Shares for the future: this stock’s dropped out of my top 10

Using his new scoring method for the first time, analyst Richard Beddard explains why this very likeable company has slipped down his list of top stocks.

9th May 2025 15:00

by Richard Beddard from interactive investor

Since I last scored Macfarlane Group (LSE:MACF) in April 2024, it has acquired two packaging businesses. Acquisitions are unremarkable events because the business has grown by acquiring packaging distributors for many years.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Macfarlane: tilt towards manufacturing

What is, perhaps, remarkable, is the nature of the acquisitions.

Over the past few years, nearly all of them have been manufacturers. The first was GWP in 2021. Macfarlane’s biggest acquisition ever, Pitreavie, acquired just after its financial year end in January 2025, also manufactures packaging:

Name | Year | £m | Activity | Location |

Pitreavie | 2025 | 18 | M/D | Scotland |

Polyformes | 2024 | 11.6 | M | Leighton Buzzard |

Allpack | 2024 | 4.7 | M/D | Bury St Edmunds |

B&D | 2023 | 3.6 | M | Barnstaple |

Gottlieb | 2023 | 3.4 | D | Manchester |

Suttons | 2023 | 9 | M | Chatteris |

PackMann | 2022 | 8.6 | D | Eppelheim (near Heidelberg), Germany |

Carters | 2021 | 4.5 | D | Redruth |

GWP | 2021 | 15.1 | M/D | Salisbury and Swindon |

Leyland | 2019 | 3.3 | D | Leyland |

Ecopac | 2019 | 3.9 | D | Aylesbury |

Greenwoods | 2017 | 16.8 | D | Melton Mowbray |

Nelsons | 2016 | 6.8 | D | Leicester |

Edward McNeil | 2016 | 1.8 | D | Glasgow |

Colton | 2016 | 1.3 | D | Teesside |

One | 2015 | 2.8 | D | Bingham |

Network | 2014 | 7.5 | D | Wolverhampton |

Lane | 2014 | ? | D | Reading |

Source: Macfarlane annual reports and announcements. The Nelsons, Greenwoods, and Network acquisitions were part funded by share placings. M = manufacturing D = distribution, overseas acquisitions are in bold.

Under the company’s current chief executive, Peter Atkinson, Macfarlane conceived its acquisition strategy to develop a nationwide footprint of distributors so it could, in turn, supply businesses with nationwide footprints: DHL, for example.

Macfarlane supplies protective packaging. These products protect goods while they are being stored and shipped. We are talking mainly about cardboard boxes and bubble wrap.

While protective packaging is not a particularly sophisticated product, it has become more so to satisfy environmental objectives, reduce cost, and meet the needs of e-commerce customers.

Macfarlane’s annual report highlights gift and transit packaging for Childrensalon, a retailer of designer childrenswear. As well as being attractive, the new packaging is easier to pack, saves 54 tonnes in materials, and is fully recyclable at home.

Specialist tool supplier Snap-on uses foam inserts made by Polyformes to protect hire tools in transit. The inserts are reusable and “virtually indestructible” (an invitation if I ever heard one).

Maybe it is becoming harder to find distributors that add value to a network that in 2022 already accounted for perhaps a quarter of the roughly £1.1 billion in sales made by UK distributors of protective packaging.

The total size of the protective packaging market in the UK then was between £5-6 billion according to Macfarlane’s estimates, so the company is enlarging its addressable market by moving into manufacturing.

- Stockwatch: onwards and upwards for this bank share?

- Insider: directors buy at FTSE 250 firm and high-flying Haleon

This adds complexity and maybe some risk to the business. Manufacturing tends to be more capital intensive than distribution and the products are more specialised. The combination of more variable demand and higher fixed costs may make profitability more variable. Investment can drain cash flow.

But manufacturing also gives Macfarlane the opportunity to add more value through the protection of fragile and high-value items with bespoke packaging designs. It is targeting the medical, space and aerospace sectors in particular.

As a distributor, the close relationships Macfarlane has with customers may also provide valuable insight for the Manufacturing subsidiaries.

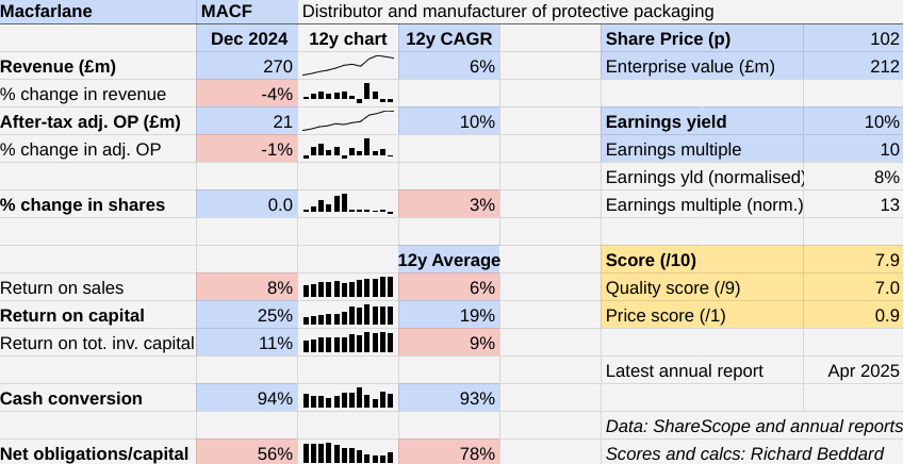

Even though revenue contracted by nearly 4% in the year to December 2024 and profit contracted by 1%, Macfarlane’s adjusted after-tax profit margin (return on sales) was 8%, 2% above the 12-year average. Return on capital was 25%, compared to a 12-year average of 19%.

