Why I’m happy to buy shares at record highs

Amid the hype around the FTSE 100’s rally, investors may have missed undervalued mid-cap stocks. Analyst John Ficenec discusses the FTSE 250 supercycle and investment ideas to benefit.

21st January 2026 08:36

by John Ficenec from interactive investor

With the FTSE 100 grabbing the headlines daily by reaching record highs, it’s understandable that investors might be concerned about buying in at the top. But far from fear, there are some important reasons why investors should embrace optimism in UK markets, as now looks like an excellent time to be buying shares which could deliver market-beating returns in the year ahead.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Markets paved with gold

The reason why I am quite happy to buy into one specific part of the UK market right now is because I think it offers some of the best value in a very long time.

Tech stocks in the US may be at eye-watering valuations, and the FTSE 100 may have delivered a total return of 25.8% last year, when you consider dividends plus share price performance. But the more UK-focused FTSE 250 has suffered from a lost decade, driven by austerity, Brexit, Covid and collapse in confidence in the UK economy.

Narrow rally

One of the reasons for this peculiarity is that FTSE 100 records are being driven by a smaller and smaller number of stocks. The top 10 largest companies in the FTSE 100 now make up almost half, or 47%, of the index, and this small group contributed over 80% of last year’s returns.

This concentration means that when we talk about the performance of the FTSE 100, we are really talking about the performance of just a handful of companies. The UK was boosted by increased defence spending, oil and gas majors, mining and pharmaceuticals. It was far from a broad-based bull market, rather it was built on decidedly shaky fundamentals, think less pyramid and more wonky tower.

- Investment outlook: expert opinion, analysis and ideas

- Sector Screener: why Rolls-Royce shares still appeal

This situation is exacerbated by the unstoppable rise of index investing through exchange-traded funds (ETFs). If I buy one share in a FTSE 100 ETF, the manager of that ETF must replicate the underlying index by holding the correct weighting of shares in his fund, so if the top 10 companies are getting bigger the ETF will compound the problem by buying more of their shares every time someone invests. It amplifies the directional momentum in the underlying market.

Reasons to be cheerful

Far from a cause for concern, the current concentration of the FTSE 100 is one of the reasons I’m comfortable buying shares right now. If only a handful of companies have been behind the rise, the same should be true on the way down.

If the top 10 companies underperform and the FTSE 100 starts falling, it wouldn’t impact on stock picks in the FTSE 250 as much. The same is true for a sell-off in US markets. If they have a wobble due to a correction in tech valuations, then the UK, while not escaping entirely, could outperform for investors.

The lost decade

Right now, the FTSE 250 is offering some of the most attractive valuations in a generation, and for very good reason. The index is made up of the next 250 companies listed on UK markets by market capitalisation behind the top 100, which means they are smaller, and more dependent on the UK economy.

Historically, the index has been higher growth, offered lower dividends and better returns at higher risk. That all came unstuck after the 2008 banking crisis when the UK entered a period of persistent low growth, and absent growth in the UK economy the FTSE 250 has drifted sideways for over a decade.

Source: TradingView. Past performance is not a guide to future performance.

This problem has accelerated during the past five years as the FTSE 100 has returned gains of 58% compared to just 13% for the FTSE 250. Again, extend that to the past decade and the FTSE 100 has risen 64% and the mid-cap index just half that at 34%. If you factor in inflation, the FTSE 250 is actually going backwards. Perversely mid-caps now offer lower growth and higher dividends, the exact opposite of the historical norm.

Source: TradingView. Past performance is not a guide to future performance.

FTSE 250 supercycle

There are several reasons I believe a FTSE 250 super-cycle has already started. Growth, albeit slow, has returned to the UK economy with the latest figures for GDP in November at 0.3%, ahead expectations that we had ground to a halt. The economy was heavily impacted in the second half of the year by the late November Budget that caused many businesses to hit the pause button. The Budget passed, it didn’t inflict a tax shock, so in the short term there is lots of catching up to do. Economists from Deutsche Bank expect growth to jump sharply in January, before settling at a lower level for the rest of the year.

UK inflation has also peaked and will continue to fall in the year ahead. Having soared to a post-Covid high of 11% at the end of 2022, inflation came in lower than expected at 3.2% in the November reading last year. “We can now see inflation at target in mid-2026, rather than having to wait until 2027 as in our previous projection,” said Bank of England policymaker Alan Taylor, expecting a further fall to the Bank of England target of 2%. This will ease cost pressure on business and increase consumers’ spending power.

- The shares attracting fund managers at start of 2026

- Shares for the future: how I find companies for my Decision Engine

The UK is still in a rate-cutting cycle, with Bloomberg consensus predicting the Bank of England will make two more cuts in the year ahead, bringing the central bank borrowing rate down from 3.75% to 3.25%. This will encourage both households and businesses to be a bit more adventurous with their finances. UK households are sat on lots of cash at the moment as the economic uncertainty has caused the savings rate to rise above the normal level.

