Stockwatch: a secure choice for income plus option for growth

Analyst Edmond Jackson explains why he’s backing this bond-like share with a technology angle, and why they look primed to break out from their three-year range.

23rd January 2026 11:21

by Edmond Jackson from interactive investor

Is Tritax Big Box Ord (LSE:BBOX) now on an improving share price trend, backed by a 5.5% prospective yield and yesterday’s bullish trading update?

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

This £4.4 billion real estate investment trust (REIT) is the UK’s leader in logistics property – “big box” warehouses chiefly serving retail with an underlying portfolio value around £7.5 billion. Its initial concept was to help institutional investors gain exposure to this growth segment, offering liquidity from shares rather than direct ownership.

As competition has increased and there has been mixed success with REIT takeovers to re-rate growth, it is interesting how Tritax Big Box is starting to apply its skills towards data centres. A first project at Heathrow is approaching the development phase, aiming for 9% to 11% yields.

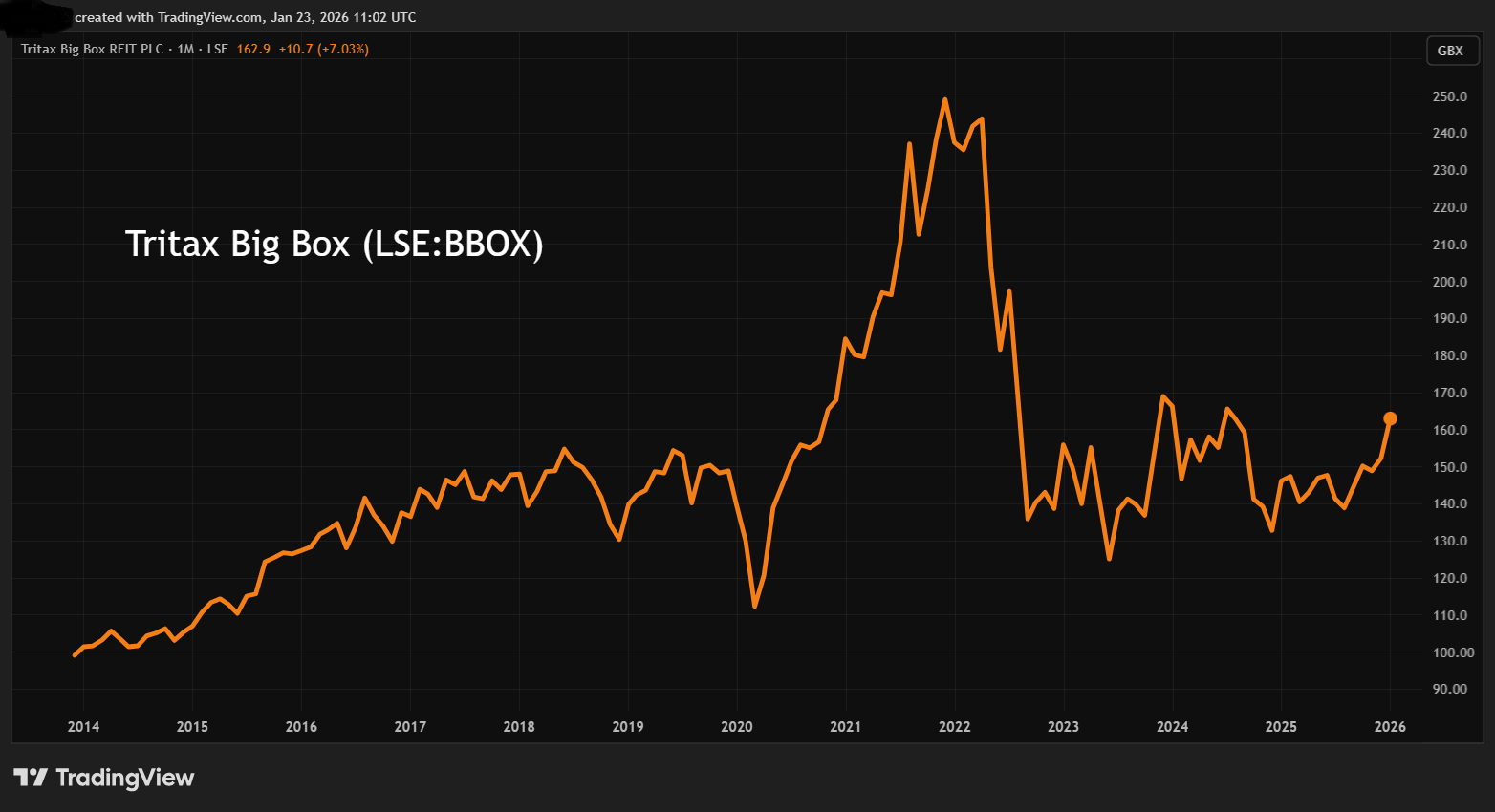

It has been a successful long-term share to examine. I initially drew attention at 100p after floating at that price in late 2013, given its concept looked promising and there was no listed rival. It had a fine run to near 250p by early 2022, after which I turned cautious lest the UK became mired in stagflation. The price plunged to 125p that September and a statutory loss arose for the year because rising inflation and interest rates prompted a sharp increase in property yields. Despite strong demand for warehouse space, the investment market de-valued logistics assets, hence a 15% fall in portfolio value.

Source: TradingView. Past performance is not a guide to future performance.

Similar discount to net tangible assets as in early 2023

At 155p in January 2023 I turned more positive given a 14% discount to net tangible assets and 4.7% likely yield, since when the shares have traded in a sideways range of 125p (last April’s tariff-induced sell-off) to 170p. Yesterday, the price closed up 2p near 163p after the full-year update compared with 144p earlier in December.