Distributors often earn relatively low margins, relying instead on selling in large volumes. Macfarlane’s profit margins are impressive to me in this context. Bunzl (LSE:BNZL), a very large, and to my mind efficient, distributor achieves about 6% (after tax).

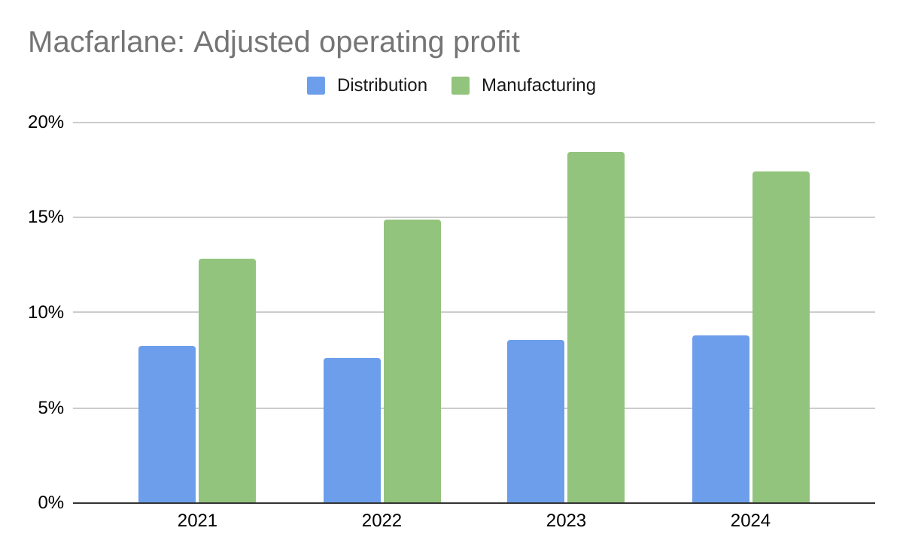

I think Distribution has become more efficient as it grows because profit margins are creeping up, but the impressive margins since 2021 are mainly due to Macfarlane’s tilt towards Manufacturing.

Manufacturing only brought in 15% of revenue in 2024 but contributed 26% of adjusted operating profit. Its profit margin was almost double Distribution’s:

Source: Macfarlane annual reports.

This short-term record is quite impressive, although it remains to be seen how the Manufacturing segment performs through thick and thin.

Meanwhile, distributors are not the only ones that can see value in their counterparts’ activities. The packaging industry is challenged by rising costs and weak demand and looking for ways to grow revenue.

Macfarlane’s risk report notes that corrugate manufacturers are seeking to boost volumes by getting into distribution. It believes its Innovation Labs in Heywood and Milton Keynes and its online and offline sales process gives it the winning hand.

- Bank of England cuts interest rates in surprise split vote

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The “Significant Six” sales process uses an algorithm to optimise the impacts of packaging on transport, warehousing, administration, damages and returns, productivity and customer experience. Judging by the company’s impressive Net Promoter Score of 6.2, Macfarlane’s customers are onside.

The outlier acquisition in Macfarlane’s history is Packmann (2022), a German distributor, which enables it to support UK customers with operations there. The company is seeking to accelerate this “Follow The Customer” strategy, by making more European acquisitions.

The acquisition of Pitreavie comes at considerable cost that will probably result in more debt on the balance sheet at the year-end in 2025. This makes me a bit nervous. While the company had little net bank debt in December 2024, most of its warehouses and factories are financed by lease obligations. Consequently, we are reliant on continuing strong cash generation to pay the rent and interest.

Helped by Pitreavie, Macfarlane expects to grow in 2025 despite the economic conditions. We will learn more when it holds its annual general meeting next week.

