Stockwatch: Is this small-cap still a buy?

21st August 2018 11:48

by Edmond Jackson from interactive investor

After guiding profits up several times in the last year or so, analyst Edmond Jackson asks whether investors should jump aboard or take profits at this booming infrastructure group.

Do strong interim results from £666 million FTSE SmallCap construction and regeneration group Morgan Sindall Group bode well for the medium term; or more likely flag 'peak cycle'?

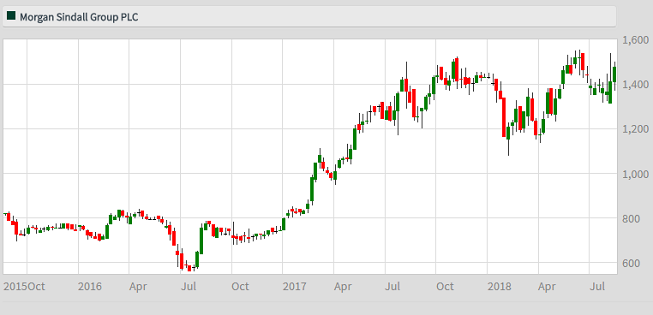

Morgan's share price chart begs a similar question: volatile-sideways through 2014-16, the financial summary table showing a 2015 profits downturn when the UK economy didn't exactly experience a jolt. Then, in 2017, the stock doubled from 750p, turning volatile-sideways again towards year-end.

Last June it hit 1,540p then fell back and, while it has improved from around 1,400p to 1,475p with the interims, even with management guiding 2018 profits slightly higher the price has not re-tested highs.

• Stockwatch: This share stays on the 'buy' list

• Stockwatch: A share for momentum traders

Interim earnings per share (EPS) is up 30% versus a forward price/earnings (PE) below 11 times and the interim dividend rises 19%, as if the market is cautious that in cyclically adjusted terms the PE multiple could be materially higher.

If market fears are overdone then Morgan rates a medium-term 'buy', yet it is potentially exposed if Brexit works out badly for London's economy – undermining office re-fits, one of Morgan's key drivers.

While all UK political parties support infrastructure improvements it's also unclear the extent to which a Corbyn government (following a Tory Brexit disaster) would involve the private sector.

Recent history of serial profit upgrades

Morgan has guided profits up several times in the last year or so – reflecting well-run operations, low interest rates and local/national government-backed schemes across a wide range of infrastructure.

It's unclear whether this also reflects continued increases in public/private debt linked to very low interest rates - which cannot last as monetary policy tightens, or maybe only very gradually as the Bank of England’s attention shifts to the deflationary effects of Brexit.

While the recent past has been buoyant, scrolling back to end-2012 when I drew attention at 550p on a prospective yield of 8% (versus 3.5% currently) Morgan had then warned: "further market deterioration which had impacted the short-term outlook into 2013".

Source: interactive investor Past performance is not a guide to future performance

But, having followed the company since it listed in 1994, I was aware of a well-run operation, and one that it pays to buy into when industry conditions are against. And, at end-2012, the market was overdoing fears, pricing for an 8% yield with analysts projecting declining earnings. Yet management also cited new long-term opportunities in infrastructure and the forward order book boded well, i.e. a likely inflection point.

Last year I twice suggested "averaging up" in May and July, amid profit upgrades. Fit-out has been a particularly strong driver, last year accounting for 45% of profit with commercial offices representing 86% of this division's revenue, and London the biggest market.

Office building/refurbishment is likely very sensitive to marginal changes in demand, e.g. it could see a downturn from current rates of growth simply if London's economic prospects flatten rather than fall. I also made clear a year ago, commercial property tends to be late cycle hence bullish updates from the likes of Morgan Sindall need a measure of caution. That's a glass-half-empty view, yet booms do tend to sow seeds of their own destruction.

On a glass-half-full view though, "infrastructure investment" is a global political meme (see the Italian government extolling it after the Genoa bridge disaster) e.g. Morgan's involvement in Transport for London’s £500 million surface transport framework, the group deriving about half its revenues this way. Housing and urban regeneration are key objectives for all UK political parties, although though private firms’ involvement nowadays needs the Tories in power.