“Falling inflation and interest rates, plus easing political uncertainty, can lift cyclical sectors and allow the UK to beat consensus growth expectations, which in our view, remain too low,” said Kallum Pickering, chief economist at Peel Hunt. For an economist, that’s about as enthusiastic as they come.

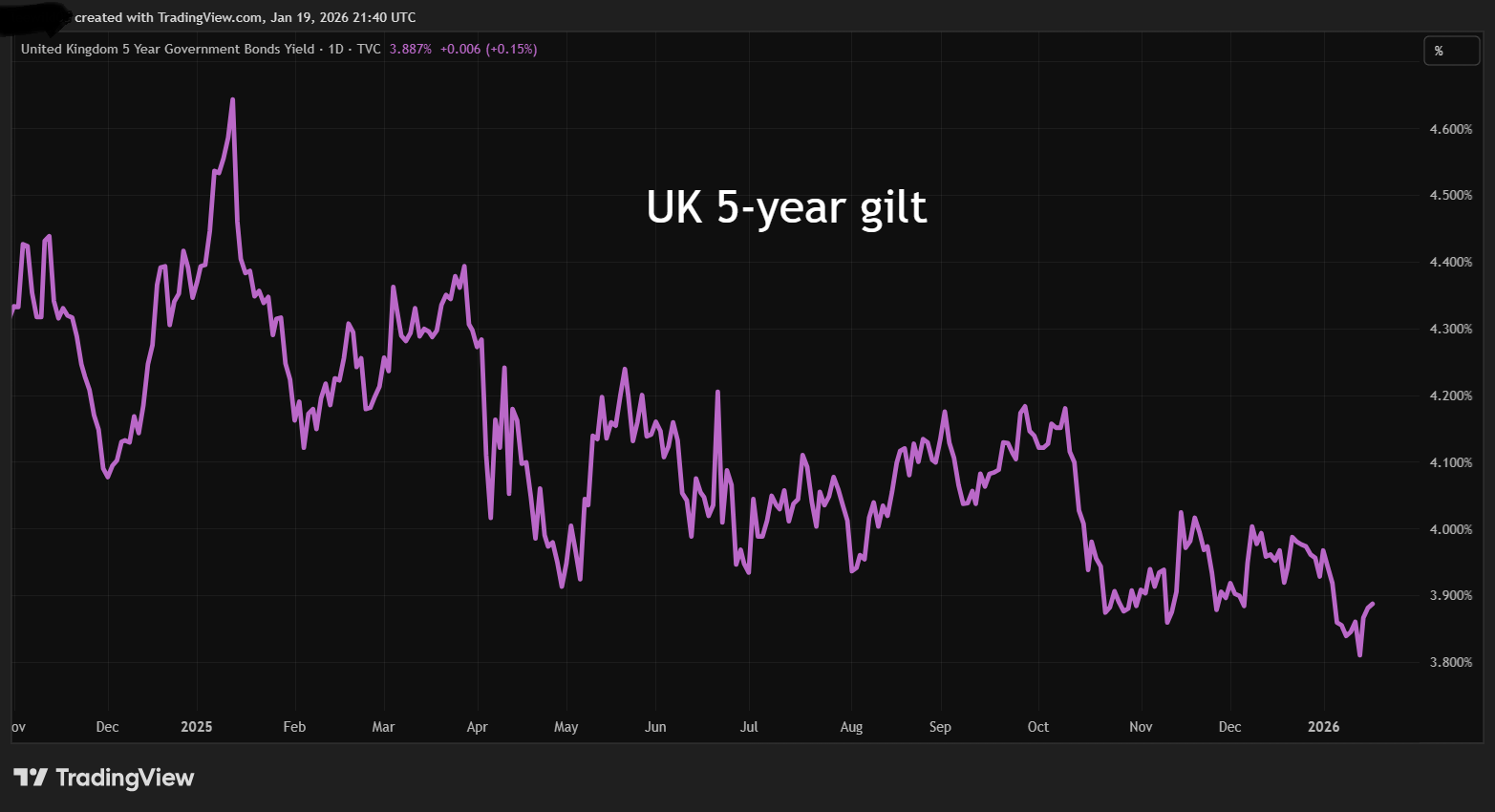

Global investors have already started to take note, with the increased appetite for UK government debt driving down the cost of borrowing. The benchmark 10-year yield has fallen to its lowest level in over a year, and the five-year gilt yield, which is a key indicator used to price mortgages, has fallen to 3.8% from 4.4% at the start of last year. In a further vote of confidence, the pound has made gains against the dollar and the euro.

Source: TradingView. Past performance is not a guide to future performance.

