Share Sleuth: the no-brainer trade to reduce my cash pile

Richard Beddard was determined to address the portfolio’s cash surplus. Here, he explains the contenders for further investment, and why he chose this holding.

9th July 2025 10:48

by Richard Beddard from interactive investor

Monday 30 June, the hottest day in June, and one of the hottest June days ever, was my designated day for trading last month.

With £13,365 of cash and a minimum trade size of a little more than £5,000 (2.5% of the portfolio’s total value), I could have made two trades and received some change.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

To keep administering the portfolio simple, cash earns no interest. This and my long-term strategy encourage me to keep the portfolio near fully invested, so I was determined to add shares.

No reductions

Consequently, I’ll pass quickly over the reductions I might have made had the portfolio not had a cash surplus.

I rate Goodwin (LSE:GDWN) and Cohort (LSE:CHRT) quite highly, but the market rates them very highly. They both have price scores of -2.3, almost neutralising their high-quality scores.

# | company | description | score | qual | price | ih% | % | ih%-% |

30 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8.0 | -2.3 | 1.4% | 5.1% | -3.7% | |

32 | Cohort | Manufactures military technology, does research and consultancy | 7.5 | -2.3 | 0.3% | 6.8% | -6.4% |

Click a share’s score to see a breakdown. # is the share’s rank out of 33, % is the value of the holding as a proportion of the total value of Share Sleuth, ih% is the ideal holding size as a percentage of the total value of Share Sleuth, and ih%-% is the difference between the two. The Decision Engine suggests trades if the difference is greater than 2.5% of the portfolio’s total value.

My Decision Engine proposes that I sell all the shares in these holdings, but I drag my feet if a sale takes a high-quality holding down to below 2.5% of the portfolio’s total value.

Technically, a holding of that size must be liquidated because 2.5% is the minimum holding size.

A reduction in Goodwin is not on the cards because the value of the portfolio’s holding is only 3.7%. A 2.5% reduction would reduce it to 1.2%.

Had no additions been available to me today, I would probably have reduced the Cohort holding from 6.4% closer to 2.5%.

Adding Macfarlane

Normally, I would be most interested in adding the highest-scoring and most underrepresented shares in the portfolio (although not if I have traded them recently or I’m about to rescore them). These are listed in the table below.

# | company | description | score | qual | price | ih% | % | ih%-% |

3 | Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | 7.5 | 1.0 | 7.0% | 3.7% | 3.3% | |

7 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.6 | 6.1% | 3.3% | 2.9% | |

8 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | 7.0 | 1.0 | 6.0% | 1.6% | 4.4% | |

10 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.3 | 5.6% | 5.6% | ||

11 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.7 | 5.4% | 2.1% | 3.4% | |

14 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | 7.0 | 0.6 | 5.3% | 5.3% | ||

15 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.6 | 5.2% | 2.3% | 2.9% | |

19 | YouGov | Surveys and distributes public opinion online | 7.5 | -0.3 | 4.4% | 4.4% |

Click a share’s score to see a breakdown. # is the share’s rank out of 33, % is the value of the holding as a proportion of the total value of Share Sleuth, ih% is the ideal holding size as a percentage of the total value of Share Sleuth, and ih%-% is the difference between the two. The Decision Engine suggests trades if the difference is greater than 2.5% of the portfolio’s total value.

But there is a complication related to the simplification of the scoring system that I introduced with Macfarlane in early May.

The revised format allows me to adjust and share scores more easily. It also puts more emphasis on risks that could undermine the long-term performance of shares in the Decision Engine.

Only two of the eight highest-scoring and most underrepresented shares have been scored using the new format. They are Macfarlane Group (LSE:MACF) (score 7.7, rank 11) and Anpario (LSE:ANP) (score 7.6, rank 15).

- Why dollar collapse is opportunity for UK investors

- Stockwatch: an income stock about to generate capital growth?

The purpose of the Decision Engine is to organise my research, so trades are no-brainers, but generally the new format has resulted in lower scores and I have less confidence in the high scores of the other six companies.