| Morgan Sindall Group - financial summary | Consensus estimates | ||||||

|---|---|---|---|---|---|---|---|

| year ended 31 Dec | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 2,095 | 2,220 | 2,385 | 2,562 | 2,793 | ||

| IFRS3 pre-tax profit (£m) | 13.9 | 22.8 | -14.8 | 43.9 | 64.9 | ||

| Normalised pre-tax profit (£m) | 4.2 | 21.7 | -15.1 | 43.7 | 64.7 | 70.0 | 75.0 |

| Operating margin (%) | 0.2 | 0.8 | -1.0 | 1.4 | 2.2 | ||

| IFRS3 earnings/share (p) | 34.9 | 41.6 | -22.3 | 81.4 | 113 | ||

| Normalised earnings/share (p) | 12.5 | 39.1 | -23.3 | 81.0 | 113 | 137 | 139 |

| Earnings per share growth (%) | -83.0 | 213 | 39.2 | 21.4 | 1.7 | ||

| Price/earnings multiple (x) | 13.1 | 10.8 | 10.6 | ||||

| Historic annual average P/E (x) | 8.5 | 62.4 | 19.3 | 14.1 | 12.1 | ||

| Cash flow/share (p) | 39.1 | 0.2 | 18.3 | 406 | 59.1 | ||

| Capex/share (p) | 8.4 | 12.4 | 16.0 | 6.2 | 6.2 | ||

| Dividend per share (p) | 27.0 | 27.0 | 27.0 | 30.0 | 38.0 | 48.8 | 51.5 |

| Dividend yield (%) | 2.6 | 3.1 | 3.3 | ||||

| Covered by earnings (x) | 0.5 | 1.5 | 2.8 | 5.6 | 2.8 | 2.7 | |

| Net tangible assets per share (p) | 85.5 | 114 | 73.1 | 137 | 225 | ||

Source: Company REFS Past performance is not a guide to future performance

After which, latest interims offer a mixed bag

Yes, there's another small upgrade - to the full-year 2018 outlook - but the order book is mixed. This likely explains why the stock has bounced from around 1,400p, albeit just a half-way recovery to the 1,540p peak.

Fit-out remains the cheerleader, with like-for-like operating profit up 29% to £18.8 million, although construction and infrastructure has seen a 49% profit jump to £11.3 million despite revenue 5% lower, due to raising its margin from 1.1% to 1.7%. This comes in context of ongoing improvement in the group operating margin (see table), although it’s still fundamentally low - i.e. changes such as labour scarcity or input cost inflation, also the fixed costs of maintaining operations though a downturn, can soon turn profit into loss.

Urban regeneration's profit has tripled to £6.1 million, but partnership housing is down 16% to £4.6 million simply due to one poorly-performing London project – thus reflecting my point how low-margin profits can waver.

While recent performance has been strong overall, the group order book is 6% lower at £3,604 million compared with the start of 2018 due to contract selectivity in construction & infrastructure (a defensive move lest a downturn does materialise?), plus activity in partnership housing is down 20%. Fit-out's 6% order growth mitigates the overall drop, while the regeneration & development pipeline is up 5% - within which there is 62% growth on the "investments" side (£113 million of work on a council property partnership with a development value of £2 billion over 15 years) if a constituting a modest 15.3% of the regeneration division’s pipeline.

No net selling by insiders

Company REFS shows the chief executive and chief financial officer reducing their holdings, but the context last March was exercising share options and selling shares to meet tax liabilities arising, retaining the balance.

There has not been any disclosed PDMR (i.e. senior manager) selling, nor by independent directors. It's possible their optimism is swayed by involvement in a business with currently healthy momentum; that insiders don’t always see things coming; and the stock’s modest rating implies portfolio investors are more astutely attuned to macro risks.

But there's a case for continuing to hold unless you see Brexit leading to doom, the Tories discredited, and a radical Labour government.

Call me inherently cautious but I'm concerned, the London office fit-out market could get hit by Brexit. Clearly the uncertainties haven’t affected operations yet, but they are liable to percolate through to compromise decisions/needs on London offices, whose significance to Morgan's earnings are shown by fit-out lately representing 59% of interim operating profit.

This does add up to a 'sell' stance, with shareholders considering what extent of exposure accords with their risk tolerance, i.e. potentially "lock in some gains", especially if a holding has grown overweight in portfolio context.

With fresh money, I'd hold off until the Brexit outcome and its effects are clearer - "no trade deal" being a very real possibility and with London front-line in the fall-out, and why 60% of Londoners voted "Remain" in June 2016.

Say if Morgan's overall narrative does turn less encouraging; well a prospective yield around 3.5% is not really support and goodwill/intangibles constitute 69% of net assets. More positively, the group has a very strong net cash position around £97 million, so would be well-placed not just to ride out a downturn but potentially exploit it - e.g. making acquisitions at attractive prices.

I still weigh towards concern and how long the good times for London office re-fits can last, and bearing in mind capital protection is the first priority in investment: Take profits.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.