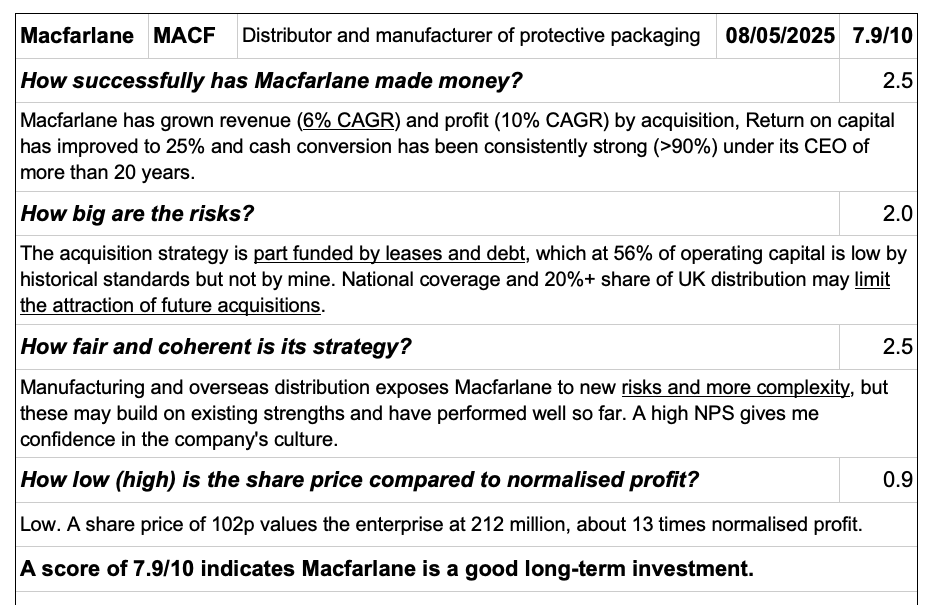

Scoring Macfarlane: a new format

As I mentioned in my last article, I am tweaking the Decision Engine, my scoring system, to make it more flexible.

A prerequisite of flexibility is simplicity. Codifying what makes a good business rigidly and updating that view only once a year may have reduced the potency of the Decision Engine.

Instead of fitting all my research into a predefined template, I am now focusing on what I consider to be the key issues when I write about a share.

You can still see how I scored the share in a summary format. The table below is Macfarlane’s score deconstructed. Underlined text indicates factors that reduce the score. Bold underlined text doubly so.

Notes: Underlined text indicates factors that reduce the score. Bold underlined text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here)

This format allows me to update and share scores more easily.

I have simplified the language for brevity and clarity and omitted the sub-factors for each category. I still consider these factors but mention only the most significant in the summary text.

Some of the factors have been reshuffled, most notably risks, which was formerly included with strategy. Risks as I define them are challenges we can identify now that are likely to impair the long-term performance of the company if the company does not address them. Putting more emphasis on risks (and how strategy addresses them) should give me a better steer on the future.

While I do not expect to change Macfarlane’s score before I consider its annual report next year, I may do so as I follow up loose ends or things happen. This format should make the process easier.

21 Shares for the future

Here is the ranked list of Decision Engine shares that score more than 7 out of 10. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value.

Judges Scientific (LSE:JDG) and 4imprint Group (LSE:FOUR) have published annual reports and are due to be re-scored.

0 | company | description | score |

1 | Churchill China | Manufactures tableware for restaurants and eateries | |

2 | James Latham | Imports and distributes timber and timber products | |

3 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | |

4 | Howden Joinery | Supplies kitchens to small builders | |

5 | Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | |

6 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | |

7 | Oxford Instruments | Manufacturer of scientific equipment for industry and academia | |

8 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | |

9 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | |

10 | Solid State | Manufactures computers, battery packs, radios. Distributes components | |

11 | Macfarlane | Distributor and manufacturer of protective packaging | |

12 | 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | |

13 | Bunzl | Distributes essential everyday items consumed by organisations | 7.8 |

14 | YouGov | Surveys and distributes public opinion online | |

15 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures, fixation devices and dressings | |

16 | Porvair | Manufactures filters and laboratory equipment | |

17 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | |

18 | Jet2 | Flies holidaymakers to Europe, sells package holidays | |

19 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | |

20 | Judges Scientific | Acquires and operates small scientific instrument manufacturers | |

21 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's score to see a breakdown (scores may have changed due to movements in share price)

19 more speculative shares

Shares that score 7 or less out of 10 are more speculative, either because their share prices are high in relation to normalised profit or because I am less confident in the businesses than I should be (or both!).

0 | company | description | score |

22 | *Treatt* | Sources, processes and develops flavours esp. for soft drinks | |

23 | *Victrex* | Manufactures PEEK, a tough, light and easy to manipulate polymer | |

24 | Softcat | Sells hardware and software to businesses and the public sector | |

25 | *Tracsis* | Supplies software and services to the transport industry | |

26 | Volution | Manufacturer of ventilation products | |

27 | *Anpario* | Manufactures natural animal feed additives | |

28 | Auto Trader | Online marketplace for motor vehicles | |

29 | Dunelm | Retailer of furniture and homewares | |

30 | *Marks Electrical* | Online retailer of domestic appliances and TVs | |

31 | *RWS* | Translates documents and localises software and content for businesses | |

32 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | |

33 | Bloomsbury Publishing | Publishes books, and digital collections for academics and professionals | |

34 | DotDigital | Provides automated marketing software as a service | |

35 | Celebrus | Makes marketing and fraud prevention software, sells it as a service | |

36 | Garmin | Manufactures sports watches and instrumentation | |

37 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | |

38 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | |

39 | Cohort | Manufactures military technology, does research and consultancy | |

40 | Keystone Law | Runs a network of self-employed lawyers |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's score to see a breakdown (scores may have changed due to movements in share price)

Shares in *italics* score less than 6/9 for business quality and may be removed

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Macfarlane and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.