Therefore, Macfarlane and Anpario are the only no-brainer trades.

I have chosen Macfarlane. It is marginally higher scoring (7.7 v 7.6) and marginally less well-represented in the portfolio (the difference between its ideal holding size and the actual size of the holding is 3.4% of the portfolio’s value compared to 2.9% for Anpario).

Reappraising Dewhurst

Rather than wait for companies whose shares I scored the old way to publish annual reports, I am expediting the process by re-scoring them mid-term - starting with the highest ranked, Dewhurst Group (LSE:DWHT). The firm is a UK-based supplier of technological solutions to the lift, transport, and keypad market sectors.

I last scored Dewhurst in January. Since then, it has published half-year results for the six months to March 2025. Revenue and profit grew modestly, but the company expects the rest of the current year (April to September) to be challenging due to tariff uncertainty in the US, and inflation and tight government spending in the UK.

- eyeQ: this FTSE 100 dividend stock is cheap

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

When the economies of its major markets splutter, construction projects are delayed and demand for lift components can fall.

News that this is happening is not particularly alarming. Family owned Dewhurst’s very experienced board has steered the company profitably through previous periods of economic contraction. I expect them to again.

Tariffs may have a direct impact on the quarter of revenue Dewhurst earns in the US because the company imports lift components into that market from the UK and Canada.

Dewhurst | DWHT | Manufactures, distributes and fits lift components | 07/07/2025 | 8/10 |

How capably has Dewhurst made money? | 2.0 | |||

Dewhurst has achieved high returns but pedestrian revenue and profit growth for over a decade by increasing its range of lift components and its geographical through innovation and self-funded acquisitions. Smaller subsidiaries make ATM keypads and street furniture (bollards). | ||||

How big are the risks? | 2.0 | |||

Construction activity is sensitive to the economy but Dewhurst is geographically diversified and earns money from repair and maintenance. It has used spare cash to plug its pension scheme deficit and buy property, reducing financial obligations. It must adopt new technologies to stay relevant. | ||||

How fair and coherent is its strategy? | 3.0 | |||

Dewhurst has diversified through acquisition, and in 2024 it acquired an LCD display factory from a supplier bringing a now widely used technology in house. The company has a long-term family owned ethos, and reported employee turnover of just 11% in 2024. | ||||

How low (high) is the share price compared to normalised profit? | 1.0 | |||

Low. A share price of 800p values the enterprise at £33 million, about 5 times normalised profit. | ||||

A score of 8/10 indicates Dewhurst is a good long-term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

Graded using the new format, Dewhurst has suffered a 0.5 point reduction in its score. However, that still puts it well inside the buy zone.

The shares are an acquired taste though. The family owns most of them, they are illiquid and the spread is wide. At the time of writing, the price to sell was 11% lower than the price to buy, which is one reason the shares are so unpopular.

Trade

I didn’t sleep on the decision, because I shouldn’t need to. If I have done my job properly and trades are no-brainers, then sleeping on them will not change anything. If they’re not no-brainers, I shouldn’t be making them.

On Monday 30 June, I added 4,156 shares to the portfolio’s holding in Macfarlane.

The actual price, quoted by a broker, was 119.6p, which cost £5005.43 after deducting £10 in lieu of fees and £34.85 in lieu of stamp duty.

