring 9). My reason for holding off on this decision is that it has been a whole year since I last scored Goodwin and it has just published its annual results.

I would like to have another look at the investment case before I commit to it for the fourth time. Three times previously I have added shares in Goodwin, but so far the business has not delivered the increase in profits I had hoped for.

Since it has reoriented its business away from the oil markets it used to derive so much profit from, patience is, of course, required.

Portfolio performance

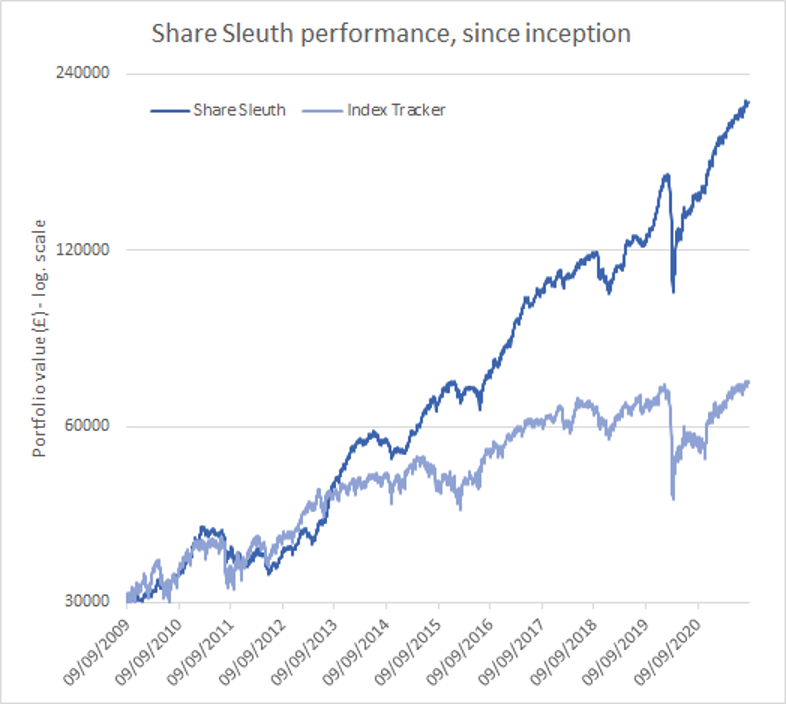

The Share Sleuth portfolio is worth a notional £215,202, 617% more than the £30,000 invested during the year following the first investments in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would have appreciated to £71,930 over the same period.

The cash balance has risen to £8,093 due to proceeds from the Anpario trade and dividends from Dewhurst (LSE:DWHT), Porvair (LSE:PRV), RM (LSE:RM.), Bloomsbury Publishing (LSE:BMY), Churchill China (LSE:CHH), and Next (LSE:NXT).

The portfolio now has more than sufficient funds to add a new share, or more of an existing constituent, at the minimum trade size of 2.5% of the portfolio’s total value (about £5,400).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 8,093 | ||||

Shares | 207,109 | ||||

Since 9 September 2009 | 30,000 | 215,202 | 617 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 7,643 | 88 |

BMY | Bloomsbury | 2,676 | 8,509 | 9,527 | 12 |

BNZL | Bunzl | 201 | 4,714 | 5,331 | 13 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,852 | 6 |

CHH | Churchill China | 341 | 3,751 | 6,564 | 75 |

CHRT | Cohort | 1,600 | 3,747 | 8,816 | 135 |

D4T4 | D4t4 | 1,528 | 3,509 | 5,921 | 69 |

DWHT | Dewhurst | 532 | 1,754 | 10,374 | 492 |

FOUR | 4Imprint | 190 | 3,688 | 5,510 | 49 |

GAW | Games Workshop | 76 | 218 | 9,090 | 4,070 |

GDWN | Goodwin | 266 | 6,646 | 8,379 | 26 |

HWDN | Howden Joinery | 1,368 | 8,223 | 13,144 | 60 |

JDG | Judges Scientific | 159 | 3,825 | 11,925 | 212 |

JET2 | Jet2 | 456 | 250 | 5,431 | 2,072 |

NXT | Next | 106 | 6,071 | 8,404 | 38 |

PRV | Porvair | 906 | 4,999 | 5,798 | 16 |

PZC | PZ Cussons | 1,870 | 3,878 | 4,582 | 18 |

QTX | Quartix | 1,085 | 2,798 | 5,262 | 88 |

RM. | RM | 1,275 | 3,038 | 2,996 | -1 |

RSW | Renishaw | 92 | 1,739 | 5,120 | 194 |

SOLI | Solid State | 986 | 2,847 | 10,304 | 262 |

TET | Treatt | 763 | 1,082 | 8,164 | 654 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 9,860 | 347 |

TRI | Trifast | 2,261 | 3,357 | 3,278 | -2 |

TSTL | Tristel | 750 | 268 | 4,500 | 1,577 |

VCT | Victrex | 534 | 10,812 | 14,183 | 31 |

XPP | XP Power | 240 | 4,589 | 13,152 | 187 |

Table notes:

Reduced holding in Anpario.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £215,202 today.

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £71,930 today.

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 2 September 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of companies in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.