Looking specifically at trading on the day of the surprise beat in November UK growth figures shows what is in store for the year ahead. While the FTSE 100 was up 0.5%, the FTSE 250 gained three times that at 1.5%. While one day’s trading is certainly not proof, I believe global investors are already adjusting portfolios.

The do-nothing rally

FTSE 250 companies have to do very little to offer returns to investors because they have been largely ignored for so long. As such, they sit on incredibly low ratings, with the index as a whole at 14.1 times earnings. That is too great a discount given the long-term average for the FTSE 250 in the 19 to 25 times range, and makes it one of the best value markets in the world right now, according to Deutsche Bank research.

- Stockwatch: director buying and new update hint at upside here

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

If we look over the Channel to Europe, which enjoyed excellent returns last year in France, Spain and Germany among others, most of the share price gains in the Stoxx 600 was driven by a re-rating of the price/earnings (PE) multiple, according to Deutsche Bank. What this means is that companies didn’t have to grow earnings, investors were just happy to pay more for the shares on the optimistic outlook.

Stocks to play the FTSE 250 supercycle

Infrastructure groups have already started to enjoy a recovery, and as growth returns and borrowing costs fall further in the year ahead, Peel Hunt’s chief economist Kallum Pickering believes we “should see the start of a multi-year expansion in public investment” under the Labour Party.

Things are clearly difficult in the construction industry as it suffers from an extended downturn, but that looks more than priced in at Keller Group (LSE:KLR) at 1,708p, trading on a PE of 7 times earnings. The groundwork and foundations specialist is a profitable, cash-generating, dividend-paying company with a strong balance sheet that looks too cheap at that price.

Infrastructure giant Kier Group (LSE:KIE) delivered great returns last year, up 54% in 2025, but starting from a low base it looks like there is still plenty to come. The shares at 223p trade on a lowly 10 times adjusted earnings, falling to 8.5 times this year’s forecast. Again, that looks anomalous for the amount of revenue, profit, cash and dividends they are digging up.

Since 2008 wages have struggled to keep pace with inflation, but having pushed through wage increases and benefits packages last year, 2026 is when the consumer should benefit. With that in mind, Currys (LSE:CURY) at 124p and trading on a PE of 11, is too cheap when you look at pre-tax profits increasing by double digits. Easing cost pressures and less disruption to global trade should help AG Barr (LSE:BAG), the maker of soft drinks such as Irn-Bru that trades on a PE of 16. Holiday treats should boost On The Beach Group (LSE:OTB) at 218p and on a PE of 14.

Another food producer that had a year to forget in 2025 was Cranswick (LSE:CWK) as problems over animal welfare at its pig farms knocked investor confidence. The shares at 5,110p and trading on a PE of 19 are not cheap, but this isn’t just a pig farmer, it’s a global protein provider across pork and poultry that is underrated for the quality of the business and the growing world population that underpin demand for its products.

Gamma Communications (LSE:GAMA) at 893p and a PE of just 9 times, is great value for a technology group that helps businesses improve their communication systems. Management certainly thinks so as they just announced a big share buyback. RS Group (LSE:RS1) is a distributor of industrial and electronic components across the UK, Europe, Asia, and America. The shares are a classic cyclical play to take advantage of a UK and eurozone recovery, and at 657p on a PE of 17 times should deliver gains.

There is no shortage of high-quality industrials and engineering groups on the FTSE 250, and one that looks cheap at 699p is Victrex (LSE:VCT), which makes a high-performance polymer for aerospace, automotive, oil and gas, and medical devices. The shares have fallen more than 70% in the past five years and now trade on a PE of 15 and near 10% dividend, which should keep you company while you wait for the profitable, cash-generative business to enjoy a rerating.

A sector that is already showing early signs of recovery and is long overdue a comeback is the great British pub. The sector has been battered by taxes, rates, soaring prices and energy bills, global pandemics, and inclement weather, but despite all this they are stubbornly resilient.

Mitchells & Butlers (LSE:MAB) shares at 293p are now cheaper than they were all the way back in 2003 and sit at a PE of 9 times. Management reported strong festive trading and, as household finances ease, it is well placed. Another option is Wetherspoon (J D) (LSE:JDW) at 766p on a PE of 14 times that could bounce back this year. For the adventurous investor there is smaller player Young & Co's Brewery Class A (LSE:YNGA).

Another name that should benefit is the tableware maker for restaurants and pubs Churchill China (LSE:CHH). The shares are bombed out at 333p, offering a yield of over 10%, on a PE of around 7 times, yet it’s still profitable and churning out cash.

Occasionally, the market throws up anomalies such as the time during Covid when you could buy Shell (LSE:SHEL) shares for £9 or Rolls-Royce Holdings (LSE:RR.) shares for 61p. I believe we are looking at just such a situation with companies in the FTSE 250, which has been punished by a combination of an overly gloomy outlook and market structure. As Benjamin Graham said: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine,” and the scales are tipped firmly in the FTSE 250’s favour right now.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.