Where to invest in Q1 2026? Four experts have their say

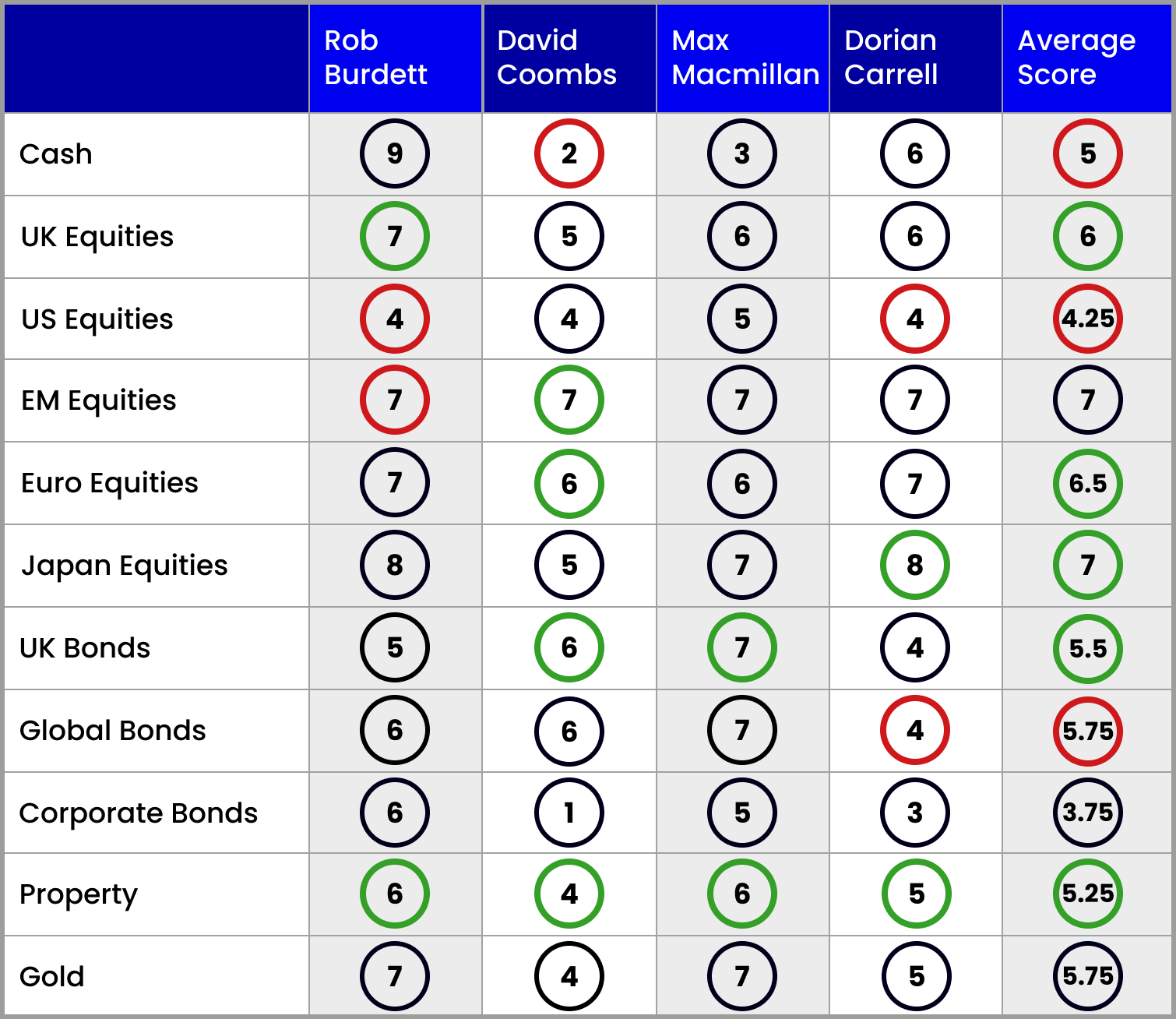

Our asset allocation panel gives their views on the areas where they are bullish and bearish.

23rd January 2026 09:13

by Jim Levi from interactive investor

You could be forgiven for thinking stock markets have been operating in a fantasy world lately. Equities made a flying start to the new year with leading indices such as Wall Street’s S&P 500, London’s FTSE 100 and Japan’s Nikkei 225 attaining all-time peaks.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

All this bullishness has taken place while the geopolitical climate has become increasingly turbulent. The real war in Ukraine rages on. New turmoil threatens Iran and Venezuela, while China’s threat to Taiwan has hardly receded. Yet equities have remained buoyant.

US President Donald Trump has meantime been throwing his weight around with increasing unpredictability: threatening an American acquisition of Greenland and the entire North Atlantic alliance by further disruptive use of tariffs.

And as if that were not enough his administration has threatened his central banker Federal Reserve chair Jerome Powell with criminal charges in an unprecedented move.

Schroders’ Dorian Carrell reckons that there are dozens of different trouble spots around the world today. “I cannot see this uncertain climate ending soon,” he says.