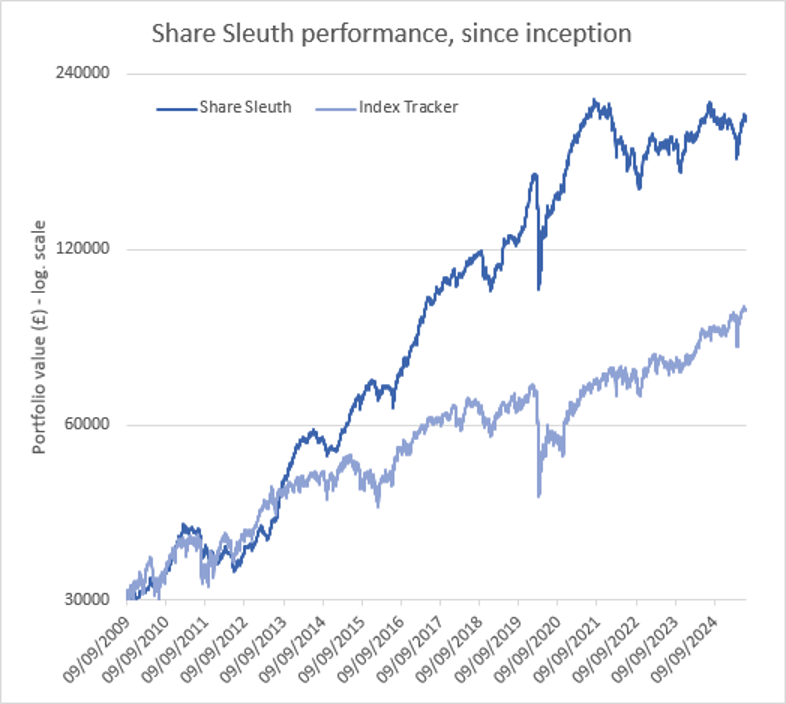

Share Sleuth performance

At the close on 4 July, Share Sleuth was worth £201,478, which is 572% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £94,871, an increase of 216%.

Past performance is not a guide to future performance.

After dividends paid during the month from Focusrite (LSE:TUNE), Macfarlane, Victrex (LSE:VCT), and Bunzl (LSE:BNZL), Share Sleuth’s cash pile is £8,468.

The minimum trade size, 2.5% of the portfolio’s value, is £5,037.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 8,468 | ||||

Shares | 193,010 | ||||

Since 9 September 2009 | 30,000 | 201,478 | 572 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,058 | -10 |

ANP | Anpario | 1,124 | 4,057 | 4,777 | 18 |

BMY | Bloomsbury | 845 | 3,203 | 4,098 | 28 |

BNZL | Bunzl | 417 | 9,798 | 9,758 | 0 |

CHH | Churchill China | 1,495 | 17,228 | 9,718 | -44 |

CHRT | Cohort | 861 | 2,813 | 13,363 | 375 |

DWHT | Dewhurst | 938 | 6,754 | 7,504 | 11 |

FOUR | 4Imprint | 116 | 2,251 | 4,257 | 89 |

GAW | Games Workshop | 66 | 4,116 | 10,481 | 155 |

GDWN | Goodwin | 133 | 3,112 | 10,028 | 222 |

HWDN | Howden Joinery | 1,476 | 10,371 | 12,273 | 18 |

JET2 | Jet2 | 456 | 250 | 7,989 | 3,096 |

LTHM | James Latham | 1,150 | 14,437 | 13,168 | -9 |

MACF | Macfarlane | 7,689 | 10,011 | 8,996 | -10 |

OXIG | Oxford Instruments | 241 | 5,043 | 4,832 | -4 |

PRV | Porvair | 906 | 4,999 | 6,704 | 34 |

QTX | Quartix | 3,285 | 7,296 | 8,245 | 13 |

RNWH | Renew Holdings | 689 | 4,902 | 5,615 | 15 |

RSW | Renishaw | 234 | 6,227 | 6,739 | 8 |

RWS | RWS | 2,790 | 9,199 | 2,455 | -73 |

SCT | Softcat | 326 | 4,992 | 5,402 | 8 |

SOLI | Solid State | 5,009 | 6,033 | 10,268 | 70 |

TET | Treatt | 763 | 1,082 | 1,881 | 74 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 14,787 | 52 |

TUNE | Focusrite | 2,020 | 14,128 | 3,333 | -76 |

VCT | Victrex | 292 | 6,432 | 2,281 | -65 |

Notes

June 30: added shares in Macfarlane

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £201,478 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £94,871 today

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope, close on 4 July 2025.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.