At 163p currently, the discount is around 13% to reported levels for 30 June of around 188p as defined by the European Estate Agency’s modelling, or 187p according to the balance sheet. With consensus anticipating an 8.4p dividend in respect of this year, relative to earnings per share (EPS) of 8.9p based on £237 million net profit, the prospective yield is 5.5%.

Tritax Big Box REIT - financial summary

Year ended 31 Dec

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Net rental income (£ million) | 18.6 | 43.8 | 74.6 | 108 | 133 | 149 | 166 | 190 | 213 | 221 | 276 |

| Operating profit (£m) | 46.7 | 143 | 110 | 265 | 277 | 181 | 492 | 1,013 | -580 | 127 | 515 |

| Net profit (£m) | 41.8 | 134 | 91.9 | 248 | 253 | 141 | 449 | 973 | -599 | 70.0 | 446 |

| EPS reported (p) | 14.7 | 21.0 | 10.4 | 19.4 | 17.4 | 8.4 | 26.3 | 55.0 | -32.1 | 3.7 | 19.7 |

| EPS normalised (p) | 14.7 | 21.0 | 10.4 | 19.7 | 17.5 | 8.2 | 26.3 | 55.1 | -32.0 | 5.0 | 19.8 |

| Operating cashflow/share (p) | 8.0 | 4.2 | 7.9 | 6.8 | 6.5 | 5.5 | 8.1 | 11.1 | 9.5 | 9.8 | 8.6 |

| Capital expenditure/share (p) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.4 |

| Free cash flow/share (p) | 8.0 | 4.2 | 7.9 | 6.8 | 6.5 | 5.5 | 8.1 | 11.1 | 9.5 | 9.8 | 8.2 |

| Dividends/share (p) | 4.2 | 6.0 | 6.2 | 6.4 | 6.7 | 6.9 | 6.4 | 6.7 | 7.0 | 7.3 | 7.7 |

| Covered by earnings (x) | 3.5 | 3.5 | 1.7 | 3.1 | 2.6 | 1.2 | 4.1 | 8.2 | -4.6 | 0.5 | 2.6 |

| Return on total capital (%) | 5.7 | 10.0 | 9.0 | 4.9 | 11.5 | 18.5 | -11.6 | 2.6 | 7.9 | ||

| Return on equity (%) | 14.8 | 12.1 | 5.9 | 16.4 | 27.8 | -16.1 | 2.1 | 11.3 | |||

| Cash (£m) | 98.6 | 59.2 | 165.0 | 71.9 | 47.4 | 21.2 | 57.6 | 70.9 | 47.4 | 36.2 | 80.6 |

| Net debt (£m) | 102 | 318 | 368 | 637 | 773 | 1,127 | 1,286 | 1,274 | 1,567 | 1,579 | 1,873 |

| Net asset value/share (p) | 104 | 121 | 126 | 140 | 151 | 150 | 170 | 218 | 179 | 175 | 184 |

| EPRA net asset value/share (p) | 108 | 125 | 129 | 142 | 153 | 152 | 176 | 223 | 180 | 177 | 186 |

Source: historic company REFS and company accounts.