One result of Trump’s shenanigans has been the continued weakness of the US dollar against other major currencies. Against the euro, for instance, the dollar has lost about 13% of its value in the past 12 months while losing 10% against the pound.

Question marks over the dollar’s future as a reserve currency is encouraging global investors into buying real physical assets. That includes commercial property, shares in companies as well as industrial commodities such as copper and tin and precious metals like gold and silver - all of which have lately been trading at record levels.

At the same time, there is increasing caution among those same investors about buying more and more US government debt.

So, maybe the strength of equity markets around the globe is not so irrational as it may sometimes seem.

Treading with caution

Even so, all four of our panel of fund managers seem to agree that they should be viewing US equities with caution in the weeks ahead.

Exceptionally high valuations and the concentrations of those valuations in artificial intelligence (AI)-linked stocks such as NVIDIA Corp (NASDAQ:NVDA), Facebook-owner Meta Platforms Inc Class A (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT) and Alphabet Inc Class A (NASDAQ:GOOGL) are sources of concern.

Indeed, global investors are now searching emerging markets such as Taiwan and South Korea for stocks that may benefit from the AI boom.

US equities are hard to bet against, given their dominance in global stock markets, with the country accounting for more than 70% of the MSCI World index. However, only Aberdeen’s Max Macmillan retains a neutral score of five, while other panel members are all underweight.

“I’m not really negative about the US market,” David Coombs of Rathbones stresses. “It is just there are better opportunities elsewhere. Also there are real question marks over just how profitable the AI boom is going to be.”

Market correction overdue?

Rob Burdett at Nedgroup admits that some sort of equity market correction looks overdue. “We have not had such a correction since March/April last year,” he says. “But that proved a very good buying opportunity.”

Burdett, a long-time fan of Japanese equities points out that Japan’s Nikkei 225 index has risen nearly 60% since early April last year. He retains his near-maximum score of eight for Japanese equities and is now being joined in his enthusiasm by Schroders’ Carrell who also scores an eight.

Carrell is encouraged partly by the prospect of a more stable political situation in the country with hopes that Japan’s first female prime minister, Sanae Takaichi, strengthening her hold on power after a snap election called for next month.

So, Burdett at least is half expecting a setback soon and in readiness for that he holds a cash score of nine. In other equity sectors, Burdett has increased his exposure to the UK market from six to seven, while retaining overweight positions (with a score of five deemed neutral) in emerging markets and European equities.

Looking at the performance of global equities over the past year, Japan has performed best among developed markets but some emerging markets, partly helped by the weakness of the US dollar have done even better. In Europe some markets, notably German stocks, have performed almost as well as Japan, while our own FTSE 100 has risen around 20%.

Looking at the latest average equity scores of the panel members, they are broadly underweight in the US, healthily overweight in Japan and emerging markets and overweight in both the UK and European equities.

Views on bonds and gold

When it comes to government bonds, only Carrell at Schroders is cautiously underweight over fears of persistent inflation and the unpredictability of the Trump presidency.

There have been no changes in the scores for corporate bonds, which are completely out of favour with both Coombs and Carrell. Both regard the risk of default as outweighing the modest yield advantage they have over government bonds.

There have been no changes either in the scores for gold, even though the yellow metal has in many respects been the star performer in financial markets in recent times. It is up nearly 80% in the past year and up 160% in the past five, with geopolitical tensions one factor behind its rise. With no dividend yield or cash flows it is hard for investors to assess whether the gold has now become too expensive. “I still don’t know how to value it,” Schroders’ Carrell admits.

Property comes in from the cold

It is intriguing to see the property sector coming slowly in from the cold with the gradual lowering of interest rates in the UK.

All four members of the panel have raised their scores with both Burdett and Macmillan of Aberdeen going overweight. Coombs at Rathbones edges up from three to four, while Carrell goes up to a neutral five. “There is a distinct shortage of supply at the quality end of the commercial property market,” Carrell claims.

Back in October, Coombs was easily the most cautious member of the panel. But he has now cut his score for cash dramatically from eight to two, while modestly raising his exposure to European equities from four to six and emerging markets from six to seven. He is also increasing his exposure to UK bonds.

- DIY Investor Diary: ‘quant’ approach goes big on gold and bonds

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Perhaps the most striking individual performance by a panel member has been from Macmillan. Back in October he made only one modest change to his score sheet - cutting his score for Global Bonds from eight to seven. This time around he is changing only two scores - lifting his property score from five to six, and his UK bonds score from six to seven. So, essentially he has displayed a confidence in his judgement of his overall mix of investments to have more or less left things alone since last July.

It will be intriguing to see if Macmillan makes any dramatic changes in our next survey in April.

His current view: “We cannot know when this bull market will end and we remain cautious about the outlook as we think we are in the late stages of the business cycle. But we think it is right to be fully invested in a portfolio that is well diversified to minimise the risks. That is why we have a low cash score.”

There is undoubtedly plenty to worry about these days, but then in these turbulent times we have to remember that old investors’ adage that bull markets always climb a wall of worry.

Note: the scorecard is a snapshot of views for the first quarter of 2026. How the panellists’ views have changed since the fourth quarter of 2025: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager with Nedgroup Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at Aberdeen.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.