A mixed two-year progress attempting substantive acquisitions

As if affirming a sense that capital growth needs help this way – were the business model to remain exclusively logistics assets – 2024 saw the £1.2 billion acquisition of UK Commercial Property REIT. This was said to introduce high-quality urban logistics assets with income and capital growth potential, after which £180 million worth of assets deemed “non-strategic” were sold at a premium to book value.

In fairness, the real estate investment trust sector has come under activist shareholder pressure to narrow discounts to net asset value, prompting takeovers for industry consolidation or to liquidate assets for financial gain.

Last June heralded an agreed all-share offer for Warehouse REIT worth £485 million, but Tritax Big Box opted not to compete with a subsequent all-cash offer from Blackstone. It appeared to underline the dilemma of looking to “step-change” acquisitions, but which introduce uncertainty and can make it seem that piecemeal acquisitions are harder to source or give much boost to group financials.

Data-centre strategy looks a timely move

The data-centre strategy is actually a year old, kicked off by the purchase of a 74-acre site at Manor Farm near Heathrow airport, within the Slough Availability Zone, considered a prime location due to proximity to key connectivity routes and power infrastructure.

Tritax Big Box took a 50% stake in a joint venture with a European renewable energy provider to deliver a potential capacity of 147 megawatts (MW). Its initial phase is due to start in the first half of 2026, although revenue generation will not begin until the second half of 2027. It will still be one of the most advanced data centres in Europe, with overall £365 million capital expenditure targeted. Tritax anticipates a 9.3% yield on cost, significantly higher than 5.0% to 5.5% for data centres generally.

- Investment outlook: expert opinion, analysis and ideas

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Moreover, a pipeline has been secured for additional grid connection agreements across the UK, capable of providing around 1 gigawatts (GW) of power for further data centre opportunities, anticipating delivery from 2028 onwards.

It looks like a sensible move in terms of “something new” given high demand for data capacity driven by AI and cloud computing, with data centres anticipated to grow in the UK by 19% to 22% until 2030. However, it is tricky to decipher in terms of meaningful forecasts until Manor Farm proves what it can deliver and further opportunities unfold.

But this possibly has helped investor perception in the sense of an overall rising share trend during 2025.

CEO cites 2025 as ‘a transformational year’

Bear in mind, Tritax Big Box does effuse bullish PR, a year ago proclaiming: “Successful strategy execution; multiple growth drivers; positive outlook.”

This January the CEO says rental income is expected to grow from development letting “with a strengthening pipeline of opportunities”; and Manor Farm reflects “strong occupier demand for well-located, power-enabled sites”.

“With clear structural tailwinds supporting our portfolio, we enter 2026 well-positioned to deliver on our ambition to grow adjusted earnings by 50% by the end of 2030.”

This is backed, however, by a Moody’s credit rating upgrade to A3 from Baa1, reflecting the company’s growing scale, diversification and focus on resilient, high-quality logistics assets. It also reflects the opportunity to boost returns via data centres’ development.

- Stockwatch: director buying and new update hint at upside here

- How to turn £120K Traitors’ prize money into £2.1m

Also, Trot Holdings - an infrastructure investment platform “dedicated to revolutionising the industrial and storage landscape in the Middle East” – took an 8.2% holding last October when the prevailing market price was around 150p. Simultaneously, Aviva disclosed that it had trimmed its stake from 3.9% to 3.0%, but there were no other holdings announcements around that time to imply from where the shares derived.

While there has not been any director trading since 6 August 2025, six directors did purchase a total £565,000 worth at 143.9p then. It followed a bi-annual pattern of buying, where last 28 February they bought £568,000 worth at 146.6p and similarly in August and May 2024. The directors therefore have backed professed optimism with cash.

A conservative choice for total return, chiefly dependable income

This kind of share strikes me as close to a bond in terms of relative security of income versus the possibility of fluctuation in capital value (according to interest rates or, in these circumstances, property values).

As such, you can consider it a portfolio “building block” especially if you have overall priority for income. It looks as if awareness of the 5.5% yield currently, with scope to augment especially if data centres prove successful, is helping drive upside. Bear in mind, property-related shares do tend to trade at a discount to net tangible assets, but can also engage some premium if their concept is especially attractive.

Obviously, there is a long way to go before data centres can rival Tritax’s warehouses, if ever they will. Yet there looks an increasing chance of a medium-term breakout from the three-year 125-170p range, hence I conclude “buy”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.